Neutral Metro Brands Ltd For Target Rs. 1,241 By Yes Securities Ltd

Result Synopsis

Q3FY25 saw a recovery in demand owing to festive and wedding season after the tepid demand in H1FY25. Hence, Metro Brands Ltd (METRO)’s overall revenue for the quarter grew by 11%YoY which was primarily driven by volume growth as average selling price remained stable at Rs1,500/pair. Contribution of <Rs500/Rs501- 1,500/Rs1,501-3,000/Rs3,000+ was 4%/8%/34%/54% respectively. During the quarter, METRO opened 22 new stores (net), an 8%YoY growth in total store count. Of the new stores- 6 were of METRO and 4 were for MOCHI while CROCS store addition stood at 4. Additionally, the 1st Foot Locker store was opened during the quarter in New Delhi. The 1st kiosk for New Era was also launched in Bangalore in the quarter followed by Hyderabad & Mumbai. The liquidation of all Fila inventory has been completed. Revenue/Sqft remained flattish YoY at Rs5,150. Revenue from ecommerce sales (including omni-channel) stood at Rs760Mn (11% of topline), a growth of 37%YoY. Gross margins contracted from 59.9% in Q3FY24 to 58.6% in Q3FY25; ~50bps lower on account of liquidation of old FILA inventory at higher discounts and ~80bps lower due an increase in e-commerce sales at reduced margins. However, owing to various cost control measures implemented by the company, EBITDA margins expanded to 32% in Q3FY25 Vs 31.3% in Q3FY24.

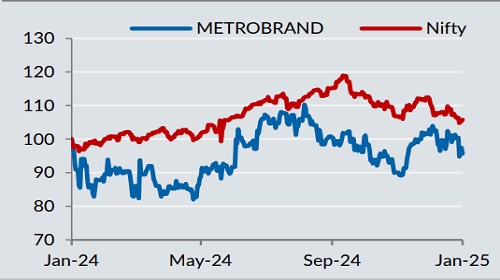

Stock performance

Guidance

Company witnessed a resurgence in demand in Q3FY25 and expects the growth trajectory to continue. Management has guided for a medium term (3-5years) revenue growth of 15-18% with 55%+ Gross Margins and 30%+ EBITDA margins. While the company will miss their target of 100 net store additions in FY25E, management is confident on opening 220-225 total over FY25E-26E.

Our View

Metro Brands has delivered its highest ever quarterly revenue in Q3FY25. With the completion of liquidation of Fila’s existing inventory at discounted prices, Metro has initiated local manufacturing of Fila footwear and is relaunching the brand. Thus, we expect margins to improve. Foot Locker will gradually ramp up as and when management receives more clarity on BIS implementation. In addition to the above, we believe company’s clear target on store expansion will further aid volume growth. Overall, we reckon Revenue/EBITDA/PAT to grow at a CAGR of 11%/12%/8% (Metro had a lower Tax as %PBT at 10.8% in FY24) respectively over FY24-FY27E. At CMP, stock trades at a rich P/E(x) multiple of 63x on FY27E EPS of Rs19.1. We value the company at P/E(x) of 65x, arriving at a target price of Rs1,241. Hence, we maintain our NEUTRAL rating on the stock.

Please refer disclaimer at https://yesinvest.in/privacy_policy_disclaimers

SEBI Registration number is INZ000185632