IT Sector Update : Indian IT: Looking beyond 3Q noise by Motilal Oswal Financial Services Ltd

Seasonal softness persists as focus shifts to CY26 demand signals

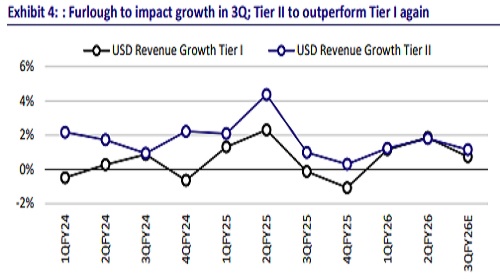

* After some respite in 2QFY26 on beaten-down expectations, we expect seasonal furloughs to weigh on growth in 3QFY26. We think markets are likely to look through this seasonality and instead focus on signals around the demand environment from client budgeting for CY26. Amid macro-tariff uncertainty and a new tech cycle, we believe clients remain cautious on committing incremental spending to large programs. As a result, we expect demand to stay steady, at best marginally incremental, until Jan’26 as planning cycles reset and budgets firm up.

* 3Q results are likely to mirror this set-up, with QoQ cc growth expected in the range of 0.3% to 2.3% for large-caps. Mid-caps are expected to outperform once again with a growth range of -2.5% to 3.5%. For 3Q, we expect aggregate revenue for our coverage universe to grow by 7.7% YoY, while EBIT and PAT are likely to grow by 7.2% and 7.6% YoY (all in INR terms), respectively.

* As seen in Exhibit 1, enterprises should gradually move from AI pilots toward scaled deployments as the year progresses, supporting deal pipeline stability, improving TCV, and higher activity in application modernization, data engineering, and AI integration-led work.

* Early signs of AI strategy formation are emerging, with IT companies investing in AI-led capabilities through acquisitions and partnerships: TCS (ListEngage, Coastal Cloud, DC investments), Wipro (Harman DTS), Coforge (Encora), and HEXT (CyberSolve). This shows companies are positioning themselves for early AI-led services demand.

* At the ecosystem level, leading LLMs such as OpenAI and Claude are opening structured channel partnerships with SIs, suggesting the AI services layer is beginning to formalize. We expect momentum here to build over the next six months, with AI services demand inflecting into CY26.

* Vertical performance in 3Q: BFSI remains relatively resilient despite furloughs; Hi-Tech is broadly flat as large deals are still in transition; Travel & Transportation benefits from ongoing deal ramp-ups. Manufacturing is mixed— auto under pressure, but core industrials remain steady. ER&D is stable in 3Q, with recovery skewed toward 4Q.

* Furloughs and wage hikes to put pressure on margins in 3Q: We expect margin declines for TCS (two-month wage hike impact plus furloughs) and Wipro (wage hikes). Among mid-caps, Coforge margins could decline ~70bp QoQ to ~13.3%, as wage hikes are partly offset by lower ESOP and D&A. HEXT and PSYS are also likely to see margin pressure of ~60bp and ~130bp, respectively, due to wage hikes and seasonality.

* As we mentioned in our upgrade note dated 24th Nov’25 (Time to buy the next cycle), we expect AI services demand could begin to improve from mid-2026 as hardware-led AI capex intensity moderates and spending gradually shifts toward software, platforms, and services. The Mar-Apr’26 budget reset period may serve as an initial indicator, with some AI programs potentially transitioning from preparation to early deployment.

Growth expectations across our coverage

* We expect revenue growth of 0.5% QoQ CC for TCS and 0.3% for INFO, driven by seasonal furloughs, with 2H weaker than 1H as growth was front-ended, in line with prior years. HCLT is anticipated to clock healthy growth of 2.3% in 3QFY26, driven by seasonality in its software business. WIPRO is likely to report 1.5% QoQ CC, organically at the mid-point of guidance, supported by inorganic contributions of HARMAN. TECHM is expected to post 0.5% QoQ growth, while LTIM is likely to report 2.2% CC growth, aided by continued large-deal ramp-up.

* Among mid-tier firms, we expect PSYS to be at the forefront with ~3.5% cc QoQ revenue growth, driven by steady growth momentum across verticals, partially offset by furloughs. COFORGE/MPHL are also likely to deliver 3.0%/1.3% cc QoQ growth. HEXT is likely to decline 2.5% CC due to lower license revenues in addition to regular furloughs (~2.5-3% impact), fewer working days and temporary government shutdown disruptions.

* Among ER&D names, we expect a gradual recovery in this quarter. KPIT is expected to report 2.8% QoQ CC growth due to full consolidation of Caresoft (1- month impact) and N-dream in 3Q. Management has guided for flat-to-modest growth in 3QFY26 (organic), while TTL/TELX /LTTS are likely to report 1.0%/1.8%/1.3% CC growth.

* We expect Cyient DET to report 1.0% CC growth, as some stabilization is expected. We are factoring in a cross-currency headwind of ~20bp for most companies.

Wage hikes and furloughs to restrict margin uplift in 3Q

* We expect TCS EBIT margins to decline by 30bp QoQ, driven by a two-month impact of wage hikes and the continuation of redundancy costs. HCLT’s margins are expected to improve by 70bp, led by a seasonally stronger quarter and cost optimization, despite the impact of wage hikes. Infosys is expected to report flat sequential margins, as tailwinds from lower third-party costs are likely to be offset by higher sales investments.

* TECHM is expected to see another quarter of margin expansion, with margins improving by ~60bp, driven by fixed-price project optimizations leading to gross margin gains. LTIM will hold margins at current levels as seasonal furloughs, lower utilization and deal ramp-up weigh on 3Q.

* Among mid-caps, Coforge margins may decline 70bp QoQ to 13.3% as wage hikes in 3Q are only partially offset by lower ESOP and D&A expenses. HEXT/PSYS, too, shall see margin decline of 60/130bp due to wage hikes and seasonal furloughs.

* Mphasis and Zensar should see margin improvement in 3Q.

* For ER&D companies, margins are estimated to decline due to the impact from furloughs, except for TELX, which should see sequential gains after a depressed 1H.

INFO and COFORGE remain our top picks

We believe CY26 should represent the bottoming of the growth cycle, setting the stage for a more meaningful acceleration in 2HFY27 and FY28 as AI services move into scaled deployment. We prefer INFO and TECHM among large caps, while COFORGE and HEXT remain our top picks among mid-caps.

* We like INFO as it is well placed to benefit from enterprise-wide AI spending, given its discretionary-heavy mix and improving revenue quality, with passthrough revenue likely to stay low. At current valuations, upside risks meaningfully outweigh downside risks. For TECHM, we see signs of transformation under the new leadership and improving execution in BFSI. We believe TECHM’s transformation remains relatively decoupled from discretionary spending.

* In mid-caps, Coforge and Hexaware remain our top picks. We believe Coforge’s strong executable order book and resilient client spending across verticals bode well for its organic business. Encora’s acquisition expands Coforge’s presence in the Hi-Tech and Healthcare verticals. We continue to view Coforge as a structurally strong mid-tier player well-placed to benefit from vendor consolidation/cost-takeout deals and digital transformation. Hexaware, meanwhile, is gaining share through consolidation deals in Financial vertical. As pressures in large accounts appear to be tapering, an improving margin trajectory bodes well for the company.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

More News

Life Insurance Sector Update : Surrender regulations affect FY25 individual WRP growth by Mo...