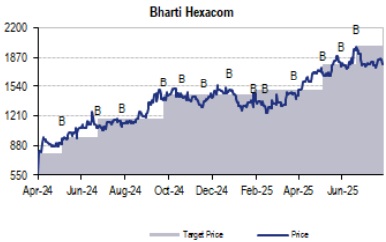

Buy Bharti Hexacom Ltd For Target Rs. 2,000 By JM Financial Services

Bharti Hexacom’s (BHL) 1QFY26 revenue was ~4% lower than JMFe/consensus at INR 22.6bn (down 1.1% QoQ but up 18.4% YoY) on weak net subs additions (at 17k vs. JMFe of 250k) while ARPU was in line with JMFe (at INR 246). Hence, EBITDA was also 4.4% lower than JMFe at INR 12.1bn (-0.6% QoQ, +31.9% YoY), though EBITDA margin still improved by 28bps QoQ to 53.4% in 1QFY26. In the home broadband and wireline business, subs addition remains strong while ARPU continues to moderate. Capex fell QoQ at INR 2.3bn in 1QFY26; net debt also fell by INR 9.5bn QoQ to INR 63.2bn while operating FCF was higher QoQ at INR 9.8bn in 1QFY26. We maintain BUY on BHL (unchanged 1-year TP of INR 2,000) as we believe the industry’s wireless ARPU will grow at 12-13% CAGR in the next 3-5 years given the consolidated industry structure, to ensure a ‘3+1’ player market and higher ARPU requirement for Jio not only to justify its significant 5G capex but also given its potential listing plans. Further, the potential 5G monetisation and FWA rollout provides significant upside risk over the long term. Moreover, there is huge FCF generation potential over the next 4-5 years with the next big jump in capex, mostly related to 6G, which is the most likely 2030-onwards story

* Revenue/EBITDA ~4% lower than JMFe at INR 22.6bn/ INR 12.1bn respectively on muted net subs addition while ARPU growth was in line:

BHL’s 1QFY26 revenue was ~4% lower than JMFe/consensus at INR 22.6bn (down 1.1% QoQ but up 18.4% YoY) on weak net subs additions (at 17k vs. JMFe of 250k) while ARPU was in line with JMFe at INR 246. However, total opex was also 2.9% below JMFe due to lower access costs. Access charges were lower than JMFe at INR 1.6bn (-34.0% QoQ, -26.2% YoY) - there tends to be seasonality in access charges on a quarterly basis. However, this was partly offset by higher network cost (at INR 5.2bn, +9.7% QoQ and +11.7% YoY) and higher SG&A and other costs at INR 1.9bn (vs. INR 1.5bn in 4QFY25) while licence fee/SUC cost was largely in line (at INR 2.1bn, +1.0% QoQ and +21.9% YoY). Hence, EBITDA was also 4.4% lower than JMFe at INR 12.1bn (-0.6% QoQ, +31.9% YoY) though in line with consensus of INR 12.1bn. However, EBITDA margin still improved by 28bps QoQ to 53.4% in 1QFY26 (vs. 53.1% in 4QFY25). Further, the company reported EBITDAaL of INR 10.8bn in 1QFY26 (up 1.2% QoQ). Wireless business net subscriber rose by only 17k to 28.1mn (significantly lower than JMFe of 250k net subs gain) with reported churn higher QoQ at 2.4% in 1QFY26 (vs. 1.8% in 4QFY25). Moreover, 4G/5G net additions were also lower at 283k in 1QFY26 vs. JMFe of 418k additions (vs 710k additions in 4QFY25); 4G/5G subscribers constitute 78% of total subscribers. However, usage metrics improved 6.1% QoQ at 29.4GB/user/month in 1QFY26. Further, wireless ARPU was up 1.7% QoQ to INR 246 and in line with JMFe (vs. INR 242 in 4QFY25) due to upgrades and improved subs mix and aided by 1 more day QoQ in 1QFY26. This compares to Jio’s 1QFY26 ARPU being up 1.3% QoQ at INR 208.8 (including FTTH) and ~INR 195 (excluding FTTH) and Bharti Airtel’s ARPU, which grew by 2% QoQ to INR 250 in 1QFY26.

* Home broadband and wireline business – strong subs addition continues while ARPU moderation continues:

: BHL’s home broadband and wireline revenue was 3.6% above JMFe at INR 784mn in 1QFY26 (+10.6% QoQ and +38.0% YoY) on robust additions of 54k subscribers during the quarter (with 502k subs at end-1QFY26). However, ARPU was lower QoQ at INR 485/month in 1QFY26 (vs. INR 490/month in 4QFY25).

* Capex fell QoQ at INR 2.3bn in 1QFY26; net debt down by INR 9.5bn QoQ to INR 63.2bn while operating FCF up QoQ at INR 9.8bn in 1QFY26:

Capex fell QoQ to INR 2.3bn in 1QFY26 (vs. 4QFY25 capex of INR 4.3bn. Net debt at end-1QFY26, including lease liabilities, declined by INR 9.5bn QoQ to INR 63.2bn with operating FCF higher QoQ at INR 9.8bn in 1QFY26 (vs. INR 7.9bn in 4QFY25). Net debt (including lease liability) to EBITDA (annualised) stood at 1.3x at end 1QFY26

* Reiterate BUY rating on BHL with unchanged 1-year TP of INR 2,000 and 3-year TP of INR 2,720 (implying 15% IRR):

As detailed in our initiation note (Mid-cap pure-play on structural wireless ARPU growth story), we reiterate our BUY rating on BHL (with unchanged 1-year TP of INR 2,000 and 3-year TP of INR 2,720, implying ~15% IRR — Exhibit 7-8) as we believe industry’s wireless ARPU will grow at 12-13% CAGR in the next 3-5 years given the consolidated industry structure, to ensure a ‘3+1’ player market and higher ARPU requirement for Jio not only to justify its significant 5G capex but also given its potential listing plans. Further, the potential 5G monetisation and FWA rollout provides significant upside risk over the long term. Moreover, there is huge FCF generation potential over the next 4-5 years with the next big jump in capex, mostly related to 6G, which is the most likely 2030 onwards story. We see BHL as a midcap pure-play on wireless ARPU growth story vis-à-vis Bharti (which sees 25-30% of its value coming from other-than-India wireless business)

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361