Buy HDFC AMC Ltd For Target Rs. 5,000 by Motilal Oswal Financial Services Ltd

PAT beat driven by other income

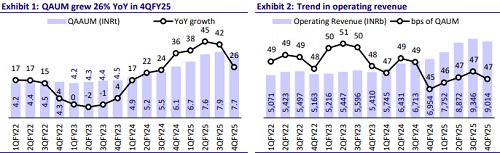

* HDFC AMC’s operating revenue was up 30% YoY/down 4% QoQ at INR9b (in line) in 4QFY25. Yields for the quarter came in at 46.6bp vs. 45.4bp in 4QFY24 and 47.5bp in 3QFY25. FY25 yields stood at INR35b, up 35% YoY.

* Total opex rose 10% YoY to INR1.7b (5% lower than est.), driven by 12% YoY growth in employee costs (in line) and 6% YoY growth in other expenses (11% lower than est.).

* 4Q EBIDTA was at INR7.3b, up 35% YoY. EBIDTA margins stood at 81% vs. 77.5% in 4QFY24 and 81.7% in 3QFY25. Other income came in at INR1.2b, 54% above our estimates (down 20% YoY, up 33% QoQ).

* Higher other income led to a 3% beat in PAT to INR6.4b, up 18% YoY and flat QoQ. PAT margins came in at 70.8% vs. 77.8% in 4QFY25 and 68.6% in 3QFY25. For FY25, PAT grew 26% YoY to INR24.6b.

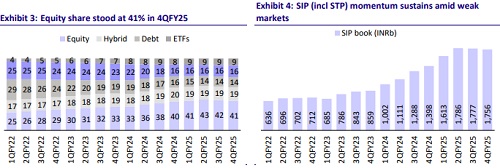

* Despite weak market sentiment, industry-level gross SIP flows declined just 2% QoQ in Mar’25 but rose 25% YoY. Management remains optimistic about a pickup in flow trends, noting that the company’s decline in SIP flows was lower than the industry average.

* We have largely kept our estimates unchanged. We maintain BUY on the stock with a TP of INR5,000 (premised on 40x Mar’27E Core EPS).

AUM growth remains stable; overall market share improves slightly

* QAAUM stood at INR7.7t, up 26% YoY/down 2% QoQ, driven by 30%/22%/12%/27%/56%/48%YoY growth in Equity/Hybrid/Debt/Liquid/ ETFs/Index funds.

* Closing AUM for 4QFY25 was INR7.5t, up 24% YoY, and the company’s market share improved to 11.5% (11.4% in 4QFY24). Excl. ETFs, HDFC AMC’s AUM market share remained stable YoY at 12.8%.

* Actively managed equity/debt/liquid AUM market share stood at 12.9%/ 13.1%/11.9% at the end of 4QFY25.

* SIP AUM at the end of 4QFY25 was up 26% YoY/down 1% QoQ at INR1.8t, backed by growth in the number of transactions to 11m.

* The number of unique investors at 4Q end stood at 13.2m (vs. 9.6m at 4QFY24 end), reflecting 24% penetration in the mutual fund industry.

Operational efficiency leads to profitability improvement

* Employee costs grew 12% YoY to INR969m (in line with est.), while other expenses grew 6% YoY to INR731m (11% lower than est.). This resulted in an opex-to-AUM ratio of 8.8bp vs. 10.2bp in 4QFY24.

* Despite weak market sentiment and underperformance in small- and midcap segments, other income recorded strong sequential growth, driven by lower yields that translated into gains in debt funds.

* Tax rates were higher in FY25, driven by increased capital gains tax rates and the recognition of deferred tax liabilities on mark-to-market (MTM) gains.

Key takeaways from the management commentary

* On the Alternatives front, HDFC AMC is set to launch a Category II Credit Fund, for which regulatory approval has already been obtained. Meanwhile, the international subsidiary launched three funds in 3QFY25, which received strong investor response, enabling global investors to access Indian markets. Management has indicated that additional fund launches are planned for the upcoming fiscal year.

* AMFI’s ‘Debt Fund Sahi Hai’ campaign has successfully enhanced investor awareness, driving a positive response. At HDFC AMC, corporate investors continued to prefer shorter-duration debt funds, while individual investors leaned towards longer-duration strategies

* In response to the SIF regulation, HDFC AMC has established a dedicated team for the development of suitable products for this investor category, aligning with its vision to be a one-stop shop for a comprehensive range of savings and investment solutions across all investor segments.

Valuation and view

* HDFC AMC remains a strong player in the mutual fund industry, backed by robust financial performance, steady AUM growth, cost efficiency and a strong retail presence. While short-term market fluctuations pose challenges, the company’s long-term fundamentals remain solid.

* With an improved market position, a well-diversified product portfolio, and digital expansion efforts, HDFC AMC is well-positioned to sustain growth and deliver value to its stakeholders.

* For FY26/FY27, we expect 12%/18% growth in equity AUM and 13%/16% growth in total AUM. We maintain our BUY rating on the stock with a one-year TP of INR5,000, based on 40x FY27E core EPS.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412