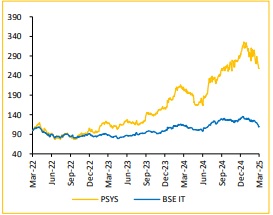

Hold Persistent Systems Ltd For the Target Rs. 5,660 by Choice Broking Ltd

Assessing Q3 Results in Light of Trump Tariffs & Macroeconomic Challenges

PSYS Revenue & EBIT slightly above estimates, PAT beats expectations.

* Revenue for Q3FY25 came at INR 30.6Bn up 22.6% YoY and 5.7% QoQ (vs consensus est. at INR 30.2Bn).

* EBIT for Q3FY25 came at INR 4.5Bn, up 25.5% YoY and 12.2% QoQ (vs consensus est. at INR 4.4Bn). EBIT margin was up 35bps YoY and 86bps QoQ to 14.9% (vs consensus est. at 14.5%).

* PAT for Q3FY25 stood at INR 3.7Bn, up 30.4% YoY and 14.8% QoQ (vs consensus est. at INR 3.7Bn).

Record $594.1M TCV deal on TTM basis drives ambitious growth plans: PSYS secured significant deals in Q3FY25, including a $150Mn+ 7-year transformation deal in BFSI, their largest to date. Other notable wins were in Software, Hi-Tech (a $50Mn+ 5-year deal), and Healthcare & Life Sciences, focusing on R&D transformation, engineering partnerships, and platform modernization, leveraging company’s SASVA platform. The TCV for the quarter reached $594.1Mn, with new bookings at $333.6Mn, and the ACV stood at $428.3Mn. Management is confident in their growth trajectory, targeting $2Bn revenue by FY27 and $5Bn by FY31. While ACV growth appeared modest, multiyear deals are expected to drive future revenue. The healthy pipeline, coupled with a focus on AI-led, platform-driven services, positions PSYS for continued success. Strategic partnerships and a focus on top clients further support a positive outlook.

Potential slowdown in IT spends amid Trump tariffs: PSYS may face revenue challenges due to uncertainty over the Fed's interest rate decisions and concerns about a potential US economic slowdown. With 80% of its revenue from North America, a dip in IT spending or delayed contract renewals from key sectors like BFSI, software, Hi-tech, and emerging industries could affect top line growth. Additionally, currency volatility poses a risk to profit margins. However, easing inflation and stable tariff policies could drive increased demand, helping US enterprises make more confident IT spending decisions

PSYS workforce, attrition, and EBIT outlook: As of Q3FY25, PSYS employed 23,941 people, with 20,661 based in India and 2,778 in North America. The company reported a TTM attrition rate of 12.6%, within acceptable limits. EBIT margin for Q3FY25 was 14.9%, up 90bps sequentially, driven by factors like higher utilization (87.4%), rationalized contractor costs, and a strong USD. Management aims for margin expansion of 200-300bps over medium term, focusing on pricing, SG&A optimization, and AI-led platform services, expecting the earnout reversal headwind to end by FY25.

View and Valuation: PSYS is committed to proactively staying closer to their clients and aiding them in prioritizing their technology spend towards cost optimization and transformation. We expect Revenue/EBIT/PAT to grow at a CAGR of 20.2%/26.9%/25.8% respectively over FY25E-FY27E. We upgrade our rating to HOLD to arrive at a revised target price of INR5,660. Considering PSYS's significant exposure to the US market, we have lowered our PE multiple to 40x (earlier 45x), based on the FY27E EPS of INR141.5.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131