Buy Emami Ltd for the Target Rs. 675 by Motilal Oswal Financial Services Ltd

Weak delivery; recovery seems slower than anticipated

* Emami’s consolidated revenue declined 10% in 2QFY26 (inline), impacted by GST 2.0-led temporary trade disruptions in Sep’25 and extended monsoon affecting the summer portfolio. Domestic revenue declined 15% YoY, along with a volume decline of 16% (est. -13%). Domestic business (exTalc/Heat Powder) declined by 12% on a high base. The talc/heat powder revenue dipped 76% YoY. The non-impacted portfolio delivered 10% growth in 2QFY26. International business delivered 8% growth despite persistent macro and geopolitical headwinds.

* The GST rate revision has benefited 88% of Emami’s domestic portfolio; now more than 93% of the portfolio is at a 5% GST rate. The management alluded that from Oct’25 onwards, the trade sentiments and deferred winter loading are recovering; thus, it is expecting 2H to be better than 1H. However, the revenue growth guidance of high single-digit to low doubledigit appears slower than anticipated following the sharp dip in 2Q revenue.

* The strategic investments portfolio grew 16% YoY, while healthcare inched up 1% YoY. The rest of the categories dipped YoY. Kesh King declined 23%, and the company relaunched the product as Kesh King Gold. The male grooming range dipped 9% YoY, while the Smart and Handsome brand launched 12 new SKUs across sunscreens, shower gels, under-eye creams, deodorants, face serums, and sheet masks, broadening its relevance across the male grooming spectrum.

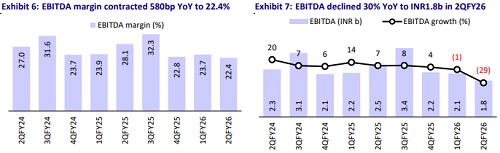

* Emami’s gross margin expanded marginally by 30bp YoY to 71%, aided by stable input prices. However, EBITDA margin contracted 580bp YoY to 22.4% due to higher investments and employee costs. We expect ~27% EBITDA margin for FY26 and FY27.

* Growth recovery guidance is slower than expected for 2HFY26; however, stable RM costs are positive for sustaining a healthy operating margin. We cut our estimates by 2-4% for FY26-27. However, the stock valuation remains comfortable, and we reiterate our BUY rating with a TP of INR675 (premised on 30x Sep’27E EPS).

Weak but in-line performance; volume dips ~16% YoY

* Trade disruption and extended monsoon hurt revenue growth: Consol. net sales declined 10% YoY to INR7,985m (est. INR8,018m). Domestic business revenue declined 15% YoY, along with a volume decline of 16% (est. -13% and -3% in 1QFY26). Domestic business (excluding talc and heat powders) declined by 12%. Talc/Heat powders’ revenue dipped 76% YoY and faced a second challenging quarter as excessive rains impacted offtakes in the category on a high comparative base. GST 2.0 implementation caused temporary trade disruptions in Sep’25; however, from Oct’25 onwards, trade sentiments and deferred winter loading are recovering. Excluding GST-impacted categories, the non-impacted portfolio delivered 10% growth in 2QFY26. International business revenue grew 8% YoY.

* EBITDA margin contracts sharply: Gross margin expanded marginally by 30bp YoY to 71% (est. 70%), aided by input price stability. Employee expenses and ad spending rose 7% each, while other expenses declined 8% YoY. However, EBITDA margin contracted 580bp YoY to 22.4% (est. 21.4%).

* Emami’s EBITDA was down 29% YoY to INR1,785m (est. INR1,719m). PBT dipped 33% YoY to INR1,520m (est. INR1,472m). APAT declined 27% YoY to INR1,711m (est. INR1,594m).

* In 1HFY26, Emami’s revenue/EBITDA/PAT dipped 5%/16%/12%.

Key highlights from the management commentary

* Trade and consumer purchases were deferred in anticipation of lower MRPs, while distributors prioritized liquidation of higher-cost inventory, leading to temporary moderation in sales.

* The company saw a recovery in Oct’25 with trade sentiment improving and deferred winter loading picking up; the first 10 days of November also witnessed healthy winter portfolio loading.

* Winter portfolio loading has been healthy across regions, and the company remains optimistic about a strong winter season.

* Sachets accounted for ~20% of the domestic portfolio and experienced a grammage increase, while the rest of the portfolio witnessed MRP reductions to align with the revised GST rates.

* The company expects high single-digit growth in 3QFY26, with the potential to deliver double-digit growth if the winter season continues to perform well.

Valuation and view

* Emami’s core categories are niche, and they have been witnessing slow user addition over the last five years. That said, the company is focusing on rebranding its portfolio to reduce the seasonal dependence. Moreover, Emami continues to strengthen its distribution reach predominantly in alternate channels (MT, e-com, and QC).

* In addition to macro tailwinds, trade normalcy and winter portfolio loading in 3QFY26 are expected to aid the company’s performance going forward. Despite a weak 2Q performance, the growth guidance for the near term is not very encouraging. However, stable RM costs are positive, and management expects operational margin to remain healthy. We reiterate our BUY rating on the stock with a TP of INR675 (premised on 30x Sep’27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)