Oil & Gas Sector Update : OMCs to drive earnings in 3QFY26 By Motilal Oswal Financial Services Ltd

* We expect our coverage universe to report: 1) 4% decline in sales YoY (+3% YoY excluding OMCs), 2) 16% YoY growth in EBITDA (+3% YoY excluding OMCs), and 3) 25% YoY growth in PAT (down 2% YoY excluding OMCs) in 3QFY26.

* RIL: Consol. EBITDA is expected to grow 9% YoY to INR479b. We estimate EBITDA of INR161b (up 6% YoY) for the standalone business, INR178b (up 15% YoY) for RJio, and INR68b (up 4% YoY) for the retail business. Production meant for sale is likely to stand at 17.7mmt (flat YoY), with standalone PAT at INR99b (up 14% YoY).

* OMCs: Standalone EBITDA for HPCL/BPCL/IOCL is expected to increase 9-18% QoQ, due to strong refining margins and receipt of LPG compensation. SG GRM averaged USD7.5/bbl in 3Q (vs. USD3.8/bbl in 2Q), while MS/HSD marketing margins were down 3%/8% QoQ.

* CGDs: We estimate 12%/5% YoY volume growth for MAHGL (incl. UEPL)/IGL and a 10% YoY volume decline for GUJGA. With Brent correcting ~USD5.4/bbl QoQ in 3Q, IGL and GUJGA are likely to see a QoQ improvement in EBITDA/scm margins. In contrast, MAHGL is expected to report a QoQ decline in EBITDA/scm, given its higher exposure to Henry Hub (HH) linked R-LNG, with HH prices rising 23% QoQ. Spot LNG prices declined to USD10.9/mmbtu in 3QFY26 (vs. USD 11.8/mmbtu in 2QFY26). Additionally, INR depreciation of ~2% QoQ is likely to put pressure on margin expansion.

* Upstream: For ONGC and OINL, we expect oil & gas sales volumes to remain largely flat QoQ and YoY, while oil realizations are likely to see a sharp YoY/QoQ decline for both companies.

Retain our bearish view on crude price

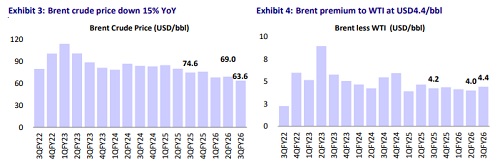

* In 3QFY26, Brent crude oil prices fell by USD5.4/bbl QoQ to USD63.6/bbl, as global oversupply from high OPEC+ output outpaced weak demand growth, exacerbated by US-China trade tensions and economic slowdown concerns.

* IEA now estimates global oil supply growth to exceed demand growth by ~2.2/1.5mbpd in CY25/CY26. Hence, we remain bearish on crude prices and maintain our Brent price forecast of USD60/bbl for FY27/28.

SG GRM up 97% QoQ in 3Q; Long-term refining outlook remains soft

* SG GRM rose 97% QoQ in 3Q owing to supply disruptions due to Russian export sanctions, Ukrainian strikes, and US/Middle East issues tightening product availability. Moreover, diesel and gasoline cracks improved 30-40% QoQ, which shall support refining margins for Indian players. However, note that diesel cracks have already normalized by 3Q end. MS/HSD marketing margins declined 22%/39% YoY and 3%/8% QoQ, with MS/HSD marketing margins (over Brent) averaging INR10.3/INR6.3 per lit. Blended marketing margins for IOCL/BPCL/ HPCL are expected at INR5.8/INR6.5/INR6 per lit in 3QFY26.

* The long-term refining GRM outlook remains subdued, with global refining capacity additions outpacing the global rise in demand for refined products. S&P Global expects ~1.35mb/d cumulative net refining capacity to be added over CY25-27 vs. ~0.7mb/d cumulative refined product demand growth. However, delays in refinery start-ups or announcements of new shutdowns can support stronger margin. We maintain our FY27/28 SG GRM assumption at USD5/bbl.

