Buy Kotak Mahindra Bank Ltd for the Target Rs. 2,500 by Motilal Oswal Financial Services Ltd

Business growth steady; RoA to sustain at ~2%

NIMs to remain range-bound with an upward bias

* Kotak Mahindra Bank (KMB) continues to align its balance sheet expansion with a disciplined growth framework of ~1.5-2.0x nominal GDP while steadily improving business granularity through retail and SME-led growth.

* NIMs are expected to remain range-bound in the near term, with 3QFY26 margins likely to be flat, largely due to temporary interbank yield distortions and short-term liquidity deployment at lower yields. The impact of the recent 25bp rate cut is expected to flow through primarily in 4QFY26.

* A repricing and the migration toward ActivMoney sweep deposits are expected to gradually ease funding costs, although benefits from term-deposit repricing will accrue with a lag. Despite near-term noise, absolute NII continues to grow, reinforcing confidence in earnings stability.

* Credit cost, which peaked in 1QFY26 owing to unsecured stress, is expected to trend down gradually, with management expecting a comfortable range of ~55- 60bp over the medium term. Visible improvement is expected from 1QFY27 onward, as stress in personal loans and MFI has largely eased.

* KMB’s leadership remains focused on execution discipline, digital investments, and cost control, reinforcing the bank’s ability to sustain RoA at ~2%+ through the cycle. The bank continues to add 150-200 branches annually without proportional headcount addition, highlighting operating leverage from digitization.

* We estimate KMB to deliver robust return ratios, with RoA/RoE at 2%/12.7% by FY27E. Retain BUY with a TP of INR2,500 (2.5x FY27E ABV+ INR775 for subs

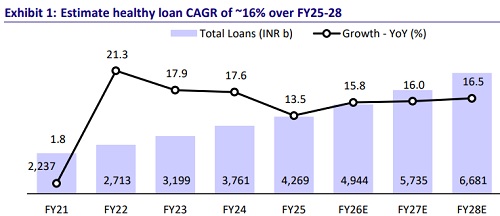

Credit growth to remain calibrated; SME and secured retail to lead

KMB remains aligned to its disciplined loan growth framework, delivering healthy 15.8% YoY growth in advances to INR4.63t in 2QFY26. Management has reiterated that secured lending will grow faster than unsecured, although absolute unsecured balances will continue to expand as risk conditions ease. Retail assets such as housing loans and LAP continue to perform well, while wholesale growth will remain selective and margin-led, with preference for flow-based businesses rather than long-tenor balance-sheet deployment. While credit cards remain in a rebuilding phase, management emphasized that portfolio quality and profitability take precedence over growth. Overall, the bank remains well positioned to sustain healthy double-digit credit growth over the medium term, anchored by SME and secured retail franchises, with the broad credit growth guidance staying intact at 1.5-2.0x nominal GDP growth.

Retail, SME, Agri and Tractor to anchor next phase of growth

Over FY26-28, advances growth is expected to be led by retail (mortgages/ LAP) and SME lending, supported by urban housing demand, rising selfemployed credit penetration, and a largely secured SME book. BB and midmarket segments continue to scale through working-capital-led growth, with utilization expected to improve in 2H. Within commercial lending, stress in retail CV and construction equipment is expected to persist in the near term, prompting the bank to remain cautious in these segments. Agri and tractor financing remains strong, supported by a good monsoon and improving rural cash flows. The bank is also stepping up focus on gold loans, currently a small base but strategically attractive, given granular sourcing and favorable risk-adjusted returns. Personal loans have picked up selectively, while credit cards remain calibrated, with growth expected to resume gradually as portfolio seasoning improves.

NIMs to remain broadly stable in near term

NIM trajectory is expected to remain range-bound in the near term, largely due to temporary interbank yield distortions and deployment of short-term liquidity at lower yields, even as underlying core margins would have expanded in the absence of these factors. The impact of the recent 25bp rate cut is expected to flow through primarily in 4QFY26; however, it will largely be offset by gains from gradual TD repricing. Importantly, management has reiterated confidence in sustaining NIMs at ~4.5-4.6% in the near term, supported by a strong liability franchise, calibrated loan mix skewed toward secured retail and SME, and disciplined pricing. As transient distortions normalize and funding costs trend lower, margins are expected to stabilize, reinforcing visibility on earnings resilience and return sustainability.

