Buy Godrej Consumer Products Ltd for the Target Rs. 1,450 by Motilal Oswal Financial Services Ltd

India recovery underway; margin levers in place

We interacted with CFO of Godrej Consumer (GCPL) to understand the company’s outlook on India business growth, margin recovery amid volatile raw material prices, and trends in its international business.

* GCPL’s operating performance has been muted in the last few quarters owing to (1) soap value/volume contraction, (2) Underscoring performance of RCCL portfolio, (3) India gross margin contraction due to steep palm oil prices, and (4) weakness in Indonesia growth and margin. India EBITDA has contracted by more than 10% during the last four quarters, while Indonesia EBITDA has declined 10% in the last three quarters. It appears that most headwinds are unwinding and operating performance will start improving from 3QFY26 onward. Macro demand recovery is steadily improving, and GCPL has been aggressively focusing on new growth levers, distribution reach opportunities in rural markets, and TAM expansion.

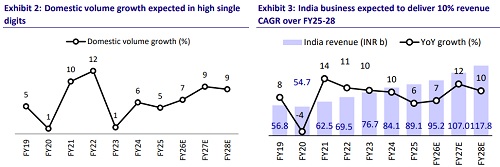

* Management expects the India business to deliver high single-digit to double-digit revenue growth in 2HFY26, largely driven by volume growth. EBITDA margins are likely to recover sequentially toward the normalized 24-26% band, driven by stabilizing palm oil prices (~MYR4,100, down 15% YoY/5% QoQ), operating leverage, and cost savings (media and marketing efficiencies by 200bp up to FY28).

* Indonesia revenue fell by mid-single digits during 1HFY26; however, the recovery was swift and better than expected, with revenue likely to be flat vs. earlier guidance of possible growth pressure in 2HFY26. Indonesia may see operating margin expansion in 2HFY26. Other international geographies are sustaining earlier trends.

* We marginally increase our EPS estimates by 2% for FY27 and 1% for FY28 and expect company to deliver a CAGR of 11%/12%/18% in sales/EBITDA/adj. PAT over FY25-28. The stock currently trades at 44x FY27E EPS and 39x FY28E EPS. With the earnings outlook improving, we expect a re-rating in the valuation multiple. We reiterate our BUY rating on the stock with a TP of INR1,450 (50x Dec’27E EPS).

India business growth outlook improves; soaps stabilizing

* GCPL’s India business delivered ~4% volume growth in 1HFY26, with performance largely impacted by the soap portfolio. Excl. soaps, volume growth remained in double digits (mid-teens in 1QFY26 and double digits in 2QFY26), showing the underlying strength across other categories.

* Soaps were affected by commodity price volatility, particularly palm oil. Before the GST implementation (22nd Sep’25), GCPL undertook selective grammage reductions in the soaps portfolio to manage input cost pressure. These actions were largely limited to smaller packs (~1/3rd of soap volume), while large packs were left unchanged. The grammage actions in smaller packs impacted volume performance significantly as compared to the large packs.

* India business saw a temporary revenue impact of 3-4% in 2QFY26 owing to destocking and pricing disruptions, primarily in soaps and hair colors due to GST 2.0. Partial restocking has been placed in 3QFY26 and the remaining is expected in 4QFY26. Management expects volume growth to improve going forward, supported by lower GST rates, formalization benefits, the company’s own initiatives (distribution expansion in rural, new launches, new price point introduction, etc.) and share gain opportunity from unorganized players

RCCL India – Underscoring performance; building blocks for stable trend

India RCCL business has underachieved after the acquisition, largely due to SKU rationalization and competitive challenges in the deodorants segment. GCPL has stepped up innovation-led initiatives to revive growth. Amazon Woods 4x has seen healthy repeat purchases, while KS99 continues to scale across southern markets, indicating early signs of traction. To improve penetration, the company has launched a deodorant lotion in select South Indian markets at an attractive price of INR20, including the Park Avenue deo-lotion extension in Tamil Nadu, positioned as an antiperspirant offering. The deodorants portfolio is also witnessing increasing traction in EDP formats, supported by gifting-led consumption. The condoms segment remains resilient, benefiting from a relatively stable competitive landscape dominated by a few key players. Management expects low double-digit growth in the near term, with a gradual improvement toward mid-teen growth over the medium term, while margins have stabilized and are expected to remain steady

Product innovation and expanding TAM to strengthen growth

GCPL continues to strengthen its growth outlook through product innovation, new category entry, and portfolio expansion. Godrej Fab and Goodnight Agarbatti have scaled up well, with GCPL emerging as the market leader in incense sticks. New launches such as Air Plug (Amazon Woods 4x), Air Pocket, and KamaSutra at INR99 have gained healthy traction across markets.

* The entry into toilet cleaners with Godrej Spic provides exposure to an ~INR30b double-digit growth category, with differentiated formulation and value pricing supporting medium-term scale-up. Moreover, the Muuchstac acquisition enables GCPL’s entry into the fast-growing men’s facewash segment (INR10b Indian men’s facewash market), which is EPS-accretive from day one and offers multiple distribution-led growth levers.

International business – Fast recovery for Indonesia

Indonesia business reported a revenue decline of 5% in 1HFY26, impacted by a market slowdown and intense price competition, resulting in low single-digit volume growth. EBITDA margin contracted during 1H due to competitive pressure and weak operating leverage. Management expects a gradual recovery from 2HFY26 (better than expected), though full improvement is likely from 1QFY27 onward. EBITDA margin is expected to stabilize in 2H, with no further contraction anticipated.

* Africa (GAUM) business delivered a strong performance in 1HFY26, recording double-digit growth in revenue and profit (>25%). The growth trends are intact. Management expects mid-teen EBITDA margins to be sustainable, although currency movements and seasonality may continue to drive quarter-to-quarter volatility.

* Latin America business continues to face near-term volatility due to hyperinflation and currency depreciation, which have weighed on reported performance despite stable underlying demand.

Valuation and view

* GCPL faced revenue growth pressure in its India business in 1HFY26 due to weak soap performance and the impact of GST transition. The growth acceleration is expected to be driven by a decline in palm oil prices, consistent strong growth for new portfolio and normalization of GST transition, which will eventually offer share gain opportunities from unorganized players.

* The company’s disruptive innovations, introduction of access packs, and expansion into new growth categories will contribute to the growth trajectory. Additionally, savings in media spends of 200bp by FY28 and palm oil prices will also restore margins.

* Besides, there has been a consistent effort to fix gaps in profitability and growth in its international business. ? We expect GCPL to deliver a CAGR of 11%/12%/18% in sales/EBITDA/adj. PAT over FY25-28. The stock currently trades at 44x and 39x P/E on FY27E and FY28E, respectively. With earnings outlook improving, we expect a re-rating in the valuation multiple. We reiterate our BUY rating on the stock with a TP of INR1,450 (50x Dec’27E EPS)

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)