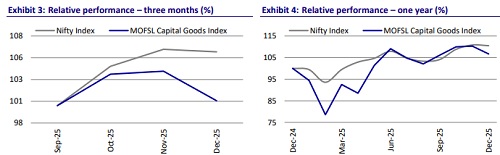

Capital Goods & Defense Sector Update : Select pockets continue to grow by Motilal Oswal Financial Services Ltd

We expect execution growth to remain healthy for our coverage companies in the capital goods universe, driven by strong order inflows and order books for them. While ordering remains strong across thermal power, renewables, T&D, data centers, buildings & factories, and defense, it is very selectively picking up from the domestic private sector. Government capex growth has remained healthy in 8MFY26, primarily driven by defense, and is expected to pick up from railways over the next few quarters. Government capex growth also benefited from the low base of last year. The export outlook is strong across renewables and T&D, with select EPC and product companies benefiting from this. We will monitor the commodity prices, as select commodities such as copper and zinc have moved up in recent months. For 3QFY26, we estimate our coverage companies to report revenue growth of ~16% YoY, EBITDA growth of 20% YoY, and PAT growth of 24% YoY. We reiterate our positive stance on LT, Cummins India (KKC), and Siemens Energy in the large-cap space and Kirloskar Oil Engines (KOEL) and Kalpataru Projects International (KPIL) in the mid-cap and small-cap segments. In the defense sector, Bharat Electronics (BHE) remains our top pick.

Ordering momentum remains stable

Ordering activity during the quarter remained stable across key areas such as defense, power T&D, hydrocarbon, heavy civil, and buildings & factories segments. Select largesized order wins were seen for L&T for an ultra-mega project in the hydrocarbon segment, Thermax for a boiler order, and GVTD for an HVDC project. Based on our discussions with companies, domestic private sector ordering is picking up selectively from metals and mining, buildings & factories, and thermal power, and further pickup is expected in the coming quarters. Ordering also remained healthy across the defense segment and is expected to pick up from railways, particularly for Kavach systems. During 3QFY26, BHE booked orders worth ~INR55b, BDL announced orders worth INR46b, KECI secured ~INR76b, and KPIL acquired ~INR51b. Supported by a strong order backlog and the expected finalization of pending pipeline opportunities, we estimate ~16% YoY growth in execution for our coverage universe in 3QFY26.

Recent developments in the defense sector

India’s Defense Acquisition Council (DAC) approved capital acquisition proposals worth INR790b in its winter session, taking FY26YTD approvals to ~INR3.3t, nearly double the capital outlay on defense of INR1.8t. Almost half of these approvals were announced in 3QFY26, with proposals worth INR1.6t announced in Oct’25 and Dec’25 combined. This provides order inflow visibility for the next 2-4 years, as conversion of AoNs takes time to convert into firm orders. The DAC has also extended the current emergency procurement window for the Armed Forces until mid-Jan’26, allowing them to continue fast-track purchases of critical weapons, platforms, and equipment to meet urgent operational needs. Other key developments include 1) completion of the user trials for the Akash-NG system, clearing it for induction, and we expect BDL and BEL to receive production and supply contracts in CY26 with ramp-up orders to follow; 2) the 5 th F-404 engine delivered to HAL by GE; and 3) the guideline rollout for the two major shipbuilding schemes by the GoI with a combined outlay of INR447b.

Commodity prices have been on the rise lately

On a YTD basis, commodity prices have trended upward across most key raw materials. While HRC steel prices, an important input for EPC companies, have moderated by ~6% from March ’25 levels, zinc prices have risen by ~9%. This may lead to some margin pressure in subsequent quarters; however, EPC players are generally able to hedge zinc price volatility. Copper/aluminum prices, which remained largely benign for some time, have recently started to increase, rising ~21%/8% from March levels. These increases have a more direct impact on product-oriented companies, and we will monitor the commodity price movements going forward. Overall, while commodity inflation remains a headwind, margin outcomes are likely to be driven more by revenue mix for product companies and indigenization levels for defense companies. We expect margins across our coverage universe to improve by ~50bp YoY, with EPC companies’ margins improving ~60bp YoY and product companies’ margins increasing ~40bp YoY.

Export demand to remain supportive

The export outlook remains selective for our coverage companies’ universe. L&T remains confident in the continuation of the long-term growth momentum from international geographies. Other EPC companies, too, are witnessing healthy order inflows globally. Transformer players are also optimistic about export order inflows due to higher spending across renewables. Product companies like ABB, Siemens, Thermax, and Triveni Turbine are yet to see a meaningful revival in exports. Cummins and KOEL are selectively targeting to grow exports. Demand outlook across defense exports remains strong, though we have yet to see any meaningful export ordering momentum for defense PSUs.

View: Selective stance continues

Our selective stance continues in the sector, and we continue to prefer companies in the T&D, renewables, and defense sectors. Companies that are growing at a high pace will remain preferred bets over the medium to long term.

Our top picks

We continue to prefer L&T, KKC, and Siemens Energy in the large-cap industrial space and KOEL and KPIL in the mid-cap and small-cap segments. BHE continues to remain our top pick in the defense sector.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

More News

IT Sector Update : Tempered expectations by Motilal Oswal Financial Services Ltd