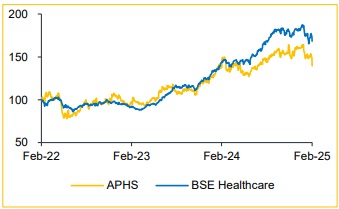

Buy Apollo Hospitals Enterprise Ltd For the Target Rs. 7,520 by Choice Broking Ltd

Revenue and EBITDA were in line with the estimates, wherein PAT outperformed and grew by 52% YoY

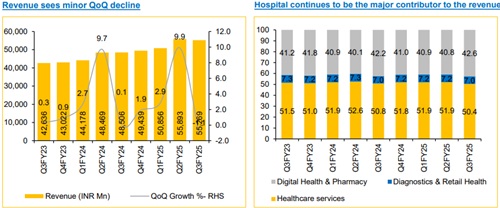

* Revenue came at INR 55.3 Bn (vs. CEBPL est. at INR 54.8 Bn), up 13.9% YoY and down 1.1% QoQ.

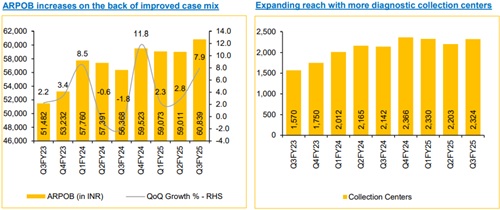

* ARPOB at INR 60,839, up 7.9% YoY and up 3.1% QoQ, while occupancy came at 68% from 66% in Q3FY24.

* EBITDA came at INR 7.6 Bn (vs. CEBPL est. at INR 7.9 Bn), up 24.1% YoY and down 6.6% QoQ. EBITDA margin came at 13.8% (vs. CEBPL est. of 14.5%), up 113bps YoY and down 81bps QoQ.

* PAT came at INR 3.7 Bn (vs. CEBPL est. of INR 3.9 Bn), up 51.8% YoY and down 1.7% QoQ

Strategic Expansion to help achieve early EBITDA breakeven

Apollo plans to add 1,737 beds in FY26 (20% of the existing capacity), strategically expanding in key markets such as Pune, Kolkata, Delhi, Hyderabad, and Gurugram. Considering the continuous progress in the expansion, we expect new facilities to achieve EBITDA breakeven within 12 months of operations, especially for the Kolkata (270 beds) and Delhi (510 beds) facilities because of their existing presence. The long-term plan is to add 3,512 beds over the next 3-4 years. The expansion targets high-margin specialties like oncology, neurosciences, and cardiac sciences, enhancing revenue intensity. The inflow of inpatients is expected to increase by 6-7% every year, sustaining the ARPOB growth of 7% annually and maintaining the EBITDA margins at 24%

Diagnostics & Pharmacy: Scaling Profitably with Digital Expansion

The diagnostic and pharmacy businesses are poised for strong growth, driven by a 15-18% revenue CAGR in diagnostics and double-digit growth in the pharmacy business. We expect that strategic partnerships with insurers and financial institutions will further boost margins. With a calibrated focus on unit economics and profitability, Apollo aims for a 6-7% EBITDA margin in its pharmacy business by FY27 and a 200bps improvement in the diagnostic business to achieve around 10% by FY27

View and Valuation:

We have revised our FY26/FY27 estimates by (3.9)% and (4.5)%, respectively, and maintain our 'BUY' rating with a target price of INR 7,520 for FY27, based on a SOTP valuation (refer page 4). We anticipate the company’s growth will be driven by a shift in case mix toward high-end specialties, an increase in inpatient volume, ARPOB growth, capacity expansion, and the introduction of an insurance business segment. These factors are expected to improve operating leverage, enhance margin, and strengthen overall profitability

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131