Buy Zydus Wellness Ltd for the Target Rs. 575 by Motilal Oswal Financial Services Ltd

Scaling up the wellness brand equity

Relevant presence in health and wellness megatrends

* Zydus Wellness is a diversified health and nutrition company (~INR40bn revenue) with leadership in several consumer wellness categories. The company’s core portfolio consists of sugar substitutes (Sugar Free), glucose powders (Glucon-D), skincare (Everyuth), functional foods (Nutralite), prickly-heat powder (Nycil), and nutritional beverages (Complan). Zydus maintains dominant positions in its core categories. Recent acquisitions, including Naturell (RiteBite Max Protein) and Comfort Click (VMS portfolio), have expanded the company’s presence across emerging consumption trends such as high-protein snacks, preventive health, and digital-first nutrition.

* The company’s portfolio is aligned with global consumption megatrends, e.g., low/no sugar, high protein, preventive wellness, high energy and on-the-go functional nutrition. Unlike FMCG peers, which are facing user-addition constraints in several core categories, Zydus can leverage its portfolio to keep expanding its user base, particularly for youth and affluent consumers.

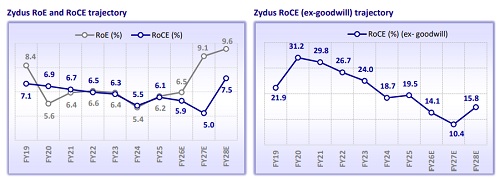

* Zydus has one of the best risk-reward profiles among peers with a similar market cap (

Gearing up for scale-up; revenue reached to ~INR40b vs.

* In FY19, with revenue of less than INR5b, Zydus decided to buy the Heinz portfolio, which was twice its size. It was a challenging decision, as it took several years to stabilize the sizable acquired portfolio amid multiple headwinds such as Covid, seasonality, etc. As a result, historical earnings growth is not inspiring but it does not reflect the true potential of the company.

* In order to achieve a meaningful scale, Zydus acquired Naturell India (RiteBite, Max Protein) in Dec’2024 in the fast-growing functional and protein nutrition segment and Comfort Click in Sep’25 (Weigh World, maxmedix, Animigo), a UK and European online-first wellness brand, to expand its international footprint.

Category choices suitable for global consumption megatrends

* Zydus’s portfolio is increasingly well aligned with the structural shifts in global food and nutrition consumption trends. The company now has a presence across low- and no-sugar categories, high-protein and functional snacks, and products that support energy and preventive wellness. These segments are witnessing strong consumer adoption worldwide.

* Growing usage of digital and D2C channels is helping Zydus build deeper consumer understanding, sharpen targeting, and enhance relevance among younger, lifestyle-focused and health-conscious users. It can drive long-term premiumization opportunities and strengthen the company’s position with evolving global demand trends.

Innovation funnel improving aided by large portfolio basket

* The company has been keeping its portfolio relevant to evolving consumer needs and aligned with modern health and wellness trends. The continuous science-backed upgrades and new formats such as Sugar Free Green (steviabased), Glucon-D Activors RTD, ImmunoVolt, and the Nutralite DoodhShakti dairy range are some notable recent launches by Zydus.

* Its strong capabilities in creating and scaling category extensions allow Zydus to broaden consumption occasions and drive premiumization through adjacent offerings such as Choco spreads, processed cheese (professional segment), protein snacks, and immunity-focused products.

Distribution evolved from niche play to more broad-based

* Zydus has transformed its distribution architecture from a primarily urban, chemist-centric model into a pan-India, omnichannel network. Early initiatives such as EnReach have improved its direct reach and launch execution, while the Heinz India acquisition significantly accelerated its scale, taking its outlet coverage from 0.8 million to ~2.8 million by FY24 and more than doubling its direct reach under Project Vistaar.

* The current distribution backbone is robust and well diversified, supported by 1,950+ distributors, 2,800+ strong field force, and 25 warehouses (including 21 cold-storage facilities). Organized channels’ contribution increased from 14.5% in FY21 to ~23% in FY25, driven by strong traction in e-commerce, modern trade, and quick commerce (which accounts for ~40% of online sales).

* Ongoing rural and digital expansion, along with strengthened warehousing and omnichannel capabilities, enhances execution of new launches, deepens market penetration, and supports steady market share gains across categories.

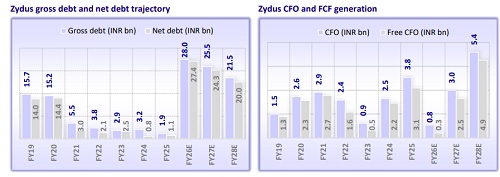

With steady core, Zydus can leverage margin improvement

* Zydus has been focusing on faster scalability for its core business and acquired business; hence, the company has been in the investment phase. Heinz portfolio was sizable (2x of core) and required higher attention of brand investment to grow the business. In this tenure, the company had seen multiple headwinds such as Covid and weak seasonal demand. Thereby, EBITDA margin has seen consistent contraction and reached 14% in FY25 from 18% seen after the Heinz acquisition in 2019 and 24% recorded before the Heinz acquisition.

* The company has been focusing on multiple cost initiatives such as streamlining the manufacturing setup (five plants to four plants) backed by flexible outsourcing (now 18 third-party partners), supply chain efficiency, and distribution leveraging. Besides, a steady shift to premiumization and operating leverage will drive EBITDA margin expansion for the organic business. ? We model organic EBITDA margin of nearly 16% in FY28, while the company aims to achieve ~17%. Thereby, there is an upside risk in our operating margin assumption for the organic business.

Valuation and view

* Zydus has been working to stabilize its large acquisition over the last couple of years. India business has reached to INR25bn with multiple core and non-core business. Max Protein and Rite Bites certainly increase growth opportunities in the rising affluent youth and health-focused consumers. Comfort Click has superior growth history (>50% CAGR), and if the business can deliver 15-20% growth over the next three years, it will accelerate overall growth of Zydus.

* The company has one of the best risk-reward profiles as compared to its similar market cap consumer peers (50% revenue growth over the last four years and the company is confident of achieving >25% CAGR; however, given global sensitivity, we model ~20% CAGR. During FY25-28, we estimate a ~30% revenue CAGR and ~35% EBITDA CAGR.

* The stock is at 22x P/E and 16x EV/EBITDA FY28E, a 30%-35% discount to other FMCG peers, and offering the best risk-reward profile in the sub-INR150b market-cap consumer universe.

* Based on SoTP, we value the India business at 27x EV/EBITDA FY28E and International (Comfort Click) at 15x EV/EBITDA FY28E to arrive at a TP of INR575 (implied consolidated 22x EV/EBITDA and 30x P/E at FY28). We initiate coverage on Zydus with a BUY rating.

* Key downside risks: a) high dependence on seasonality; b) input cost volatility; c) underperformance in the HFD category; and d) increase in competitive intensity.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412