Buy CSB Bank Ltd For Target Rs. 380 By Yes Securities Ltd

Sector level considerations barely matter

Our view – Margin decline the only near term concern

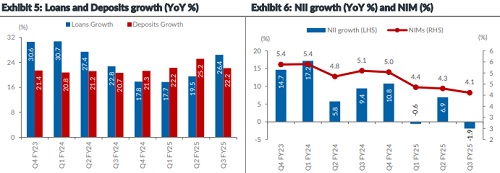

Balance sheet growth – Loan growth outcome far outstrips the banking system from a small base: Total advances in 3Q were Rs 286bn, up by 7.7% QoQ and 26.4% YoY whereas total deposits in 3Q were Rs 334bn, up by 4.9% QoQ and 22.2% YoY. Gold loans, other retail loans and SME loans grew 36%, 32% and 29% YoY, respectively. Corporate loan growth picked up and was 30% YoY on a gross basis but the reported growth was 5% YoY due to liquidation of the DA portfolio and other deliberate exits from certain accounts. The bank's gold loan business is not impacted by RBI's 30th September Circular in 3Q and will not be impacted by it going forward.

Net Interest Margin – Margin declined on sequential basis due to the shedding of higher-yield assets and tight liquidity: NIM was at 4.11%, down -19bps QoQ and - 99bps YoY. The liquidity was tight during the quarter causing cost of funds to move up. There has been a decline in yield since high-yield segments such as 2W, personal loans, microfinance, agri loans and relatively higher yield corporate loans have seen degrowth. Management felt that NIM maximization in the current environment by pursuing high yield segments is not prudent.

Asset Quality – Asset quality remained under control with sector level aspects not having any bearing on the bank: Gross NPA additions amounted to Rs 0.62bn for 3QFY25, translating to calculated annualized slippage ratio of 0.9% for the quarter. Gross NPA additions had amounted to Rs 0.64bn during 2QFY25. The impact from unsecured retail and microfinance has been minimal for the bank. Provisions were Rs 0.17bn, up by 18.8% QoQ and translating to a calculated annualised credit cost of 24bps. The bank continues with its earlier approach of making accelerated provisions.

We maintain ‘Buy’ rating on CSB with a revised price target of Rs 380: We value the bank at 1.3x FY26 P/BV for an FY25/26/27E RoE profile of 14.0/14.8/15.2%.

(See Comprehensive con call takeaways on page 2 for significant incremental colour.)

Other Highlights (See “Our View” above for elaboration and insight)

* Opex control: Total cost to income ratio at 62.9% was down/up by -175/146bps QoQ/YoY and the Cost to assets was at 3.6% down by -23/-25bps QoQ/YoY

* Fee income: Core fee income to average assets was at 2.0%, up 26/111bps QoQ/YoY.

Please refer disclaimer at https://yesinvest.in/privacy_policy_disclaimers

SEBI Registration number is INZ000185632