Buy VA Tech Wabag Ltd for the Target Rs.1,900 by Motilal Oswal Financial Services Ltd

Multi-decadal water theme drives robust outlook

* We initiate coverage on VA Tech Wabag (VATW) with a BUY rating and a target price of INR1,900, based on 26x FY27E P/E (premium to historical average of 18x on improved outlook). We believe that VATW has a robust growth outlook ahead on the back of a strong order book, improving margins and return ratios, and healthy FCF generation, making VATW a cash-rich company. Moreover, any large order inflows and a significant expansion in margins could drive valuation rerating in the medium term.

* VATW is a leading 100 years old water technology company. It provides full solutions in the design, construction, and operation of wastewater projects.

* The company follows an asset-light model with high focus on engineering and procurement (EP) and operations and maintenance (O&M) works. With R&D centers in Europe and India, it holds over 125 intellectual property rights.

* Despite being eligible to execute large critical projects globally, it is selective in bidding (focus is on margins and cash flows) and has a win ratio of 25- 30%.

* The focus is clearly visible in its FY21-25 revenue/EBITDA/PAT CAGR of 4%/ 18%/28%. We estimate a CAGR of 17%/22%/23% over FY25-28E.

* The current order book of ~INR137b (4.2x FY25 revenue) and a strong bid pipeline of up to INR200b provide 15-20% revenue growth visibility for the next 3-4 years, as guided by the management.

* Its focus on executing large-scale projects in high-margin segments such as EP (aims 1/3rd mix in EPC) and O&M (18%/39% mix in revenue/order book, 5-20 years execution cycle) augurs well for margins.

* We expect VATW to sustain strong FCF generation with an average of INR3.5b annually over FY25-28E, given its robust operating performance and scope for further improvement in the working capital cycle.

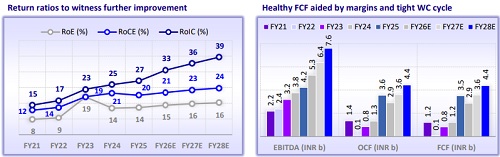

* Over FY25-28E, we expect further expansion in RoCE (from ~20% to ~24%), RoE (from ~14% to ~16%), and RoIC (~28% to ~39%), above its guided range.

Water management is a multi-decadal theme with new emerging areas

* The global water & waste management market is estimated to reach USD576b by 2032, from USD329b in 2023, at a CAGR of ~6%. Of this, smart water management market is projected to grow at a 11% CAGR to reach USD44b in 2029.

* Rising water pollution, increasing environmental compliances, water scarcity, and demand for wastewater services from industries are key growth drivers.

* The global wastewater treatment market is fully developed in Europe, North America and some parts of the Asia-Pacific region. On the other hand, the Middle East and Africa (MEA) and Latin America are high-potential markets.

* Large projects are backed by central governments, sovereign funds and multilateral agencies to support companies to execute with payment security.

VATW is the world’s leading pure-play water technology company

* VATW, with over 100 years of experience, is a global leader in the water treatment industry and offers a complete range of technologies and services for total water solutions in both municipal and industrial sectors.

* It ranks 3rd as a private water operator globally (up from 6th in 2019 and 10th in 2017) and as a desalination plant supplier. (Source: GWI)

* The company is present in 25+ countries in all major segments of water treatment, including drinking water, sewage, industrial, seawater desalination, and water recycling.

* It follows an asset-light model with high focus on EP and O&M works. It has R&D centers in Europe and India and holds over 125 intellectual property rights.

* With technical expertise and vast experience in executing large critical projects, VATW is now qualified to independently bid for marquee projects globally. However, it is selective in bidding, with a focus on margins and cash flows, and has a win ratio of 25-30%.

Growth strategy ‘Wriddhi’ drives business transformation

* VATW's initiated a long-term comprehensive plan, ‘Wriddhi’, in FY23, in response to the ever evolving and complex global water treatment market.

* The strategy focuses on advancing technological innovation, increasing global footprint, fostering strategic partnerships, and driving sustainable practices.

* It is aimed at profitable growth, global market leadership, free cash generation and improved valuation, results of which are already visible.

* Outlook for next 3-5 years under ‘Wriddhi’: a) order book 3x of revenue, b) revenue CAGR of 15-20%, c) EBITDA margin of 13-15%, d) RoCE of >20%, e) O&M mix at 20%, f) RoE of >15%, and g) net-cash positive.

