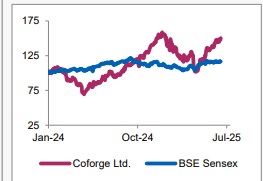

Buy Coforge Ltd For Target Rs. 1,870 by Axis Securities Ltd

In-line Performance; Strong Revenue Visibility

Est. Vs. Actual for Q1FY26: Revenue – INLINE; EBIT Margin – MISS; PAT – MISS

Recommendation Rationale

• Macro-economic outlook: Overall macro environment remains volatile, particularly due to tariff-related discussions. Meanwhile, discretionary spending on AI initiatives continues to be weak, supporting large deals aimed at enterprise budget changes.

• Deal wins/pipeline: In Q4FY25, the company secured a landmark $1.6 Bn deal - a 13- year engineering services agreement with Sabre. This deal is expected to continue a sequential ramp-up in subsequent quarters.

• AI Implementation: The company launched over 100 foundational agents addressing industry pain points in travel, financial services, and healthcare. The company strengthened its partnerships with ServiceNow (Dispute Accelerate, recognised as a leader in Nelson Hall's NEAT report), Zscaler (Secure Access 360 on Microsoft Azure), and Snowflake (data insights retrieval AI system on Snowflake Cortex)

Sector Outlook: Positive Company

Outlook & Guidance: The company’s strong executable order book and client spending across verticals augur well for its business. With a strong deal pipeline across business verticals, new partnerships, and higher adoption for new-age technologies, management remains confident towards the coming quarters of FY26 and FY27.

Current Valuation: 32x FY27E P/E

Current TP: Rs 1870/share

Recommendation: Given the company’s strong growth potential, backed by robust deal wins and superior execution capabilities, we resume our coverage with a BUY rating on the stock.

Financial performance

In Q1FY26, Coforge reported revenue of Rs 3,689 Cr vs Rs 2,401 Cr in Q1FY25, registering a growth of 54% YoY and 8.2% QoQ. In CC terms, revenue grew 51% YoY and 8% QoQ. EBIT stood at Rs 418 Cr vs Rs 212 Cr in Q1FY25, up 97.3% YoY and 4% QoQ, driven by strong topline growth. EBIT margin stood at 11.3% (incl ESOP cost) and 13.2% (excl ESOP cost). Net income came in at Rs 286 Cr vs Rs 139 Cr in Q1FY25, reflecting a growth of 105% YoY. It, however, declined 6.4% QoQ, led by an exceptional loss of Rs 25 Cr related to legal expenses of cybersecurity issues. However, attrition rose by 200 bps YoY to 13.9% from 11.9% in Q1FY25. Total order intake for the quarter exceeded $507 Mn. Moreover, five large deals were signed during the quarter. The board recommended an interim dividend of Rs 4/share

Valuation & Recommendation

The company maintains a positive outlook, expecting recent deal wins to drive revenue growth. Management remains committed to setting new performance and capability benchmarks, aiming to be a leader in the evolving industry, especially with the pivot towards AI. Therefore, we resume our coverage with a BUY rating on the stock and assign a 32x P/E multiple to its FY27E earnings to arrive at a TP of Rs 1870/share, implying an upside of 12% from the CMP.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633