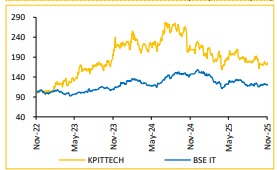

Buy KPIT Technologies Ltd For Target Rs. 1,400 By Choice Broking Ltd

Bottoming Out; Growth Recovery Ahead

Structural Transition; Long-term Story Remains Strong

We believe KPIT’s near-term softness reflects timing and transition effects rather than structural demand weakness. The company’s strategic pivot from services to AI-driven, IP-led solutions and productised offerings enhances scalability, client stickiness and long-term margin potential. Investments in Helm.ai, CareSoft and Qorix are expected to drive medium-term growth and differentiation in the Software-Defined Vehicle (SDV) ecosystem. We revise our rating to BUY with an unchanged TP of INR 1,400, valuing the stock at 35x (unchanged) on average of FY27E–FY28E EPS, in line with its long-term growth trajectory and premium positioning in the SDV ecosystem.

Revenue & Margin Beat Estimates; PAT Misses due to Forex Loss

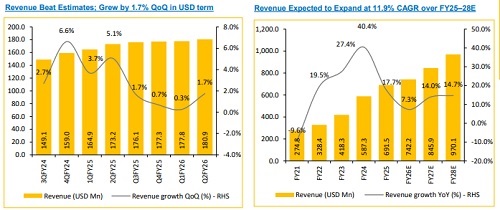

* Reported Revenue for Q2FY26 stood at USD 180.9Mn up 1.7% QoQ and 4.4% YoY (vs CIE est. at USD 177.8Mn). In CC terms, revenues grew by 0.3% QoQ. In INR terms, revenue stood at INR 15,877Mn, up 3.2% QoQ.

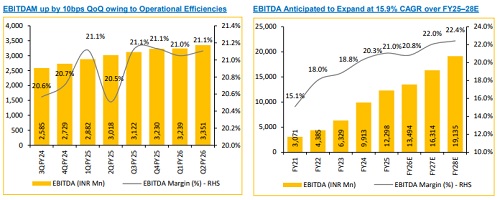

* EBITDA for Q2FY26 came in at INR 3,351Mn up 3.5% QoQ (vs CIE est. at INR 3,107Mn). EBITDA margin was flat QoQ at 21.1% (vs CIE est. at 20.2%).

* PAT for Q2FY26 came in at INR 1,691Mn, down 1.6% QoQ and 3.1% YoY (vs CIE est. at INR 1,973Mn).

Soft Q2; Growth to Rebound from Q3FY26: KPITTECH reported Q2FY26 revenue of USD 180.9 Mn, up 1.7% QoQ and 4.4% YoY, with growth muted due to OEM program delays and ongoing shift towards AI-led, solution-driven engagements. Management indicated a USD 65 Mn revenue impact – USD 45Mn from OEM reprioritisation and delays in Electrical and Middleware programs. Further impact of USD 20Mn from internal cannibalisation as smaller service deals were integrated into broader, end-to-end solution offerings. Europe drove growth aided by Caresoft integration, while Asia (led by India and China) saw improving traction. US is expected to recover over the next 1–2 quarters, supported by Off-highway and Commercial Vehicle. Management expects sequential recovery from Q3FY26, driven by large deal ramp-ups & IP-led, margin-accretive solution growth.

Healthy Pipeline; Strategic Investments & Transition Enhance Growth Visibility: KPITTECH’s reported an orderbook of USD 232Mn, driven by multiyear engagements across Validation, Digital Cockpit and Middleware. The recent large European OEM win reinforces its strong foothold in the SDV space. Strategic acquisitions –Caresoft (Validation), Helm.ai (Autonomous Software) and Qorix/ N-Dream (digital platforms)—are accelerating its transition from services to AI-led, solution-driven models. Management’s selective expansion into adjacencies, such as Off-highway, Industrial and Defence offer additional scalability. We believe KPITTECH’s shift towards AI-led, end-to-end solution strengthens its strategic relevance with OEMs and supports sustainable growth with margin resilience over the medium term.

Strong Cost Discipline & Mix Improvement Support Margin Stability: In Q2FY26, EBITDAM stood at 21.1% marginally higher QoQ supported by strong cost control and higher mix of solutions-led projects (now ~18% of revenue, doubled YoY). Management reiterated its confidence in sustaining 21% EBITDAM for FY26, even after factoring in upcoming wage hikes, reflecting improved delivery efficiency, disciplined project execution & synergies from the CareSoft acquisition.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131