* VATW has already achieved most of the guidance laid out in the strategy

Strong book-to-bill ratio of 4.2x supports 15-20% revenue CAGR guidance

* VATW's current order book of about INR137b (4.2x FY25 revenue) provides strong revenue growth visibility for the next 3-4 years.

* The order book has a rich mix of O&M (39%, 5-20 years execution cycle) and EPC (52%, 2-3 years execution cycle) projects.

* Long-duration O&M projects (up to 20 years vs. 2-5 years a decade ago) provide annuity-based sustainable revenue over the long term. These orders account for 18% of total revenue mix and 39% of the order book.

* VATW manages customer default risk by participating majorly in well-funded projects by central government programs such as Namami Gange Mission and Atal Mission for Rejuvenation and Urban Transformation (AMRUT), bilateral (JICA) and other multilateral (World Bank, ADB etc.) agencies.

* With a strong bid pipeline of INR150-200b, the company expects to capture orders worth INR60-70b annually.

* Thus, we expect a revenue CAGR of ~17% over FY25-28E (in line with company guidance of 15-20% CAGR), after a subdued ~4% CAGR during FY21-25 (impacted by focused bidding and divestment of European subsidiaries).

Focused bidding to support 13-15% EBITDA margin

* VATW has guided for EBITDA margin of 13-15% (FY24/25: 13.2%/12.8%) over the next 3-5 years. Key margin levers include its healthy order book (INR137b, 4.2x FY25 revenue), execution of large projects (INR25.6b Chennai plant, INR14.2b Al Haer KSA ISTP plant), and greater focus on winning orders in EP, O&M, industrial, and overseas segments and markets.

* Expenses related to bad debt provisioning have declined materially in the last 6- 8 years. VATW booked INR101m in expenses in FY24 (0.4% of revenue, the least in the last 10 years), which fell from its peak of ~INR1.1b in FY22 and FY23 (~3.9% of revenue, mainly Gammon Genco projects and European subsidiaries).

* Since the launch of ‘Wriddhi’ in FY23, the company has already achieved a notable expansion in its EBITDA margin to ~13% (vs. 7-9% band historically).

* Going ahead, we expect VATW's EBITDA margin to further expand toward the higher range of its guidance of 13-15% in the coming years.

Turned net-cash company with healthy return ratios

* VATW has witnessed a remarkable turnaround in its free-cash flow generation in the last five years, achieving a net-cash balance of INR5.9b as of FY25 end from net debt of INR4b in FY19.

* RoCE/RoIC have also doubled to ~20%/28% in FY25 from ~11%/12% in FY19. RoE has also expanded to 13.8% in FY25 from 8-9% reported till FY22.

* A significant improvement in EBITDA margins (~2x), tightening of the working capital cycle and an asset-light business model have been key drivers.

* Its asset-light strategy (FY25 net block ~INR0.7b for INR32.9b revenue, gross block broadly same since FY14), R&D capabilities and focus on EP jobs (while subcontracting the machinery-intensive civil construction work) have paid off.

* Leveraging its technical skills, VATW has followed a partnership model for investment in R&D (mostly done by customers) and HAM projects (with less than 5% equity contribution and an option to monetize after three years).

* We expect strong FCF generation (~INR3.5b annually over FY25-28E) to sustain on the back of healthy operating performance and improvement in WC cycle.

* During FY25-28E, we expect further expansion in RoCE (from ~20% to ~24%), RoE (from ~14% to ~16%), and RoIC (~28% to ~39%), above its guided range.

Valuation and view – Initiate with BUY

* After delivering a CAGR of 4%/18%/28% in revenue/EBITDA/PAT over FY21-25, we estimate them to clock a CAGR of 17%/22%/23% over FY25-28E.

* VATW's current order book of ~INR137b (4.2x FY25 revenue) and a strong bid pipeline of up to INR200b provide 15-20% revenue growth visibility.

* Greater focus on executing large-scale projects in the high-margin segments (EP, O&M and Industrial) augurs well for the overall margins of the company.

* Outlook of strong FCF generation, net-cash status and expansion in return ratios make VATW’s scrip attractive at ~20x FY27E EPS on CMP.

* We initiate coverage on VATW with a BUY rating and a target price of INR1,900, based on 26x FY27E P/E (premium to historical average of 18x on improved outlook). We believe large order inflows and a significant margin expansion could fuel valuation re-rating in the near to medium term.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412