Stable CASA franchise and sweep product to ease funding costs

KMB’s liability franchise remains a structural competitive advantage. Management clarified that the moderation in reported SA balances is also due to migration into ActivMoney sweep deposits, rather than any underlying weakness. SA growth has picked up over the last two quarters, reflecting improved granularity and customer acquisition. The bank continues to gain traction in corporate salary accounts, affluent customers, and NRIs, supported by bundled propositions. CASA remains healthy at ~42%, while sweep products are cushioning funding-cost pressures and preserving customer stickiness. While benefits from SA repricing have largely flowed through, term-deposit repricing will take another few quarters, especially following recent TD rate cuts across the system. Nevertheless, management remains confident that cost of funds will trend lower over the medium term, supporting NIM resilience.

Bank focused on execution, digital depth, and granularity

Under the current leadership structure, KMB has sharpened its focus on digital platforms, segmentation, and execution excellence. Initiatives such as Solitaire, enhanced NRI propositions, and deeper ecosystem integration are strengthening customer engagement across liabilities, lending, investments, and protection. The Kotak 811 franchise continues to mature, transitioning from an acquisition-led model to a sustainable, granular relationship engine. The bank remains cautious in extending unsecured credit to this segment, preferring secured cards and gradual seasoning, while expanding SIP and term-insurance journeys to improve monetization. Operating leverage continues to improve, with branch expansion without commensurate headcount growth, reinforcing cost discipline and return sustainability.

Open to M&A opportunity; no immediate plans to unlock value from subs

KMB’s franchise has been strengthened over time through selective acquisitions aimed at strategic depth rather than scale. While the bank remains open to M&A on a case-by-case basis, management reiterated that capital discipline and return thresholds remain paramount. The bank has no plans for value unlocking of subsidiaries, consistent with its long-standing philosophy of 100% ownership and long-term compounding. Strong capital buffers (CET-1 ~21%+) provide ample flexibility for growth while ensuring balance sheet resilience.

Asset quality resilient; unsecured stress showing signs of easing

Asset quality trends remain stable and reassuring, with slippages, early delinquencies, and cheque-bounce indicators under control. Stress in MFI and personal loans has largely normalized, while credit card losses remain within expected levels. Retail CV stress persists but is manageable, given the smaller book and proactive pruning. The SME portfolio remains largely secured, limiting downside risk. With a healthy PCR of ~77%, credit losses are expected to remain well cushioned. Management has reiterated that slippages are not expected to rise meaningfully from current levels, and credit costs should trend down steadily after FY26, reinforcing confidence in sustainable, risk-adjusted growth. We estimate GNPA/NNPA ratios at 1.35%/0.29% in FY26E and 1.31%/0.27% in FY27E.

RoA well positioned to sustain at ~2% over the medium term

Despite near-term NIM volatility and elevated credit costs in early FY26, KMB remains well positioned to sustain RoA at ~2%+ through the cycle. Margin normalization, declining credit costs, fee income diversification, and operating leverage from digital investments remain key drivers. As credit costs move toward ~60bp in the medium term, RoE is expected to expand toward the mid-teens over time. Strong capital adequacy ensures that growth can be funded without diluting returns, reinforcing KMB’s positioning as a high-quality compounder.

Valuation and view

* KMB witnessed near-term NIM volatility and elevated credit costs earlier in FY26; however, operating performance is expected to normalize as funding-cost repricing plays out and unsecured stress subsides.

* The bank remains focused on profitable, calibrated growth, with retail, SME, agri, and tractor portfolios supporting balance-sheet expansion, while CV and unsecured exposures remain well managed.

* Subsidiaries continue to provide structural earnings diversification, supporting consolidated profitability over the medium term.

* Disciplined execution, strong liability franchise, and capital strength underpin confidence in sustainable RoA of ~2%+.

* We thus estimate KMB to deliver robust return ratios, with RoA/RoE at 2%/12.7% by FY27E. Retain BUY with TP of INR2,500 (2.5x FY27E ABV, including an SoTP value of INR775 for subs).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412