Automobiles Sector Update : Strong demand and stable costs to drive healthy earnings growth By Motilal Oswal Financial Services Ltd

Strong demand and stable costs to drive healthy earnings growth

Demand sustenance post festive has been encouraging

* Aggregate auto demand for all OEMs in our coverage universe grew 17% YoY for 3Q. Key to highlight is that demand has been healthy across all segments: 2W and PVs up 17% each, CVs up 22%, and tractors up 21%. Further, demand has sustained even after the festive season, which is the key positive.

* On the back of a healthy recovery in volumes, auto OEM companies under our coverage (ex-JLR) are expected to post a strong 24% revenue growth. Similarly, excl. JLR, both EBITDA/PAT for our coverage universe is expected to grow by 27% each YoY.

* Given the strong OE growth, auto ancillaries within our coverage universe are likely to post ~14% revenue growth and a much healthier 17%/20% EBITDA/PAT growth in 3Q.

* Within auto OEMs, all OEMs (ex-JLR) are anticipated to post healthy double-digit earnings growth, with the lowest being HMCL at 13% and the highest being TVS at 62%.

* Given the sustained demand pickup, there have been moderate earnings upgrades across our coverage universe.

* Our top OEM picks are MSIL, MM, and TVSL. Top auto ancillary picks are ENDU, Happy Forgings, and SAMIL.

Demand remains healthy even after the festive season

While demand in this festive season has been strong across segments, the encouraging part has been that the same has remained strong even post the festive season. Retail growth, even in Nov and Dec’25, has held up very well. As a result, the overall auto industry volume growth for 3Q (aggregate for all listed OEMs) stood at 17% YoY. More importantly, growth was driven across all segments: 2Ws and PVs rose 17% YoY each, CVs grew 22% YoY, and tractors were up 21% YoY. Within 2Ws, TVS (+27%) and RE (+21%) continued to drive growth. On the other hand, while HMCL volumes were up 13%, BJAUT volumes grew 10%. Similarly, in PVs, ex-HMIL, the other three listed OEMs posted healthy double-digit growth. HMIL underperformed peers with just 5% YoY growth in 3Q. A key highlight has been that all three CV OEMs have posted 20%+ growth in 3Q. Further, within tractors, while MM posted 23% YoY growth, Escorts’ volumes grew 14% YoY. While demand has picked up well, discounts have moderated sequentially, especially in PVs.

Auto sector to experience healthy earnings growth in 3Q

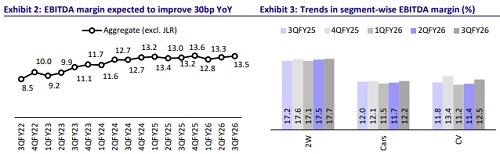

On the back of a healthy recovery in volumes, auto OEM companies under our coverage (ex-JLR) are expected to post a strong 24% revenue growth. While input costs are likely to rise marginally QoQ (precious metals are up but likely to be partially offset by cooling steel prices), this impact is likely to be offset by operating leverage benefits and moderation of discounts. Aggregate EBITDA margin for our OEM coverage universe is estimated to rise marginally by 30bp YoY to 13.5%. In 3Q, major margin gains are expected for Escorts Kubota (+220bp YoY), HMIL (+150bp), TTMT CV (+100bp), and TVSL (+100bp). The key is that none of the auto OEMs are expected to see any meaningful margin decline on a YoY basis. As a result, we expect OEM companies (ex-JLR) under our coverage to record a strong 27% growth each in EBITDA/PAT.

Given the strong OE growth, auto ancillaries within our coverage universe are expected to post ~14% revenue growth. This is likely to lead to a strong 17%/20% growth in EBITDA/PAT for 3Q. Within auto ancillaries, all automobile based tyre companies under our coverage are expected to register healthy margin expansion given the lower input costs. Apart from these, we expect CRAFTSMA to post a 280bp margin expansion YoY over a low base. On the other hand, players like BKT (-180bp YoY) and SONACOMS (-240bp YoY) are likely to see margin pressure in 3Q.

Estimated hits and misses in 3QFY26

We expect our auto OEM coverage universe (ex-JLR) to post a 27% YoY growth in earnings. It is important to highlight that all listed OEMs (ex JLR) are anticipated to clock a healthy double-digit growth in earnings with the lowest being HMCL at 13% and the highest being TVS at 62%. As highlighted above, our ancillary coverage universe is also expected to deliver healthy 20% YoY growth in earnings. Most of the auto ancillaries within our coverage are expected to record strong earnings growth. However, the few with relatively weak performance would include AMRJ (-5% YoY), BIL (-36%), BHFC (9%), and SONACOMS (+9%).

Moderate earnings revision expected in 3QFY26

Given the strong demand post-festive season, there has been a moderate upwards earnings revision for most of the OEMs under coverage, largely in single digits. For a few auto ANCs, there has been a need for earnings cuts as well. Within our coverage, players like APTY (-5% for FY26E) and BIL (-4%), SONACOMS (-4%) and Exide (-4%) have seen some earnings cut.

Post-festive season demand sustenance encouraging

Following the GST rationalization, demand has picked up across segments and seems to have remained intact even after the festive season. A notable trend is that entry-level vehicles, both 2Ws and PVs, are seeing a marked pickup in demand. Further, wholesales were strong in Dec, and retails were equally healthy across most segments. Thus, OEMs are likely to have ended 2025 with lean inventory. This would help them sustain the volume momentum in 4QFY26 as well. With a recovery in demand, we expect discounts (in the PV segment) to gradually reduce. MSIL is our top pick among auto OEMs, as its new launches and the current export momentum are likely to drive healthy earnings growth. We also like MM, given the uptrend in tractors and healthy growth in UVs. In 2Ws, we are positive on TVSL. In the auto ancillary space, our top picks are ENDU, HAPPY, and SAMIL.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

More News

Cables and wires Sector Update : UTCEM`s entry into cables and wires: Is it time for valuati...