Accumulate Emami Ltd For Target Rs.683 by Prabhudas Liladhar Capital Ltd

All eyes on winters as summers play spoilsport

Quick Pointers:

* Short summer hit talk portfolio which declined 17%, ex of those sales grew 6%

* FY26 growth acceleration depends on re-launch of Smart & Handsome, Kesh King and Man Company

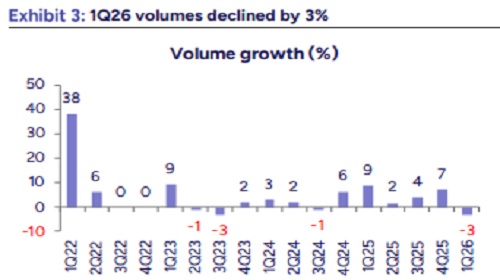

HMN delivered a 3% decline in volumes, impacted by a shorter summer season and early onset of the monsoon, which impacted its summer-centric portfolio. Near-term outlook remains cautiously optimistic given 1) Repositioning of Smart & Handsome, backed by a strong innovation pipeline. 2) Revamp and relaunch of Kesh King, with a new proposition, packaging and pricing. 3) Stabilization of sales in The Man Company, with growth expected to ramp up in the coming quarters, driven by increasing market share in QC and online marketplaces. Although the summer portfolio may face headwinds in 2Q also, it will be partially neutralized by gains in pain management. Despite expected demand recovery, onset of winter and product placement will hold key to 2H26 growth. We estimate a 7.1% Sales CAGR and 10.7% PAT CAGR over FY25–FY27 as we cut EPS by 1 / 2.6% following growth pangs in 1Q26. We value the stock at 30x June’27 EPS, arriving at a target price of ?683 (697 earlier). Maintain Accumulate.

PAT grew by 8.8% with 3% volume degrowth: Revenues declined by 0.2% YoY to Rs9bn (PLe: Rs9.2bn led by 17% YoY decline in Talc/Prickly Heat Powder (PHP) category due to unseasonal rains and early monsoons. Core domestic business (excluding Talc/PHP) posted 6% revenue growth. Domestic revenues declined by 3% along led by 3% volume de-growth, international business grew by 2% (INR) & Flat in CC. Gross margins expanded by 176bps YoY to 69.4% (Ple: 67%). EBITDA declined by 1.1% YoY to Rs2.1bn (PLe:Rs.2.2bn); Margins contracted by 20bps YoY to 23.7% (PLe:22%). Adj PAT grew by 8.8% YoY to Rs1.62bn (PLe: Rs1.59bn)

Above views are of the author and not of the website kindly read disclaimer