Buy Aster DM Healthcare Ltd For Target Rs.700 by Prabhudas Liladhar Capital Ltd

Scaling up well

Quick Pointers:

* ASTERDM + QCIL 3,800-bed expansion plan over the next 3 years

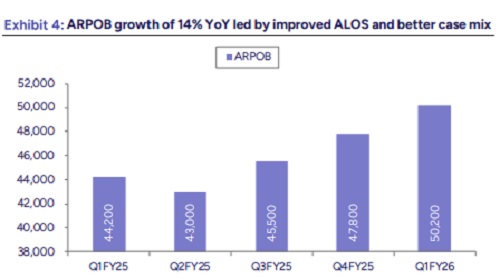

* ARPOB growth guidance at 7-8% YoY over the next 2-3 years

ASTER DM Healthcare’s (ASTERDM) Q1 consolidated EBITDA grew 25% YoY to Rs2.1bn, 6% above our estimate. EBITDA beat was led by improved performance at Kerala cluster. EBITDA has been increasing sharply over the last 3 years (29% CAGR over FY22-25). Our FY26-27E EBITDA estimate broadly remains unchanged. We estimate 24% EBITDA CAGR over FY25-27E aided by scale-up in margins, healthy ARPOB and bed additions. ASTERDM’s board has recently approved merger with Quality Care (QCIL), making it the third largest healthcare chain by revenue and bed capacity in India. The combined entity is trading at ~26x EV/EBITDA on FY27E (adj for minority stake and rental). We maintain our BUY rating with a revised TP of Rs700/share, valuing 30x EV/EBITDA for combined entity.

* Robust EBITDA across Kerala and Karnataka cluster: ASTERDM’s EBITDA (post-Ind AS) grew 25% YoY (12% QoQ) to Rs2.1bn, vs our estimates of Rs1.96bn. OPM improved by 270bps YoY to 19.3% (80bps QoQ). Pre-Ind AS EBITDA was at Rs1.81bn (up 25% YoY) with OPM of 16.8%. Hospital EBITDA grew by 17% YoY to Rs2.35bn with OPM of 22.6%, up ~180bps YoY. Cluster wise, Kerala, and Karnataka & Maharashtra cluster reported EBITDA growth of 17% and 23%, respectively, while AP & Telangana cluster’s EBITDA declined by 18% YoY. Pharmacy business turned EBITDA positive at Rs10mn with 2% margins driven by a strategic exit from certain loss-making unit. Labs reported EBITDA of Rs30mn with margins at 8%.

* Strong ARPOB; occupancy steady QoQ: Consolidated revenue improved 8% YoY (8% QoQ) to Rs10.8bn. ARPOB continues to improve 14% YoY (5% QoQ) to Rs50.2k per day aided by improved ALOS and better case mix. Occupancy was flat QoQ at 59% vs 67% in Q1FY25. IP volumes were down by 1% YoY. ALOS improved to 3.1 days vs 3.2 days in Q1FY25. Net cash stood at Rs8.1bn as of Q1FY26.

Above views are of the author and not of the website kindly read disclaimer

.jpg)