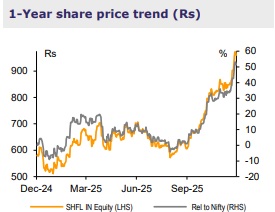

Buy Shriram Finance Ltd for the Target Rs.1,100 by Emkay Global Financial Services Ltd

MUFG deal puts growth and profitability in the higher orbit

SHFL hosted an analyst call to highlight its strategy for growth and utilization of the funds as a consequence of its announcement of the mega deal of Rs396.2bn with MUFG. The deal is expected to close by end-FY26, subject to regulatory approvals. In terms of its medium-to-long term strategy, the management indicated that it would see CoF moderating by ~100bps over the next 2 years (matching that of other AAA-rated NBFC peers), which would result in SHFL focusing on retaining preferred customers (who would otherwise typically move out due to higher rates) and an increase in share of new vehicle financing. This would also improve AUM growth to ~20% (from ~15-16% earlier), supported by the CoF benefit and expansion in non-South regions. The management also indicated that retaining preferred customers would result in some improvement in overall asset quality and moderation in credit cost by ~10-15bps in the medium to long term. The management also expects overall margin to see some improvement, led by COF moderation, while increasing share of new vehicle financing and retention of good customers will have limited impact. Factoring in the outlook and the management commentary, we raise our FY27-28E AUM growth by ~2-5% and cut our CoF assumptions by ~95bps, resulting in a ~5-8% rise in our EPS forecasts. We maintain BUY and lift our target price by 5% to Rs1,100, implying a FY27E P/B of 2.2x.

Deal to strengthen balance sheet and core competency

The Board of Shriram Finance has approved a strategic equity investment by MUFG, through a preferential allotment that will give MUFG a ~20% stake in the company and bring in ~USD4.4bn of fresh capital. Following the transaction, MUFG will be classified as a public shareholder with the right to nominate 2 board members, while the management stated that there will be no changes at the senior management or KMP level. The management described the partnership as a long-term association, aimed at strengthening the balance sheet, lowering funding costs, and drawing selectively on MUFG’s experience across Asian markets. The management expects the stronger capital base and the MUFG association to support credit rating upgrades which, along with gradual repricing of liabilities and deposits, could lead to a ~100bps reduction in borrowing costs (including RBI rate cut) over the next 2 years. The management expects ROA to improve to 3.6% in the medium term (~2.8% currently) and to deliver currentlevel ROE by FY31.

Maintain our positive view; reiterate BUY with TP raised to Rs 1,100

Factoring in the recent development and the management’s medium-term outlook, we adjust our FY27-28 estimates – raising AUM growth by 2-5% and cutting CoF by ~65- 90bps, resulting in a 5-8% rise in our EPS estimates. We reiterate BUY and lift our Dec26E TP by ~5% to Rs1,100 (Rs1,050 earlier), implying FY27E P/B of 2.2x.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354