Consumer Goods Sector Update : Print appears to be improving; jewelry continues to outperform by Motilal Oswal Financial Services Ltd

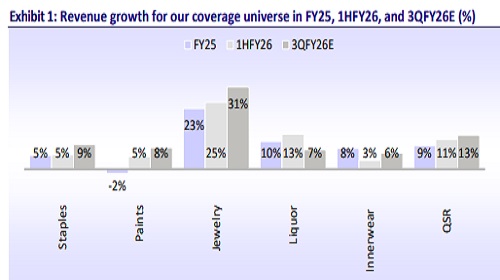

Within our consumer coverage universe, almost all segments are expected to see an improvement in revenue/EBITDA growth YoY in 3QFY26 — staples +9%/+7%, paints & adhesives +8%/+11%, liquor +7%/+12%, innerwear +6%/+2%, QSR +13%/+10%, and jewelry +31%/+20%.

* Staples companies are expected to report sequential improvement in revenue growth. Post GST 2.0, the disruption continues for Oct and partially in November (nearly 40-45 days affected). Thereafter, partial restocking supported the primary growth. Grammage additions in price packs (LUPs), undertaken to pass on GST rate reductions, should support volume growth (particularly packaged foods). A favorable winter further drives off-take of health supplements, personal care, hot beverages, and other winter-sensitive products. From 4Q onwards, growth is likely to reflect better underlying demand as trade disruptions fully normalize. Rural demand is expected to remain resilient, while urban demand has also shown an improving trajectory. Benign raw material prices should start seeing a recovery in gross margin. EBITDA margin is also likely to improve. Nestle, GCPL, Marico, Britannia, Emami, LT Foods, and Tata Consumer are expected to deliver doubledigit YoY EBITDA growth. We expect our coverage universe to deliver a sales/ EBITDA/APAT growth of 9%/7%/8% in 3QFY26.

* Paint & Adhesives – Improvement in demand was below expectation but is expected to be slightly better than 1HFY26. Demand post-festive period has not seen much pickup. Industry demand in value terms is expected to be in the lowto-mid-single digits in 3Q. Gross margins are expected to improve, supported by benign raw material prices, which should also aid EBITDA margin expansion. Pidilite is likely to sustain double-digit growth, underpinned by margin tailwinds and resilient underlying demand. We build in sales/EBITDA/PAT growth of 8%/ 11%/12% for our coverage companies in 3QFY26.

* Liquor: UNSP’s volume and revenue are expected to grow ~2% and ~6%, respectively, in 3Q, impacted by the excise duty hike in Maharashtra (a highteens revenue contributor) and the annualization of the AP policy. In contrast, Radico is expected to sustain robust double-digit, volume-led revenue growth. Gross margins are likely to see YoY improvement, supported by benign raw material prices. UBBL is likely to report weak revenue growth, hurt by the offseason (extended monsoon and early winters). Weak volume growth is expected to impact EBITDA margins. We expect sales/EBITDA/PAT growth of 7%/12%/13% for our coverage companies in 3QFY26.

* Innerwear demand remains soft, mainly due to a slowdown in the GT channel, while e-commerce continues to grow well. GT demand in Metro and Tier-1 cities (around 60% of sales) is still under pressure, whereas Tier-2/3 cities are seeing healthy growth. PAGE has geared up well for product launches, along with marketing and technology, though growth is expected to trend below its guidance. Going forward, it expects a new steady-state volume growth of 8-9% and a pricing contribution of 2-3% to drive double-digit revenue growth. EBITDA margins may face some pressure due to higher ad spending and a high base (23% in 3QFY25). We expect a sales/EBITDA/PAT growth of 6%/2%/5% for PAGE.

* QSR: The QSR print is expected to look better than 2Q, as Navratri was shifted to September vs. last year in October. Underlying demand has not seen much improvement. ADS and SSSG should be better than 2QFY26. Gross margins for most players are expected to see an improvement post-GST benefits. With better ADS, we believe the operating margin will be better than 2Q but will be lower for several brands on a YoY basis. We expect JUBI and RBA to deliver YoY expansion in EBITDA margin, and we expect them to deliver double-digit EBITDA growth. Intensified focus on in-store activations and new launches will be important to drive footfalls and order growth ahead. We expect sales and EBITDA growth of 13%/10% for 3QFY26.

* Jewelry: In 3QFY26, gold prices surged, rising ~60% YoY and ~20% QoQ. Despite this steep inflation, consumer demand for top brands remained resilient, supported by a strong festive season and sustained momentum during the wedding period. Demand was further aided by higher old-gold exchange-led purchases and attractive promotional offers. Gold coin sales also witnessed a sharp uptick amid rising gold prices. Now, consumers increasingly view gold inflation as structural and are therefore advancing their purchase decisions rather than postponing them. SSSG is expected to grow in high double digits, largely driven by value growth. However, margins may witness YoY pressure due to an adverse product mix amid elevated gold prices and high coin sales. We model a sales/EBITDA/PAT growth of 31%/30%/30% for our coverage jewelry companies in 3QFY26.

* Outperformers and underperformers: Among our coverage companies, Britannia, Emami, GCPL, MRCO, Nestle, Pidilite, Radico Khaitan, RBA, Titan, and Kalyan Jewelers are expected to be outliers in 3QFY26, whereas Colgate, HUL, UNSP, and UBBL will likely be the underperformers.

* Outlook: With trade stabilizing after the GST reduction, staples are expected to see a gradual pickup in demand, supported by a steady rural recovery and improving urban sentiment. Multiple measures have been initiated by the govt., and we expect steady improvement in demand from 4QFY26 onward. Our top picks are Britannia, Titan, and Radico.

Raw material prices remain stable

* Commodity prices have seen deflationary trends during the quarter. We expect staple companies to see some sequential GM expansion. Further, margins started to see a YoY recovery for some companies. Most agricultural commodities and prices of non-agricultural commodities, including crude oil, its derivatives, TiO2, and VAM, have seen moderation. However, select commodities such as gold continue to see inflationary pressure. Overall, RM inflationary pressure is likely to ease out in 2HFY26.

* Agricultural commodities: Wheat prices dipped 10% YoY and 3% QoQ. Barley prices declined 4% YoY and were flat QoQ. Sugar prices increased 7% YoY and 1% QoQ. Coffee prices increased 1% YoY while down 2% QoQ. Cocoa bean prices have started to ease and were down 33% YoY and 26% QoQ, offering relief to companies like Nestlé and HUL. Copra prices surged 71% YoY while down 1% QoQ, while palm oil prices are down 13% YoY and 2% QoQ.

* Non-agricultural commodities: These commodities have seen a moderation in prices. Crude oil prices are down 14% YoY. Other commodities such as TiO2 and TiO2 (China) continue to show a downward trend. VAM (China) prices rose 2% YoY and 4% QoQ. Gold prices jumped 60% YoY and 21% QoQ, putting pressure on the margins of jewelry companies.

* Companies remain focused on normalizing the gap between volume and value growth while prioritizing a strategic balance between revenue growth and margin expansion amid evolving market dynamics. This approach aims to navigate cost pressures effectively while maintaining competitive positioning.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

Tag News

Consumer Sector Update : Consumer price and commodity tracker By Motilal Oswal Financial Se...

More News

Life Insurance Sector : Industry individual WRP growth highest in ~3 years at ~27% by Motil...