Buy Amber Enterprises India Ltd for Target Rs. 8,460 by Elara Capital

H2 may rebound led by electronics, RAC recovery3

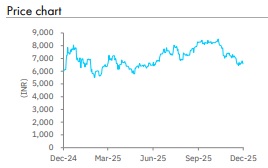

Amber Enterprises (AMBER IN) reiterated its target of double -digit growth in sales in H2, as Q3 is set to be better than Q2 for room air conditioners (RAC) and the e lectronics segment to see continued strong growth of 40 -45% YoY in FY26, led by robust sectoral tailwinds. Mobility, which has been dismal , due to a delay in Vande Bharat execution, is likely to double revenue by FY28. Three n ew acquisitions in electronics are likely to diversify its product s and geographical reach along with margin accreti on . We revise to Buy with a n unchanged TP of INR 8,460 on 52x September FY27E P/E based on an earnings CAGR of 32% during FY25 - 28E , led by tailwinds in electronics and large capex for Printed Circuit Board (PCB ), positive outlook in RAC in H2 despite weak H1 , and recovery in mobility . The stock has underperformed the Nifty by 23% in the past three months.

New acquisitions to propel growth: AMBER’s acquisition of Unitronics, Shogini Technoarts and Power One Microsystems , are likely to d iversify sales mix, geographical reach into the EU and the Americas along with margin rise . Unitronics is an Israel -based listed company , pri ma rily involved in industrial automation, catering to the US and E U market s. Management says product s are of a superior quality but expensive currently for the India markets , due to higher cost of production. Unitronics acquires the PCB and PCBA from Israel. AMBER looks to cater to their PCB requirement in the long term , which would reduce cost. Management expects to make Unitronics products viable for India in the next 5-6 quarters. Currently, it is earning healthy margin of 25 -30%. Its other acquisition , Shogini Technoarts , is involved in PCB manufacturing for automotive, medical, IT, telecom , and defence. It post ed sales of INR 4bn in FY25 with a margin of 16%, which is set to improve consol idated margin.

QIP-led robust capex plan for growth: The company has raised INR 27.5bn through QIP in AMBER and Il Jin E lectronics . Out of this, it has utilized ~INR 2.6bn for acquisition of Power One , INR 4.3bn for Unitronics , and ~INR 5.1bn for Shogini Technoarts. It has liquidated debt of ~INR 300 -350mn. AMBER plans to utilize the balance and internal cash balance for large capex plans of INR 9.9bn for Ascent Circuits (which has received approval under the Electronic component s manufacturing scheme (ECMS) ) and INR 12bn for Korea Circuits, which await s ECMS approval. It expects ~60 -70% subsidy for both projects from CG and SG on completion of milestones. Ascent Circuits is set to see an asset turn of 1.25 -1.30x while Korea Circuits of 0.7 0-0.80x. AMBER target s to be OCF -positive this year , which would be a positive catalyst.

Revise to Buy with TP of INR 8,460: We retain our EPS estimates during FY26 -28. However , we revise to Buy from Accumulate with an unchanged TP of INR 8,460 on 52x September FY27E P/E as we have a positive outlook for FY26 despite weather constraints, along with strong tailwinds in electronics and large capex for PCB, providing revenue visibility. The stock has underperformed the Nifty by 2 3% in the past three months . We expect an earnings CAGR of 32% during FY25 -28E, with an average ROE of 1 4% during FY26 -28E .

Please refer disclaimer at Report

SEBI Registration number is INH000000933