Neutral Aditya Birla Lifestyle Brands Ltd for the Target Rs. 190 by Motilal Oswal Financial Services Ltd

Well-Stitched Brands, Loose Ends in Execution

Aditya Birla Lifestyle Brands (ABLBL) will be listed on 23rd Jun’25. ABLBL was demerged from Aditya Birla Fashion and Retail (ABFRL) in May’25 and comprises four industry-leading lifestyle brands (Louis Philippe, Van Heusen, Allen Solly and Peter England) and emerging brands such as Van Heusen Innerwear, Reebok and American Eagle. We expect ABLBL to deliver ~10% revenue CAGR over FY25-28E, driven by 1) acceleration in retail store additions in lifestyle brands, 2) improvement in store productivity, and 3) scale-up of emerging brands. Driven by lower discounting, an improved channel mix and operating leverage benefits, we expect gross/EBITDA margin to expand ~80bp/~140bp to 59%/16.6% by FY28E. Further, ABLBL could generate cumulative FCF of INR11b over FY25-28E, which should help ABLBL to become a net-cash company (excl. leases). We ascribe a TP of INR190/share (vs. ~INR171/sh implied price on demerger), premised on 15x FY27E EV/EBITDA for lifestyle brands and ~1x FY27E EV/sales for emerging brands. We assume coverage on ABLBL with a Neutral rating.

ABLBL: Portfolio of India’s leading fashion brands and emerging brands

* After the demerger from ABFRL, ABLBL comprises four established lifestyle brands (Louis Philippe, Van Heusen, Allen Solly and Peter England) and emerging brands such as Van Heusen Innerwear, Reebok and American Eagle.

* ABLBL is the pioneer in the branded apparel industry with over three decades of presence. It has scaled up Madura Fashion from revenue of ~INR2b in 1999 to INR78b+ in FY25.

* ABLBL’s four power brands have a strong presence across formals, casuals, sportswear and ethnics and have top-of-mind recall, which has enabled all four brands to cross INR10b in annual revenue.

* ABLBL has a retail presence of 3,250+ stores spanning a retail area of ~4.6m sqft and a wide presence across LFS, MBOs and online channels. The company follows an

Targets consistent double-digit growth in revenue and EBITDA

* Management aims to double revenue over FY24-30 (11%+ CAGR), driven by high-single-digit L2L and network expansion (250+ net store additions annually).

* It has set a mission to have at least three brands in the INR25b category and scale up emerging brands profitably in the next 2-3 years.

* Management aims to expand margins by ~300bp, improve pre-INDAS RoCE to ~70% by FY30, and become debt free in the next 2-3 years.

* Further, management expects ABLBL to be a dividend-paying company, given its likely strong cash flow generation.

Valuation and view

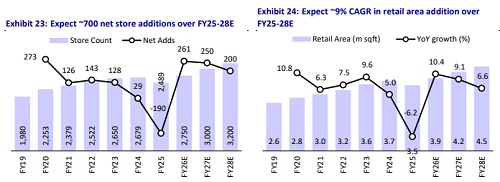

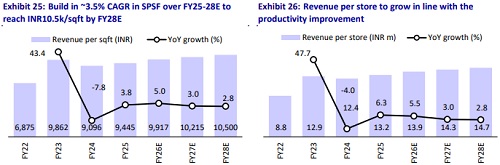

* We expect ABLBL to deliver ~10% revenue CAGR over FY25-28E, driven by 1) acceleration in retail store additions in lifestyle brands (~700 net store additions over FY25-28E), 2) improvement in store productivity (~3.5% SPSF CAGR over FY25-28E) and 3) scale-up of emerging brands.

* Driven by lower discounting, an improved channel mix, a scale-up in profitability of emerging brands and operating leverage benefits, we expect gross/EBITDA margin to expand ~80bp/~140bp to 59%/16.6% by FY28E.

* PAT growth is likely to be significant (~51% CAGR over FY25-28E), driven by operational improvements and benefits of deleveraging.

* We expect ABLBL to generate cumulative FCF of ~INR11b (post leases and interest) over FY25-28E, which should lead to net cash position (excl. leases) and dividend payouts by FY28E.

* Based on the share price of demerged ABFRL immediately after the demerger, the market is ascribing ~INR171/sh or ~INR210b market cap to ABLBL.

* We value ABLBL based on the SoTP methodology. We ascribe 15x FY27E EV/EBITDA multiple to ABLBL’s lifestyle brands and ~1x FY27E EV/sales multiple to ABLBL’s emerging brands to arrive at a TP of INR190/share or ~INR230b market cap, which implies ~16.5x FY27E EV/EBITDA (or ~28.5x FY27E pre-INDAS EBITDA).

* We assume coverage on ABLBL with Neutral rating.

Key risks and concerns

* Persistent weakness in demand could affect its store addition plan and SSSG for existing stores.

* A slower-than-expected scale-up of emerging brands,

* Higher-than-expected rental and manpower cost escalations,

* Capital misallocation through non-value-additive M&As, and

* Exit by shareholders (who invested for demerger gains or recent investors in ABFRL’s fund raise) could also be near-term overhang

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)

Ltd ( 1 ).jpg)