Fundamental Stock Pick :- Nuvoco Vistas Corporation Ltd For Target Rs.435 by Nirmal Bang Ltd

Nuvoco Vistas Corporation Ltd

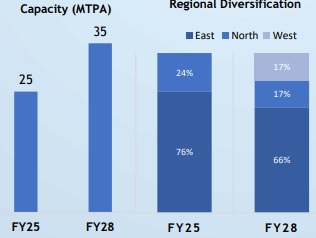

Nuvoco Vistas Corporation Ltd is India’s fifth-largest cement company with a strong presence across East, North, and now diversifying in West India. Backed by the Nirma Group, the company operates an integrated building materials platform spanning cement, ready-mix concrete (RMX), and modern building materials. It has an installed cement capacity of 25 MTPA, expected to rise to 35 MTPA post the Vadraj Cement acquisition. Nuvoco’s strategy is centered on premiumisation, blended cement leadership, cost efficiency, and disciplined deleveraging, positioning it well to benefit from sustained infrastructure and housing demand in India.

* Capacity Expansion & Growth Visibility: Nuvoco’s cement capacity is set to rise from 25 MTPA to 31 MTPA with the Vadraj acquisition, complemented by 4 MTPA of additional grinding capacity in East India taking it to 35MTPA. The East India grinding expansion is being executed through a phased debottlenecking plan, with Phase 1 adding 1 MTPA by Dec 25, Phase 2 another 1 MTPA by Mar 26, Phase 3 an additional 1 MTPA by Jun 26, and the final Phase 4 of 1 MTPA scheduled in FY27. Clinker capacity will increase from 13.5 MTPA to 17 MTPA, enhancing clinker security and operational flexibility. Trial runs for Vadraj assets are expected by H1 FY27, with full commissioning targeted by Q3 FY27, providing clear visibility on incremental volumes

* Premiumisation Driving Margin Expansion: Nuvoco continues to strengthen its premiumisation strategy, with a rising share of value-added and blended cements supporting higher realisations and margin resilience. In the previous quarter, premiumisation reached an all-time high of 44%, reflecting strong traction across key markets for premium brands such as Concreto Uno and Duraguard Microfiber. Management sees further headroom and targets +150–200 bps premium mix improvement over coming quarters. The trade mix remained healthy at 74%, underscoring the company’s continued focus on retail-led volume growth. A higher trade mix, combined with increasing premium product penetration, has supported improved realisations and margin stability.

* Operational Efficiency & Balance Sheet Strengthening: On the operational and balance sheet front, structural cost savings are being achieved through fuel mix optimization, logistics efficiency, and plant-level productivity initiatives. Blended fuel cost is targeted to reduce from 1.46 to 1.43 kcal, with Alternate Fuel and Raw Material usage rising from 10% to 12% at key plants. Completion of railway sidings and clinker/cement loading systems is expected to lower freight costs and enhance market servicing efficiency, contributing to a targeted cost reduction of Rs. 50/ton versus the previous year. Nuvoco continues its deleveraging trajectory, reducing net debt from Rs. 4501 cr in Sept 24 to Rs. 3,492 cr in Sept 25 and improving net debt/EBITDA to 2.7x, with a medium-term target of 2.0x supported by improving EBITDA, strong cash generation, and conversion of bridge financing into long-term instruments such as Compulsory Convertible Debenture Securities.

* Valuation:

* The long-term outlook for the cement sector remains positive, supported by robust government infrastructure spending growing in double digits. Industry demand is expected to rise 7–8% over the next 4–5 years, with East and Central India benefiting disproportionately from government-led projects, driving regional volume growth and higher capacity utilization.

* Nuvoco is expanding its footprint with cement capacity set to rise from 25 MTPA to 35 MTPA through the Vadraj acquisition, along with 4 MTPA of additional grinding capacity in East India to support blended cement growth, enabling incremental sales of 1.75–2 MTPA in FY27.

* Q2 FY26 performance was impacted by softer cement prices in key markets, compressing realizations, with EBITDA/ton at Rs. 853. Margins are expected to improve in H2, supported by premiumisation and structural cost savings.

* Eastern region plants operate at 85–90% utilization during peak seasons, while overall utilization averages 70–75%, leaving room to ramp up as demand strengthens and new capacities come online.

* These strategic expansions and operational efficiencies are helping Nuvoco gain market share across existing capacities while entering new markets, positioning the company for sustainable growth.

* We estimate Revenue/EBITDA to grow at 10%/25% CAGR between FY25-27E respectively, supported by the timely execution and ramp-up of Vadraj assets, along with significant deleveraging that strengthens the balance sheet. The company’s growth is further underpinned by strong premiumisation, government capex and rising demand. The stock is currently trading at 7.6x to FY27E EV/EBITDA which is below its historic average valuation. We have valued stock at 8.9x FY27E EV/EBITDA to arrive at a target price of Rs 435 and recommend to BUY the stock.

Please refer disclaimer at https://www.nirmalbang.com/disclaimer.aspx

SEBI Registration number is INH00000176

Tag News

Selling was broad-based, with IT, chemicals and consumer durables under sharp pressure - Ni...