Petchem spreads remain under pressure

* LDPE/ HDPE/PP prices declined 15%/9%/16% YoY in 3Q. ? PX spread over naphtha increased 19% YoY but was down 5% QoQ, while PP spread over naphtha was down 22%/20% YoY/QoQ.

CGDs: USD/INR and HH price volatility key challenges for margin expansion

* The benefit of lower gas costs (amid lower crude oil prices) has been partly offset by two headwinds: 1) 6% YoY INR depreciation in 3Q, and 2) sharp 52% YoY rise in Henry Hub (HH) prices in 3Q. GUJGA and IGL are expected to show a QoQ increase in margin, while MAHGL could see margin decline due to the highest exposure to HH.

* On the volume front, we estimate IGL/MAHGL (incl. UEPL) to clock a 5%/12% YoY increase in volumes in 3Q, as CNG vehicle adoption remained healthy. However, we expect a YoY/QoQ drop in GUJGA’s I&C PNG volumes as competition from alternate fuel intensified at Morbi.

* Zonal tariff reform to benefit IGL: With the revised unified zonal tariff effective 1st Jan’26, IGL is expected to gain an EBITDA margin benefit of INR0.9/scm, MAHGL would see a contraction of INR0.3/scm, and GUJGA will remain unaffected.

OMCs: Refining and marketing strength to drive QoQ earnings growth

* OMCs are likely to report broadly stable GRMs QoQ in 3Q. Diesel, gasoline and ATF GRMs improved meaningfully QoQ during the quarter, supporting blended refining margins. However, the sharp QoQ decline in crude prices is expected to result in inventory losses, partly offsetting the strength in product cracks. On the marketing side, performance is expected to moderate QoQ, as MS/HSD marketing margins declined 3%/8% QoQ in 3Q. That said, recognition of LPG under-recovery compensation since Nov’25, along with lower QoQ per-cylinder LPG under-recoveries, should provide support to blended marketing margins.

Valuation and view

* HPCL: We continue to prefer HPCL among OMCs, given: 1) its high leverage toward marketing, which remains our preferred sub-sector, 2) the reasonable current valuation of 1.4x FY27E P/B, 3) receipt of INR6.6b per month in LPG compensation over Nov’25-Oct’26, which will boost earnings, even as the sharp decline in LPG under-recovery to INR30-40/cyl currently, vs ~INR135/cyl in 1HFY26, improves blended marketing margins, and 4) medium-term auto-fuel marketing margin outlook remains robust amid a weak crude price outlook (USD60/bbl in FY27/28). Further, the start-up of RUF and HRRL, coupled with steady strength in diesel cracks, should meaningfully boost refining earnings.

* GAIL’s valuations have corrected sharply from their Sep’24 highs, and the stock now trades close to its historical average at ~1.1x one-year forward core P/B, offering limited downside, considering an attractive dividend yield and a robust FCF outlook. Further, the transmission tariff revision, effective from Jan’26, would raise the FY27E PAT by around 7%. Transmission volumes are also set to rebound in FY27 as the impact of multiple one-off disruptions in FY26 wanes, with a recovery in power and fertilizer offtake and normalization of floodimpacted supplies. Government initiatives to further rationalize natural gas (NG) taxation can be a significant long-term positive. We have a BUY rating with a TP of INR215.

* We model MAHGL’s volumes to clock an 11% CAGR over FY25-28 and estimate an EBITDA margin of INR8.7-8.9 per scm during the period. While margins may face pressure in the near term amid high HH prices, we believe this has already been factored into the current stock price. MAHGL currently trades at 10.1x FY28E SA P/E. We value MAHGL at 15x Dec’27 P/E, resulting in a TP of INR1,700. We have a BUY rating.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

More News

Internet Eternal & Swiggy Sector Update : A buffet of tailwinds by Motilal Oswal Financial ...