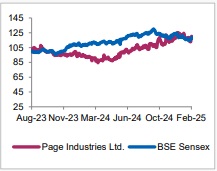

Hold Page Industries Ltd For Target Rs. 42,700by Axis Securities

Margin Expansion Driven by Cost Savings; Maintain HOLD

Est. Vs. Actual for Q3FY25: Revenue – MISS; EBITDA –BEAT; PAT – BEAT

Changes in Estimates post Q3FY25

FY26E/FY27E – Revenue: -5%/-6%; EBITDA: -6%/-6%; PAT: -4%/4%

Recommendation Rationale

* Resilient performance despite challenging environment: Page Industries delivered a resilient performance in Q3FY25, with revenue growing 7% YoY, though slightly below estimates. Volume growth stood at 5% YoY, supported by a favourable category mix. The Athleisure segment saw strong traction, aided by deeper market penetration. The company continued expanding its retail footprint, reaching 1,10,176 MBOs, 1,436 EBOs, and 1,212 LFS outlets, driven by stable operations and robust e-commerce growth.

* Margins guidance: EBITDA margins expanded by 435bps YoY to 23%, driven by improved gross margins and cost optimisation. Management expects EBITDA margins to remain in the 19-21% range for FY25, as IT-related and marketing expenses will keep margins lower. While no price hikes are planned for FY25, the company will reassess pricing for FY26 as part of its ongoing budgeting process. Notably, there has been no price increase over the past three years.

* Demand Outlook: The management highlighted the short-term challenges persisting in the Indian apparel retail sector due to subdued consumer sentiment. However, long-term growth remains intact, supported by economic expansion, urbanisation, and higher disposable incomes. The athleisure and innerwear segments are expected to drive growth, aided by the increasing penetration of organised retail and e-commerce

Sector Outlook: Cautiously Optimistic

Current Valuation: 57x Dec’26 EPS (Earlier valuation: 57x Dec’26 EPS)

Current TP: Rs 42,700/share (Earlier TP: Rs 44,500/share)

Recommendation: With a 7% downside from the CMP, we maintain our HOLD rating on the stock.

Financial Performance

Page Industries Q3FY25 results missed the topline. Revenue grew by 7% YoY (~5% volume growth), driven by customer engagement, focus on premiumisation, and strong performance across all product categories. Gross margin improved by 327 bps YoY to 56.3%, aided by stable input costs (cotton prices). EBITDA stood at Rs 303 Cr, up by ~32% YoY, and EBITDA margins improved by 435 bps to 23%, fueled by cost efficiencies, strategic sourcing, healthier inventory management, and gross margin gains. The company reported a PAT of Rs 205 Cr, up ~34.3% YoY.

Outlook: We appreciate the management's unwavering focus on expanding distribution through multiple channels (MBOs, EBOs, LFS) and smaller cities, along with their consistent commitment to implementing ARS across the retail network. This strategy will likely make Page Industries more flexible and resilient than its competitors in the long run. However, shortterm challenges, such as a subdued demand environment and increased competitive intensity, are expected to constrain volume growth.

Valuation & Recommendation: We maintain our HOLD rating on the stock as shortterm demand and margin profile pressure will limit the upside potential. Furthermore, we are looking for sustained signs of recovery from a longer-term perspective before reassessing our position. We have revised our target price to Rs 42,700/share as we roll over our estimates to Dec’26 EPS.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ00016163