Add Mahindra & Mahindra Ltd For Target Rs. 289 By InCred Equities

Tractor volume growth uncertainty prevails

* 3Q standalone EBITDA growth of 19% yoy in line with our estimate, but below BB consensus. Higher other income and lower depreciation provide EPS beat.

* New product launch, price hike, and capacity build-up drive our EBITDA upgrade. Tractor volume growth uncertainty prevails due to El Nino challenge.

* We maintain ADD rating on the stock as forward P/E valuation eases to +2SD.

In-line EBITDA performance; global provisions are cause for concern Mahindra & Mahindra, or M&M’s 3QFY26 standalone EBITDA rose by 19% yoy and 14% qoq to Rs52.9bn, which was in line with our estimate, but 4% below Bloomberg (BB) consensus estimate. EBIT margin stood at 9.5% for automotive (-21bp yoy & +117bp qoq) segment. Electric vehicle (EV) contract manufacturing continues to be margin-dilutive to the extent of 90bp in 3Q. Farm equipment segment’s EBIT margin stood at 20.2% (+210bp yoy and +49bp qoq). Normalised PAT rose by 31% yoy to Rs40bn due to higher other income (+63% yoy) and flattish depreciation. The Rs5.9bn charges in respect of global farm equipment business hit reported PAT.

Management conference-call highlights Management indicated that Goods and Services Tax (GST) cut is benefitting sports utility vehicle (SUV) premiumisation and entry-level car customers. Management indicated that XUV7XO launch has garnered 70% of bookings for top two variants. Improvement in the internal rate of return (IRR) for commercial segments (LCV, tractor & 3W) post-GST cut is driving their volume. Tractor demand is also influenced by Maharashtra government’s subsidy scheme to the extent of 3% of industry volume. While El Nino fears are a cause for concern, the precise timing of its landing will be key to gauge the impact on FY27F tractor demand.

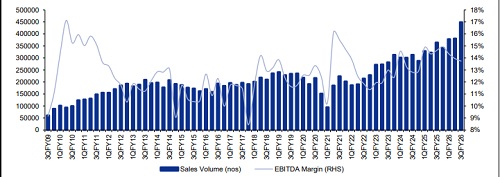

Raise our EBITDA estimates by 3–5% for pricing power benefit We have raised sales volume estimates by 5-7% for FY26F-27F to factor in new vehicle launch momentum & capacity build-up. We build in 8% tractor industry volume growth for FY27F. Better pricing power and increasing models being confirmed for production-linked incentive (PLI) scheme benefits leads to our EBITA upgrade of 3-5% for FY26F-28F. Low depreciation trend & higher other income lead to our FY26F-28F EPS upgrade of 7-9%.

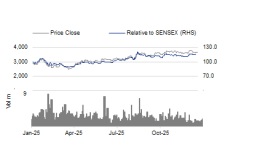

Maintain ADD rating with a higher target price of Rs4,289 With current mark-to-market of investment in subsidiaries, we raise the value of subsidiaries to Rs709/share (from Rs654 earlier). The standalone entity is valued at 22x one-year forward P/E, marginally below the +1SD level to reflect concerns over rainfall, leading to a SOTP-based higher target price of Rs4,289 (Rs4,157 earlier) and maintain ADD rating on the stock. Key downside risk is the worse-than-expected rainfall trend impacting rural demand or a weak response to new vehicle launches.

Tractor volume growth uncertainty prevails

Tractor volume growth uncertainty prevails Management conference call highlights

* Outlook: Management expects 8–10% long-term volume growth, supported by government initiatives and favourable Indian demographics.

* Volume performance: Auto segment volume grew by 23% yoy, with margin expansion of 90 bp; farm equipment volume increased by 23% yoy, with margin up 240bp being partially offset by international impairment of Rs5.7bn.

* Growth gems: Subsidiaries like Mah

indra Finance delivered a breakthrough performance with its PAT up 97% yoy, as transformation initiatives concluded and the business pivots to growth. Mahindra Lifespaces reported 5x PAT growth driven by strong residential project execution, while logistics business turned profitable after 11 quarters. For growth gems, the valuation stood at Rs 560bn three months ago; however, some smaller businesses have yet to post a meaningful performance.

Above views are of the author and not of the website kindly read disclaimer