Reduce Tata Motors Passenger Vehicles Ltd For Target Rs. 365 By JM Financial Services Ltd

Weak quarter; pain to persist

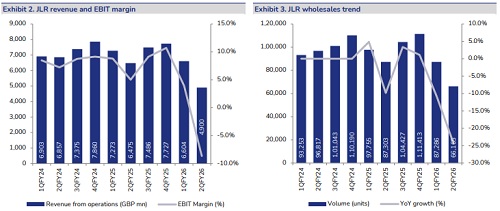

In 2QFY26, JLR EBIT margin came in at -8.6% (-1,370 bps YoY, -1,260 bps QoQ), impacted by production loss due to cyberattack, tariff-related expenses (£74 mn), unfavourable forex (£237 mn), and higher warranty costs. Management highlighted that geopolitical tensions, tariff uncertainty, and supply chain risks persist. Reflecting these challenges and the cyberattack impact, JLR lowered its FY26 guidance, now expecting EBIT in the range of 0%–2% (earlier 5%– 7%) and negative free cash flow of £2.2–£2.5 bn (earlier near zero). The India PV business posted an EBITDA margin of 3.9% (-230 bps YoY, +50 bps QoQ), impacted by adverse realisations and higher raw material costs. On the domestic EV front, the company maintained a strong position with 42% market share over the last 3 months. PV-EV margins improved to 4.2% from 0.2% in 1QFY26, aided by PLI benefits (INR 1.25bn), operating leverage, and a favourable mix. EV profitability is expected to improve further with product interventions and PLI benefits. The outlook for the domestic business in 2HFY26 remains strong, with double-digit industry growth expected and overall FY26 growth likely in the 5% range. ICE profitability is expected to remain muted in 3Q but should improve in 4Q with the Sierra launch, price increases, better mix, and cost-reduction initiatives. We initiate coverage with REDUCE rating and a SOTP-based (JLR at 7.5x EV/EBIT and standalone at 10x EV/EBITDA) TP of INR365.

* JLR – cyberattack pushes it into the red: JLR reported revenue of £4.9 bn (-24.3% YoY, -25.5% QoQ), primarily due to a production halt caused by the cyberattack and the planned wind-down of legacy Jaguar models ahead of new launches. Wholesale volumes (ex-CJLR) declined 24.2% YoY (-24.2% QoQ) to ~66.2k units. EBIT turned negative, with EBIT margin at -8.6% (-1,370 bps YoY, -1,260 bps QoQ), impacted by production loss, tariff-related expenses (£74 mn), unfavorable forex (£237 mn), and higher warranty costs. Free cash flow was negative at £791 mn in 2Q due to the production halt.

* JLR – challenging outlook: JLR highlighted that sales in the EU remain uncertain, while the UK continues to be stable. Demand in the US remains weak due to tariff-related issues, and in China, the reduction in the luxury tax threshold (from RMB 1.3 mn to RMB 0.9 mn) has further dampened demand, with JLR expected to absorb the cost impact in the near term. Management indicated that variable marketing expenses (VME) will remain elevated. On tariffs, some improvement is expected in 3Q (majority part of 2Q had lower tariffs). Overall, geopolitical tensions, tariff uncertainty, and supply chain risks persist. Reflecting these challenges and the impact of the cyberattack, JLR has lowered its margin guidance, now expecting FY26 EBIT in the range of 0% - 2% (earlier 5% - 7%) and negative free cash flow of £2.2 - £2.5 bn (earlier near zero).

* India business: Standalone revenue stood at INR 129bn (-7.5% YoY, +17.4% QoQ). EBITDA margin stood at 3.9% (-230bps YoY, +50bps QoQ).

* India PV segment gets flip post GST rationalisation: Overall Volumes grew 10% YoY in 2Q, with market share at 12.8%, which further increased to 13.7–14% during the festive season. The PV-ICE segment reported an EBITDA margin of 6.4% (-210 bps YoY, +150 bps QoQ), with the contraction driven by negative operating leverage and commodity-linked cost inflation. The outlook for 2H remains strong, with double-digit industry growth expected and overall FY26 growth likely in the 5% range. ICE profitability is expected to remain muted in 3Q but should improve in 4Q with the Sierra launch, price increases, better mix, and cost-reduction initiatives. TTMT plans a price hike in 4Q to offset commodity inflation, which will also lead to lower discounts from January 2026 onward.

* Indian EV business: EV penetration for the company reached 17% in 2Q (vs. 13% in 1Q), and along with CNG vehicles, accounted for approximately 45% of domestic volumes. The company maintained a strong position in the EV market with a 42% share over the last three months. In terms of profitability, the PV-EV business saw EBITDA margin improve to 4.2% from 0.2% in 1QFY26, aided by PLI benefits of INR 1.25bn, operating leverage, and a favourable mix. EV profitability is expected to improve further with product interventions and PLI benefits. Tiago, Tigor, and Punch (~30% of volumes) already have PLI certification, while Nexon (~25% of volumes) and Harrier (run rate of 2.5k units per month with a waiting period of 16–18 weeks) will start accruing benefits in 3Q and 4Q respectively. Curvv, manufactured through a JV, does not qualify under the PLI scheme.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361