Buy Ambuja Cement Ltd For Target Rs.792 by Centrum Broking Ltd

Acquisitions drive margins down

Ambuja reported weak results with adjusted EBITDA coming in at Rs8.85bn, 42% below our estimate. While volume growth was better at 17% YoY, realizations were weak and costs higher, resulting in a weak margin performance. The management highlighted that acquired capacities of Penna and Sanghi are driving volume growth, but given the sub-par utilizations of these capacities and their southern exposure, costs are higher and realizations lower. The management expects these capacities to operate at optimum utilization by FY26 and several other efficiency improvement measures will result in better profitability. We believe that our FY26 EBITDA estimates are at risk if operating cost remains elevated. The management reiterated its guidance of 140mn mt capacity and cost reduction of ~Rs1,000/mt from current levels by FY28. We maintain our estimates and BUY rating. We value ACEM based on 18x FY27E EV/EBITDA to arrive at our target price of Rs792

Q3FY25 result highlights

Ambuja reported weak numbers for Q3FY25 with EBITDA of Rs8.85bn, which was 42% below our expectation largely due to lower realizations and higher operating costs. Revenue at Rs85bn was largely in-line with our estimate and up 5% YoY. Volume increased by 17% YoY whereas realizations declined by 0.8% QoQ (against our expectation of 2.5% increase). Operating cost at Rs4,616/mt increased by 2.3% QoQ against our expectation of a decline. EBITDA came in at Rs8.85bn, down 49% YoY and 9% QoQ. EBITDA/mt stood at Rs537 against our expectation of Rs988. PAT at Rs3.8bn was down 65% YoY.

Weak operating performance of acquired capacities key reason for lower margins

The management highlighted this is the first quarter wherein acquisitions of Penna, Sanghi and Tuticorin were consolidated. As both Sanghi and Penna capacities are operating at sub40% utilization, fixed cost absorption was lower. Additionally, the company undertook maintenance shutdowns in 4 kilns, resulting in higher stores & spares expenses reflected in higher other expenses. Finally, since the company sold ~1mn mt of volume in southern region, which was not there in earlier quarter, overall realizations look depressed as southern realizations were lower. It expects improvement in margins as utilization of acquired capacities improve and other efficiency improvement measures such as renewable power and higher rail coefficient kick in.

Operating cost reduction to accelerate in FY26

Ambuja has outlined ambitious cost reduction plan to reduce operating cost to Rs2,650- 3,700/mt by FY28 from current levels of Rs4,600/mt. The cost reduction will be driven by efficient procurement of raw materials and fuel, higher share of renewable power, WHRS capacities, higher rail coefficient (through owned rakes), reduction in lead distance, higher proportion of sea freight and captive coal.

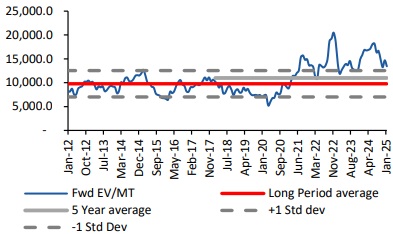

Valuation and outlook

Given the weak performance of Sanghi and Penna, we believe that there is 10-15% downside risk to our EBITDA estimates of FY26. However, we are keeping estimate unchanged for the time being. We are building in 13%/23% CAGR in revenue/EBITDA for Ambuja over FY24- FY27E. We are building in EBITDA/mt of Rs1,400 in FY27 from Rs1,081 in FY24. We value Ambuja based on 18x FY27E EV/EBITDA to arrive at our target price of Rs792. We maintain our BUY rating. Sustained weakness in demand and prices, delay in capacity additions and increased competition remain key downside risks to our call.

Valuation

We are building in 13%/23% CAGR in revenue/EBITDA for Ambuja over FY24-FY27E. We value it based on 18x FY27E EV/EBITDA to arrive at our target price of Rs792.

1-year forward EV/MT

EV/EBITDA mean and standard deviation

For More Centrum Broking Disclaimer https://www.centrumbroking.com/disclaimer/

SEBI Registration No.:- INZ000205331