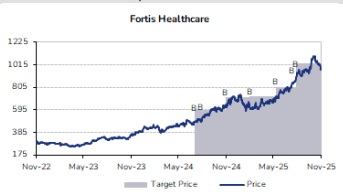

Add Fortis Healthcare Ltd For Target Rs. 1,090 By JM Financial Services Ltd

Fortis reported strong numbers in 2QFY26, with revenue/EBITDA/PAT growing 17%/28%/82% YoY and coming in In-line/1%9% ahead of our estimates. EBITDA margin stood at 23.9%, up 199 bps YoY. The strong performance was driven by sustained growth momentum in the hospital business, which grew 19% YoY, and improved profitability in the diagnostics business, which achieved a margin of 29% during the quarter. Operationally, occupancy was at 70% from 71% in 2QFY25, ARPOB grew 6% YoY, and ALOS largely stable at 4.18. For the rest of the year, 1H and 2H performance is expected to be broadly similar. A mild dip in 3Q may occur due to holidays and festivities, but the 4Q performance should offset this impact. While management has retained its EBITDA margin guidance of 22% for FY26, we believe Fortis is likely to surpass this, supported by more units reaching maturity. On a longer run, given the robust performance of the existing business and the addition of Gleneagles Hospital and Shrimann Hospital, we believe Fortis is increasing its EBITDA per occupied bed from INR 5mn in FY25 to INR 7mn in FY28, narrowing the gap with leading peers such as Max. Consequently, valuation multiples have expanded to 28x FY27 EV/EBITDA from its 5Y LTA of 21x. We value Fortis on an SOTP basis and arrive at a target price of INR 1090 with ADD rating on the stock.

* Hospital business growth led by OBD (+13% YoY): Hospital business growth during the quarter was driven by a 13% YoY increase in OBD and a 6% YoY increase in ARPOB. Occupancies stood at 71%, lower by 100bps YoY, and are expected to remain in the 70–75% range despite new additions. Around 550 operational beds were added in 1HFY26, including ~150 organic beds in 2Q. International patient revenues grew 26% YoY to INR 169 crore. Digital channels, including the website, mobile app, and online campaigns, recorded 20.4% YoY growth and contributed 29.5% to overall hospital revenues.

* ARPOB growth from improved speciality mix: ARPOB growth was driven largely by an improved specialty mix led by oncology which grew 29% YoY. Price increases contributed 1–1.5%. A 5–6% ARPOB growth is expected to continue in the second half as well. Key surgical proce dure volumes grew sharply across specialties, with robotic surgeries up 66%, radiation therapy up 54%, and renal sciences up 22% YoY.

* More hospitals improve margin levels: Among geographies, Ludhiana, Mohali, and Amritsar hospitals saw temporary disruption in patient inflow due to Punjab floods, though operations were not materially affected. The company’s three key hospitals delivered 20% revenue growth YoY along with margin expansion. Mulund and Jalandhar hospitals achieved margins above 20%, while Manesar turned EBITDA positive within a year of operations. All empanelments at Manesar are completed, with additional beds expected to open in 2H; the facility is currently operating at a quarterly run rate of INR 40 crore and is expected to grow by 20%.

* Diagnostics- wellness portfolio improves: Revenue grew 7.3% YoY, with lower incidence of vectorborne diseases impacting overall growth. No price hikes were taken during the period, though RPP improved due to a higher contribution from the wellness portfolio. Margins for the quarter stood at 26% (24% excluding one-offs), with a full-year guidance of 23–24%. Agilus conducted 10.62 mn (+2% YoY), and added 19 new tests across onco, infectious diseases, and autoimmune. The wellness/routine/specialised mix stood at 13%/53%/34% respectively, vs 10%/57%/ 33% in 2QFY25, indicating a shift toward wellness testing. On the business mix, B2C/B2B contributed 52%/48%, marking a 100bps YoY shift toward B2C. The genomics portfolio continued to strengthen, supported by focus on next-generation tests, and recorded 20% YoY growth. The company added over 200 customer

* Expansion plans largely on track: The Manesar facility, with a total planned capacity of around 300 beds, has added about 180 beds till July 2025, of which 124 beds were operational as of October 2025. The remaining capacity will be added in the second half of FY26. The new tower at Faridabad, comprising 50 beds, was operationalized in 2QFY26. At the Noida facility, the new tower with a capacity of around 150 beds had 73 beds operationalized in the first half of FY26, with the remaining 77 beds expected to become operational in the second half. The FMRI new tower, with 220 beds, is now expected to be commissioned in the first half of FY27, following a three-month delay from the earlier target of 2QFY26. The company expects to add 300–400 beds in the next financial year.

* Greater Noida agreement- strong margin ramp-up expected: The company has entered into a lease agreement with RR Lifesciences for a multi-specialty hospital in Greater Noida with a capacity of around 200 beds. The facility, which was earlier managed by Fortis under an O&M arrangement, currently has 170 operational beds and the potential to add another 50 beds. With this addition, the company’s total presence in the Delhi NCR region has expanded to approximately 2,100 beds. The Greater Noida facility, opened about 1.5 years ago, is currently operating at an EBITDA margin of 2– 3%. The company expects the margin to reach around 15% over the next six months as operations stabilize and occupancy improves.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361