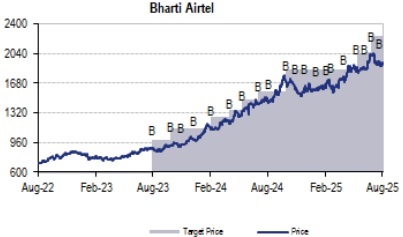

Buy Bharti Airtel Ltd For Target Rs. 2,240 By JM Financial Services

India wireless EBITDA was 0.5-1% above JMFe/cons at INR 162.7bn (up 3.3% QoQ) on robust ARPU growth (up 2% QoQ to INR 250), but it was partly offset by lower net subscriber (subs) additions (1.2mn) and slightly lower 4G/5G subs additions (3.9mn). Further, strong traction continues in the home broadband business, led by FWA rollout, but the company lags Jio on subs addition. The management expects strong growth in the Enterprise business, having completed shedding of low-margin business. India capex (ex-Indus) moderated sharply to INR 54.5bn, led by the wireless business; consolidated net debt (exlease liability) declined by a sharp INR 130bn QoQ to INR 1,255bn reflecting the huge FCF generation potential. We maintain BUY on Bharti (revised TP of INR 2,240) as we believe the industry’s wireless ARPU will grow at 12-13% CAGR in the next 3-5 years given the consolidated industry structure, to ensure a ‘3+1’ player market and higher ARPU requirement for Jio not only to justify its significant 5G capex but also given its potential listing plans. Further, the potential 5G monetisation and FWA rollout provides significant upside risk over the long term. Moreover, there is huge FCF generation potential over the next 4-5 years with the next big jump in capex, mostly related to 6G, which is the most likely 2030-onwards story.

* Consolidated revenue slightly higher at INR 500bn led by strong growth in India wireless and home broadband business, while EBITDA in line with JMFe at INR 284bn:

Bharti’s 1QFY26 consolidated revenue at INR 500bn (up 3.3% QoQ, and up 28.6% YoY on a small base due to Indus consolidation) was ~1% higher than JMFe/consensus led by strong growth in India wireless, home broadband and Airtel Africa businesses. However, consolidated EBITDA at INR 284bn (up 3.1% QoQ, and up 41% YoY on a small base due to Indus consolidation), was in line with JMFe but 1% above consensus. Separately, it reported EBITDAaL of INR 250bn in 1QFY26 (up 2.5% QoQ), with EBITDAaL margin at 50% in 1QFY26.

* India wireless EBITDA 0.5-1% above JMFe/consensus at INR 162.7bn (up 3.3% QoQ) on robust ARPU growth (to INR 250) but partly offset by lower net subs adds (1.2mn):

India wireless revenue, at INR 274bn (+2.9% QoQ and +21.6% YoY), was marginally above JMFe/consensus of INR 273bn. Further, India wireless EBITDA at INR 162.7bn (+3.3% QoQ and +30% YoY) was also 0.5-1% above JMFe/consensus of INR 162bn/INR 161bn; India wireless EBITDA margin improved to 59.4% in 1QFY26 (vs. 59.2% in 4QFY25). India wireless ARPU was higher at INR 250 (vs. JMFe of INR 249 and vs. INR 245 in 4QFY25), up 2.0% QoQ due to upgrades and improved subs mix and aided by 1 more day QoQ in 1QFY26. This compares to Jio’s 1QFY26 ARPU being up 1.3% QoQ at INR 208.8 (including FTTH) and ~INR 195 (excluding FTTH) and Bharti Hexacom’s ARPU, which grew by 1.7% QoQ to INR 246 in 1QFY26. Further, usage metrics was up 7.2% QoQ at 26.9GB/user/month in 1QFY26. However, India wireless business net subscriber additions was lower at 1.2mn QoQ (vs. JMFe of 2.3mn) with reported churn higher QoQ at 2.7% in 1QFY26 (vs. 2.3% in 4QFY25). Further, 4G/5G net additions were also slightly lower at 3.9mn in 1QFY26 vs. JMFe of 5.5mn additions (vs. 6.6mn additions in 4QFY25); 4G/5G subscribers constitute 77% of total subscribers. However, post-paid subscriber net additions (excluding IoT) continued to be strong at 0.7mn in 1QFY26 to 26.6mn (vs. 0.6mn in 4QFY25).

