Accumulate Emami Ltd For Target Rs.608 by Prabhudas Liladhar Capital Ltd

GST impact factored in, winter onset near term positive

Quick Pointers:

* GST 2.0/Deferred winter loading impacted sales by 10.5%

* October saw a strong rebound in demand and winter loading, HMN expects Double digit value growth in 2HFY26 led by healthy winters

HMN saw ~10.3%/16% decline in sales/volumes as GST transition, deferred winer loading and consumer purchase impacted sales by ~10.5%. Near-term outlook remains optimistic given 1) Healthy demand outlook for Q3/Q4 led by strong onset to winters 2) Repositioning of Smart & Handsome with entry in new male grooming segments 3) Revamp and relaunch of Kesh King, with a new proposition, packaging and formulation. Although the summer portfolio may continue to face headwinds in 3Q also, it will be partially neutralized by gains in winter portfolio led by early winters. We estimate a 8.5% Sales CAGR and 7.5% EPS CAGR over FY27–FY28. We value the stock at 27x Sep’27 EPS, arriving at a target price of ?608 (Unchanged). Strong rebound in 3Q sales can provide upside from current levels. Maintain Accumulate.

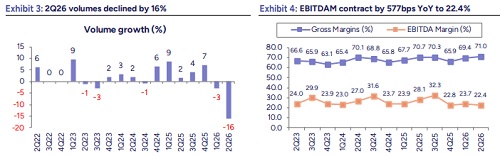

Revenue de-grew by 10.3% on 16% decline in volumes: Revenues declined by 10.3% YoY to Rs8bn (PLe: Rs7.9bn) as GST 2.0/deferred winter loading/Talc portfolio impacted sales by 4.1%/4.4%/4.5% with overall impact being ~10.5%. Excluding GST-impacted categories, non-impacted portfolio cohorts delivered 10% growth in Q2. Navratna, Boroplus, Kesh King, Male grooming and 7 oils in 1 reported a decline in sales by 33%, 30%, 23%, 9% and 12% respectively. Domestic revenues declined by 15%, IBD sales grew by 8% with growth across geographies. Strategic businesses reported 16% growth in sales.

69%) on benign input costs. EBITDA declined by 28.7% YoY to Rs1.8bn (PLe:Rs.1.8bn); Margins contracted by 577bps YoY to 22.4% (PLe:23.5%). Adj PAT grew by 8.8% YoY to Rs1.6bn (PLe:Rs 1.5bn) amidst lower tax rate. Company declared interim dividend of Rs4/share.

Concall takeaways:

1) 2Q demand remained impacted by ~10.5% due to GST transition issue, deferment of purchases and deferred winter loading 2) Excluding GST-impacted categories, non-impacted portfolio cohorts delivered 10% growth in Q2 3) October saw a strong rebound in demand with deferred winter loading recovering faster. 4) Management confident on double digit value growth in Q3 led by early winters. 5) 93% of core domestic portfolio now attracts 5% GST which is likely to drive volume growth in near term with shampoos, cool oils, pain management etc will be key beneficiary 6) Summer portfolio continue to face pressure amidst excessive rains thus impacting offtake in talc and prickly heat categories on a high base. 7) Smart & Handsome expanded into newer male grooming categories with 12 new launches across sunscreens, shower gels, undereye creams, deo’s, face serums & sheet masks. 8) Kesh King relaunched as Kesh King Gold with new packaging and upgraded formulation. 9) Company further strengthened its premium offerings with the launch of the Creme 21 Xtra Bright range including Elixir, Day Cream, Night Cream, Facewash, Face Scrub, and Micellar Water 10) Growth across divisions: 4% degrowth in Pain Management, 1% growth in healthcare, 23% de-growth in Kesh-King, 33% de-growth in Navratna & Dermi-cool range, 30% de-growth in Boroplus. 11) Company expects FY27 to better than FY26 as summer portfolio may gain share.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271