Accumulate FSN E-Commerce Ventures Ltd for Target Rs. 225 by Elara Capitals

Recovery in motion

FSN E-Commerce Ventures’ (NYKAA IN) Annual Investor Day highlighted its: a) aim to grow BPC GMV (25-30% CAGR) with A&P focus, b) EBITDA turnaround in FY26, in Fashion, led by scale (32% CAGR in FY25-30) and cost efficiency benefits (we await visible growth acceleration before modeling in a turnaround) and c) order convenience (turnaround within 30-120 minutes with Nykaa Now in top-seven cities). We expect BPC/Fashion GMV CAGRs at 28/20% in FY25-28E. However, as the strategy involves a focus on customer acquisition (A&P spends) ahead of achieving scale benefits, we pare our EBITDA estimates by 5-6% for FY27E28E. However, we raise our TP to INR 225 as we roll over to Sep-28E - Retain Accumulate

BPC - Penetration and premiumization, growth levers: NYKAA enjoys a strong 30% market share in the online BPC segment and aims to grow its GMV by 25-30% CAGR in FY25-30 via two drivers: a) expanding penetration into Gen-Z and tier 2/3 markets by leveraging a 28,000- strong influencer network and a tailored app experience (to boost user conversations), b) by promoting ‘Stepification’, NYKAA will advance premiumization through a structured product ladder. Continued engagement with brand partners is expected to bring more global players on board in H2FY26. GMV growth will be led by customer acquisition and expanding scale to 500 stores by FY30 (237 in FY25). Expect an overall BPC GMV CAGR of 28% till FY28E

Fashion - Scale + efficient marketing to catalyze break-even: Losses in Fashion are a key drag on overall profitability, though these have pared by 15% in past two years. After a slowdown in FY25, NYKAA expects a recovery and has guided for a green EBITDA in FY26, on improved efficiency and sharper marketing to boost conversions. So, in Fashion, NYKAA is aiming for 4x GMV by FY30, at a 32% CAGR versus 12.4% in FY25 (elevated even after the slowdown in FY25). With much of the turnaround attributed to scale, we await acceleration in growth to model in a break-even in FY26. In Fashion, expect a GMV CAGR of 20% till FY28E

Nykaa Now - A convenience channel: To up convenience, NYKAA is offerings select SKUs within 30-120 minutes in top-seven cities across 300 pin-codes, to protect market share amid competition from quick commerce. NYKAA believes that beauty, as a category, does not require a sharp 10-minute delivery (like grocery platforms). Also, a 10-minute delivery frame requires a denser network (not operationally feasible). For a delivery frame of 30-120 minutes, NYKAA can operate with lesser store density, thus supporting profitability.

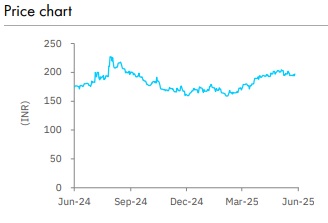

Maintain Accumulate; TP raised to INR 225: NYKAA is a play on growing BPC and Fashion categories, with tech-led approach. Macro drivers such as Gen-Z users, niche and genuine brand offerings bode well for outperformance. Profitability levers exist - Private labels, premiumization and advertising revenue to support scale. Initiatives such as NYKAA Land and digital campaigns will drive conversion up. NYKAA is focusing on growth, which may keep A&P costs sticky, yielding less operating leverage. So, we cut our FY27E-28E EBITDA by 5-6%, retaining FY25-28E revenue CAGR at 29%. The stock price has scaled 22% in past three months, limiting further upside (BPC is trading at 75x P/E- one year forward), but as we roll over to Sep-28E, we raise our TP to INR 225 (from INR 215). Maintain Accumulate.

Please refer disclaimer at Report

SEBI Registration number is INH000000933