Buy Atul Ltd for the Target Rs. 8,450 by Motilal Oswal Financial Services Ltd

Stellar bounce-back in FY25; growth expected to continue

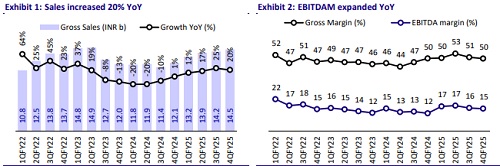

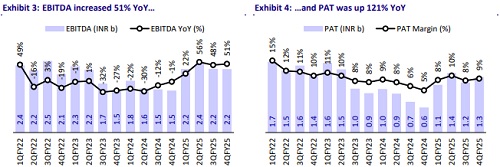

* Atul’s (ATLP) 4QFY25 revenue came in line with our expectation. The Life Science Chemicals (LSC) segment’s revenue increased 18% YoY, while the Performance & Other Chemicals (P&OC) segment’s revenue rose 21% YoY. Gross margin came in at 49.7% (-10bp YoY), while EBITDAM expanded 320bp YoY to 15.4%. EBITDA grew 51% YoY to INR2.2b, and PAT jumped 121% YoY to INR1.3b.

* The LSC segment maintained strong performance for the fifth straight quarter, with EBIT margin expansion of 410bp YoY. The P&OC segment also delivered robust results, recording a 660bp YoY margin gain in 4Q. LSC’s EBIT contribution fell to 53% (from 84% in 4QFY24), while P&OC’s share rose to 47% (from 16%). Additionally, total PBT contribution from subsidiaries and JVs turned positive in FY25 vs. FY24.

* ATLP delivered a 17% YoY increase in sales volume, with a 1% uptick in contribution margin in FY25. While capacity utilization improved vs. FY24, geopolitical disruptions and subdued end-user demand constrained output, leading to underperformance in new investments. ATLP completed a major capex in FY25 and debottlenecking activities took place for seven products. The total unrealized sales potential currently stands at INR25b.

* Due to the beat in 4QFY25 and FY25 earnings vs. our estimates, we increase our EBITDA/PAT estimates by 9%/12% for FY26 while keeping FY27 estimates unchanged as of now. We estimate a CAGR of 13%/16%/19% in revenue/EBITDA/PAT during FY25-27. EBITDAM is estimated to improve 80bp in FY27 from the FY25 level. We believe ATLP is on track to make a comeback in the next 2-3 years, and FY25 earnings support our view.

* Investments are set to be supported by further recovery in ATLP’s subsegments and management’s efforts to expand its capacities for key products and for debottlenecking the existing ones. The stock is trading at ~29x FY27E EPS of INR241.4 and ~16x FY27E EV/EBITDA. We value the stock at 35x FY27E EPS to arrive at our TP of INR8,450. We reiterate our BUY rating on the stock.

Beat on EBITDA; lower interest and higher OI drive strong earnings beat

* 4Q revenue stood at INR14.5b (+20% YoY). LSC revenue came in at INR4.4b (+18% YoY). P&OC revenue was INR10.5b (+21% YoY).

* Gross margin was 49.7% (-10bp YoY) and EBITDA margin was 15.4% (+320bp YoY).

* EBIT margin expanded YoY for both LSC and P&OC segments. LSC margin stood at 21.8% (+410bp YoY) and EBIT at INR966m. P&OC margin was at 8.1% (+660bp YoY) and EBIT at IN855m.

* EBITDA came in at INR2.2b (est. INR1.8b, +51% YoY). Adj. EBITDA was INR2.5b (+68% YoY) as other expenses included ~INR246m related to application fees, cess, premium, conversion charges, customary penal charges, non-agricultural assessment charges, differential stamp duty, etc., for converting a part of agricultural land to industrial use.

* PAT stood at INR1.3b (est. INR835m, +121% YoY), resulting in EPS of INR44.2. Contribution from the subsidiaries/JVs was positive (profit at INR44m in 4QFY25 vs. PAT of INR244m in 3QFY25 and net loss of INR161m in 4QFY24).

* For FY25, revenue was at INR55.8b (+18% YoY), EBITDA was at INR9.1b (+43% YoY), and PAT at INR5b (+54% YoY). EBITDAM for FY25 stood at 16.4% (+290bp YoY).

* The board has recommended a final dividend of INR25/share for FY25.

Valuation and view

* The end-user market demand has picked up in FY25 compared to FY24, though significant improvements are yet to happen in the new investments that ATLP has done. The company is undertaking various projects and initiatives aimed at improving plant efficiencies, expanding its capacities for key products, debottlenecking its existing capacities, capturing a higher market share, and expanding its international presence.

* ATLP has already commissioned its liquid epoxy resins plant of 50ktpa capacity in Oct’24 (revenue potential of INR8b). Its caustic soda plant (300tpd) also faced teething issues in Dec’23, which were largely resolved in FY25. The unrealized sales potential remains at INR25b (INR17b from existing projects and INR8b from a new project). The future looks bright for both the retail businesses of ATLP as well.

* The stock is trading at ~29x FY27E EPS of INR241.4 and ~16x FY27E EV/EBITDA. We value the stock at 35x FY27E EPS to arrive at our TP of INR8,450. We reiterate our BUY rating. The upside risk could be a faster-than-expected rampup of new projects and products. Downside risks include weaker-than-expected revenue growth and margin compression amid teething issues in new projects.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412