Add Sun Pharmaceutical Industries Ltd For Target Rs. 2,000 By InCred Equities

Innovation-led growth takes shape

* Healthy 2Q results - above expectations. US biz up 5% QoQ, & innovative medicines surpass generics in the US. India biz growth stays in double digits.

* Innovative medicines to generate additional US$200m revenue & aid margin. ? Upgrade our rating to ADD on the stock with a higher target price of Rs2,000.

Healthy 2QFY26 results beat our estimates

Sun Pharmaceutical Industries’ (Sun Pharma) 2QFY25 results were healthy and above our/Bloomberg consensus (BB) estimates by ~2% on the revenue front. Margin came in at 28.3%, 30bp above our estimate and in line with the BB estimate. Notably, R&D spending was 5.4%, much below management’s guidance of 6-8% for FY26F; R&D guidance now stands revised to the lower end of 6-8%, which should provide some cushion to margin from the US$100m investment being made in sales and distribution (S&D) in FY26F. The US business saw a QoQ growth of 5% (at US$496m vs. estimate of US$485m) led by Ilumya, Cequa and Odomzo. The gRevlimid contribution was flat QoQ. Innovative medicine sales in the US have surpassed generics for the first time in 2QFY26. The global innovative medicines business posted a robust performance (US$333m, +7% QoQ), led by Ilumya. Odomzo, in the hedgehog inhibitor segment, currently has 60%+ market share in the EU whereas over 50% market share in the US among dermatologist prescribers. India biz continued its double-digit growth (11% YoY growth vs. 12% estimate), largely led by volume and new launches. The emerging market business grew by 15.7% YoY (8% CC growth), while RoW market grew by 22.7% YoY led by generics and innovative medicines (Ilumya & Odomzo-led).

Innovative medicines business to aid US market growth in FY27F

Sun Pharma’s global innovative medicines segment has delivered a robust 23% CAGR over the past five years, and we expect this momentum to sustain over the medium term, driven by a strong launch pipeline. The company introduced Leqselvi in the US during 2QFY25, which we estimate would contribute US$110–125m over FY26F-27F. In addition, the planned Unloxcyt launch in 2HFY26F (with potential revenue of US$50–70m over FY26F-27F) and dossier filings in the EU are expected to further strengthen the franchise. The anticipated launch of Ilumya for PSA by end-FY26F should also bolster overall Ilumya sales. Collectively, these products are expected to offset the gRevlimid cliff and generate nearly US$200m in incremental US revenue. Given the superior margin profile of innovative medicines, we expect the margin expansion to materialize from FY27F.

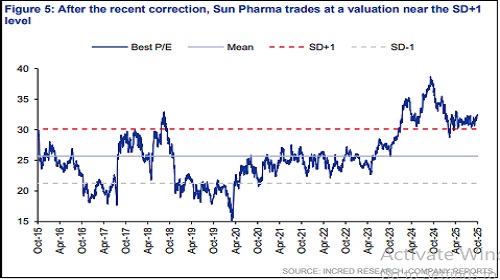

Upgrade to ADD rating with a higher target price of Rs2,000

We upgrade Sun Pharma’s rating to ADD (from HOLD), reflecting the sustained momentum across key markets and a strong launch pipeline in the innovative medicines franchise. While near-term margins may remain range-bound due to elevated S&D expenses, we expect margin expansion to resume from FY27F as high-margin innovative products scale up. Downside risk: Slowdown in the specialty portfolio.

Above views are of the author and not of the website kindly read disclaimer

.jpg)