Accumulate Indoco Remedies (INDR IN) For the Target Rs. 325 By PL Capital- Prabhudas Lilladher

Weak quarter led by negative operating leverage

Quick Pointers: * US sales likely to remain impacted in Q4FY25 while EU market will recover.

* Next two quarters will continue to face higher remediation costs.

Our FY26/FY27E EPS have been cut sharply to factor in low margins given ongoing remediation cost and lower sales across regulated markets. We downgrade stock to ‘Hold’ from ‘Accumulate’. Indoco Remedies’ (INDR) Q3FY25 EBITDA was much below our estimates due to muted international business and higher expenses. The warning letter issued for both units is expected to restrict growth, particularly in the US market. The company cited other expenses to remain elevated over next two quarters. Our numbers do factor in higher remediation cost till H1FY26. At CMP, the stock is trading at 3.5x EV/domestic sales based on FY26E. We expect 11% PAT CAGR over FY24- 27E. We downgrade stock to ‘Hold’ from ‘Accumulate’ rating with revised TP of Rs325 valuing at 21x FY27E EPS as we roll forward. Timely resolution of Goa facility Unit 2 is a key for re-rating.

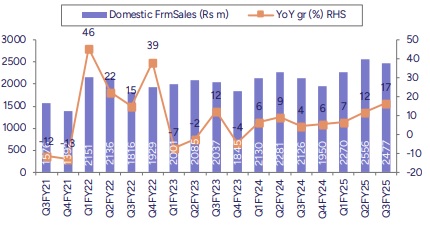

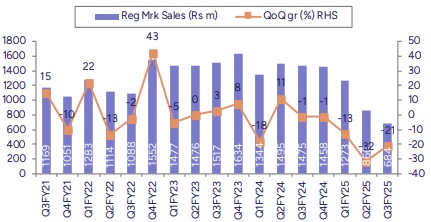

* Lower exports impacted Revenues YoY: Consolidated revenues (ex-other operating income) was down 12% YoY to Rs4bn (PLe Rs4.1bn). Domestic formulations sales grew 16.5% YoY to Rs2.48bn, above our estimate. Key therapies like gastro, stomatologicals, derma, as well as respiratory reported healthy growth YoY, whereas anti-infectives delivered single-digit growth YoY. Regulated market continued to underperform, down 53.6% YoY and 21% QoQ to Rs684mn. EM sales declined by 17.4% YoY to Rs354mn whereas US sales came in higher QoQ at Rs280mn (up 15.5%). Overall API sales declined by 17% YoY. CRO sales were down YoY.

* EBITDA miss led by higher opex: EBITDA (incl other operating income) stood at Rs120mn, below PLe of Rs394mn. Other operating income came at Rs 81mn. Reported OPM stood at 2.9%, down both QoQ/YoY. Employee expense increased 8.4% YoY. Gross margins (excl other operating income) came in higher at 71.7% up 270bps YoY and 350bps QoQ. Other expenses remain elevated given ongoing remediation cost and higher expenses toward repair and maintenance work of plants. R&D cost continue to stood lower at 4.6% of sales, down 23% YoY. Reported loss adj for minority came in at Rs264mn.

* Key concall takeaways: Domestic Formulations: Key therapy areas (gastro, stomatologicals, dermatology, respiratory) reported healthy YoY growth. Major brands like Cyclopam, Karvol, Cital, Sensoform, and Methycal achieved double-digit growth, while Oxipod grew by 3% YoY. Launched 5 new products (a) Iceraft Susp. (b) Afebrex Drops (c) Afebrex Syrup (d) Biltal – DX Syrup and (e) Winbrinza Eye Drops. International markets: Supplies to international markets (EU and US) remain impacted. US was impacted by corrective actions at master manufacturing facilities and due to warning letter at the sterile Plant 2 in Goa. EU remained impacted on account of delayed production rollout for OSD at the Baddi site. Order book for international markets (EU and US) stands at Rs 1.8bn. Entered a strategic distribution partnership with Clarity

Pharma, UK. Plans to launch 18 products over the next 18 months, with supply to Clarity for further distribution. Capex was incurred for refurbishment and setup of a plant for cosmetic toothpaste manufacturing, addition of a block to increase API production capacity, and for installing new equipment to enhance efficiency at the oral solid dosage site. Other: New introductions contributed 4.8% of the domestic revenues. Indoco received final ANDA approval from the USFDA for Cetirizine HCL Tab Tablets 10 mg & Varenicline Tablets 0.5 & 1.0 mg. Plant 2, Line 1 is operational.

Above views are of the author and not of the website kindly read disclaimer

.jpg)