Buy GAIL Ltd for the Target Rs. 220 by Motilal Oswal Financial Services Ltd

Tariff hike falls slightly short; valuations now more compelling

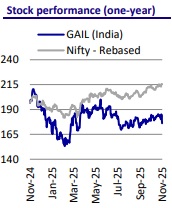

On 27th Nov’25, the Petroleum and Natural Gas Regulatory Board (PNGRB) issued a tariff order for GAIL’s integrated natural gas pipeline network. The tariff has been increased to INR65.69/mmBtu from INR58.61/mmBtu (~12% increase) w.e.f. 1st Jan’26, which is slightly below our expectation of USD67-71/mmbtu. Since we did not build in any tariff hike in our estimates previously, this results in a 7%/8% increase in our FY27 EBITDA/PAT estimates and an increase in our TP to INR220 (from INR205). GAIL’s valuations have corrected sharply from their Sep’24 highs, and the stock now trades close to its historical average at ~1.1x one-year forward core P/B, offering limited downside, considering an attractive dividend yield and a robust FCF outlook. Further, the transmission tariff revision, effective from Jan’26, would raise the FY27E PAT by around 7%. Transmission volumes are also set to rebound in FY27 as the impact of multiple oneoff disruptions in FY26 wanes, with a recovery in power and fertilizer offtake and normalization of flood-impacted supplies. Government initiatives to further rationalize natural gas taxation can be a significant long-term positive. Reiterate BUY with a TP of INR220.

Interim relief provided; another tariff revision due in Apr’28

* The PNGRB also stated that truing up all parameters at this stage would result in a sharp and sudden increase in tariffs, potentially creating unexpected financial pressure on customers, while GAIL must also be ensured a fair return. Accordingly, the PNGRB has approved this interim relief order for GAIL over the existing tariff, limited to adjustments related to: 1) System Use Gas and 2) capacity determination, with full true-up to be undertaken during the next tariff review effective 1st Apr’28. All the remaining elements, including: 1) actual and future opex and capex, 2) transmission loss, 3) working days, 4) revenue-sharing adjustments, and 5) other regulatory amendments, would be trued up in the FY28 tariff review, effective 1st Apr’28.

* The increase in GAIL’s tariff by ~INR7.1/mmbtu would result in an ~INR0.3/scm increase in tariffs for consumers. Further, the zonal tariff reform is also expected to be effective from 1st Jan’26.

Valuation and view

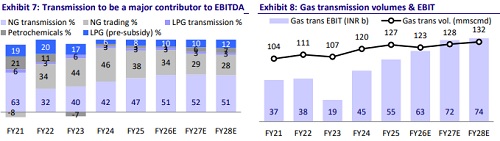

* We reiterate BUY on GAIL with our SoTP-based TP of INR220. Over FY26-28, we estimate an 11% CAGR in PAT, driven by:

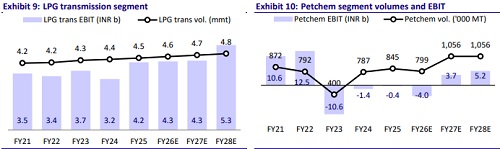

* an increase in natural gas transmission volumes to 132mmscmd in FY28 from 123mmscmd in FY26;

* substantial improvement in the petchem segment’s performance over FY27-28, as new petchem capacity becomes operational and spreads bottom out;

* healthy profitability in the trading segment, with guided EBIT of at least INR40b in FY26/FY27.

* We expect RoE to stabilize at ~13% in FY27/28, with a healthy FCF generation of INR171.4b over FY26-28 (vs. -INR45.3b in FY23), which we believe can support its valuations.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412