* Strong traction in home broadband business continues, led by FWA rollout, but Bharti lags Jio on subs addition; completes shedding low-margin business in B2B segment:

Bharti’s home broadband EBITDA increased to INR 8.6bn in 1QFY26 (+7.9% QoQ and +25% YoY) with additions of 939k subscribers during the quarter, aided by FWA rollout (with ~11mn subs at end-1QFY26), but this is lower than Jio’s robust FTTH/FWA addition of ~2.6mn in 1QFY26 (with 20.7mn subs at end-1QFY26). However, ARPU moderated to INR 537/month in 1QFY26 (vs. INR 543/month in 4QFY25) as additions are happening at lower tariff plans. Its home-pass network also expanded at an faster pace of 1.6mn home passes in 1QFY26, which the management aims to further accelerate to 2.5mn per quarter going forward. Separately, enterprise business revenue was down 4.9% QoQ and down 7.7% YoY to INR 50.6bn; EBITDA was down 3.7% QoQ but up 8.5% YoY to INR 21.5bn, impacted by portfolio transformation in line with the company’s stated strategic goal to eliminate low-margin business (finally completed in 1QFY26). However, Bharti shared that the underlying revenue growth was steady at 2.0% QoQ growth with continued improvement in funnel and order book. Further, enterprise segment capex normalised QoQ to INR 7.3bn in 1QFY26 (after seeing one-off jump to INR 24.9bn in 4QFY25).

* India capex (ex-Indus) moderating sharply to INR 54.5bn led by wireless business; Net debt (ex-lease liability) also declined by sharp INR 130bn QoQ to INR 1,255bn:

Consolidated capex (excluding Indus) moderated sharply to INR 64.9bn in 1QFY26 (of which India business capex excluding Indus moderated to INR 54.5bn) vs. sharp jump 4QFY25 consolidated capex to INR 123bn (of which India business capex was INR 104bn). Net debt at end-1QFY26, excluding lease liabilities, declined by a sharp INR 130bn QoQ to INR 1,255bn. Net debt-EBITDA, including lease liabilities, stands at 1.69x at end-1QFY26 (vs. 1.85x at end-4QFY25).

* Reiterate BUY with revised 1-year TP of INR 2,240 and 3-year TP of INR 3,035 (implying 16% IRR); our TP implies 13.7x Sep’27 EV/EBITDA for India wireless:

We have tweaked our FY26-28 Revenue/EBITDA estimates marginally, incorporating 1QFY26 results; however, our TP has been revised downwards to INR 2,240 (from INR 2,250) due to decline in the value of listed investment, i.e., Indus (which is valued at CMP less 20% holding discount). Our TP implies 13.7x Sep’27 EV/EBITDA for India wireless business and 12.8x for overall India business. Further, given the attractive, long growth runway, we see Bharti delivering a 3-year IRR of 16% based on our revised 3-year TP of INR 3,035 (Exhibit 11-12). As detailed in our Deep-Dive note (Biggest beneficiary of structural ARPU growth story), we reiterate BUY on Bharti as we believe the industry’s wireless ARPU will grow at 12-13% CAGR in the next 3-5 years given the consolidated industry structure, to ensure a ‘3+1’ player market and higher ARPU requirement for Jio not only to justify its significant 5G capex but also given its potential listing plans. Further, the potential 5G monetisation and FWA rollout provides significant upside risk over the long term. Moreover, there is huge FCF generation potential over the next 4-5 years, with the next big jump in capex, largely related to 6G, which is the most likely 2030-onwards story.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361