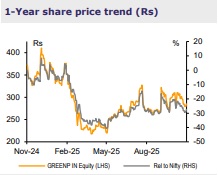

Reduce Greenpanel Industries Ltd for the Target Rs.260 By Emkay Global Financial Services Ltd

Revival in profitability to be gradual

Greenpanel (GIL)’s Q2FY26 performance was weaker than expected on the profitability front. Although the MDF sales volumes were better than expected in Q2, we trim our estimates for FY26/27/28 by 4-7%, to factor in the management growth guidance. On the other hand, profitability was impacted by the poor product mix, higher OEM sales, price rationalization, and impact of forex loss in MDF. While we expect better operating leverage and the costs to soften in coming quarters, realization is likely to remain weak as ability to take price hikes is limited amid GIL’s focus on gaining market share in an industry grappling with supply pressures. Hence, we expect profitability improvement to remain gradual. We maintain REDUCE on GIL and TP of Rs260 on Sep-27E EPS.

Focus on market share gains in the next 2-3Y

GIL reported domestic sales volume growth of 31% YoY to 112,884CBM, while export sales volumes declined 6% YoY to 14,105CBM. Overall sales volume grew 25% YoY to 126,989CBM. Capacity utilization improved to 53% (vs. 47% QoQ). The company would primarily focus on ramping up production, and push sales to gain market share. It now expects a high-teen volume growth in FY26. While our volume estimates were on the lower side, the company’s current growth target translates into slightly lower volumes than our earlier expectations. Accordingly, we cut FY26E by 4%. Overall, we now expect 18% sales volume CAGR during FY25-28E, at ~712,000CBM .

Pricing pressure persists; profitability improvement to be gradual

EBITDA declined 17% YoY to Rs248mn, while EBITDA margin contracted by 260bps YoY to 6.3% (lower than expected). In the MDF division, cost of production declined ~5.5% QoQ (cost rationalization, improved efficiency). Realizations were lower by 4% YoY/2% QoQ due to poor product mix, higher OEM sales, and price rationalization. Timber costs have declined, while chemical costs have increased, although they are expected to decline in coming months. However, scope of MDF price hikes is limited (supply pressures in the industry). Hence, we expect profitability improvement to be gradual and remain a monitorable, as it would largely depend on better operating leverage and decline in input costs. We cut FY26E EBITDA margin by 60bps, while keeping FY27E/28E unchanged.

We maintain REDUCE

Factoring in the H1 performance and management guidance, we trim volume growth estimates by 4-7%. Timber costs have softened, while chemical costs—which have recently risen—are expected to cool off. However, scope of price hikes in the MDF division remains limited, given supply-side pressures and the company’s primary focus on gaining market share. Hence, while coming quarters would see benefits of better operating leverage and reduced costs, GIL could possibly offer further discounts for pushing sales, which would lead to a gradual recovery in profitability. We cut FY26E/27E/28E PAT by 24%/12%/10%. Despite the attractive valuations, we retain REDUCE on GIL; maintain our TP of Rs260 (unchanged due to roll over on Sep-27E EPS; valued at 20x).

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354