Buy DCB Bank Ltd for the Target Rs. 210 by Motilal Oswal Financial Services Ltd

Growth outlook steady; RoE target at 13.5%/14.5% for FY27/FY28

We estimate 24% CAGR in earnings over FY26-28

* DCB Bank (DCBB) has been delivering healthy loan growth and has guided for a steady growth rate of 18-20% over the coming years. The bank continues to focus on granular retail loans with a retail mix (ex-Agri) at 65% of the total portfolio.

* NIMs improved 3bp QoQ to 3.23% in 2QFY26, aided by a reduction in deposit costs. NIMs are expected to improve gradually, supported by lower funding costs and limited yield compression, though further rate cuts remain a factor to watch out for.

* With healthy business growth, operating leverage and margin improvement, we expect DCBB to report steady traction in the balance sheet and earnings growth.

* Its operational focus and technology-led efficiencies will help DCBB keep cost ratios below 2.5%. As operating leverage improves, the bank targets RoE of ~13.5% by FY26- 27 and ~14.5% by FY27-28 (without factoring in any capital raise).

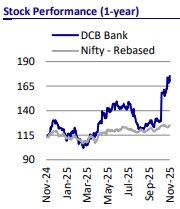

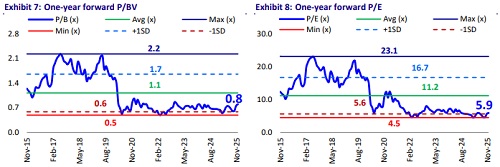

* Notwithstanding a sharp rally in recent months, the valuations remain attractive at 0.8x FY27E ABV for a potential RoA of ~1% and ~24% earnings CAGR estimated over FY26-28E. We reiterate our BUY rating with a revised TP of INR210 (premised on 1.0x FY27E ABV).

Loan growth to be healthy at 18-20%; focus remains on granularity

DCBB is set to maintain a robust growth trajectory, with expectations of annual growth of 18-20% while remaining adequately capitalized with CAR in the range of 15.50% to 17.0% in the next two years. The bank reported 19% YoY growth in advances in 2Q. This growth is fueled by strength in co-lending and strategic initiatives such as optimizing business from its existing branch network and enhancing digital capabilities to improve customer experience. The bank has focused on expanding granular retail loans to drive profitable growth. However, mortgage disbursements slowed as the bank raised ticket sizes and prioritized LAP over home loans, thereby improving yields. Co-lending partnerships contribute 16% to advances and the bank intends to maintain this mix at this level. Overdraft is a key differentiator and will continue to drive growth over the coming years. We estimate loan CAGR of ~19% over FY26-28E.

Retail mix healthy; productivity to improve further

DCBB continues to strengthen its retail portfolio, with retail loans (ex-Agri) forming ~65% of the loan book, reflecting the bank’s emphasis on granular, customer-focused lending. This retail-heavy mix aligns with the bank’s strategy of leveraging branch-level productivity for sustainable growth. To increase business per branch, the bank has focused on enhancing digital capabilities and improving operational efficiency while maintaining strong cost controls. DCBB is comfortable with 60:40 mix in BL:HL ratio (at sourcing) and will maintain this going forward. Deposits grew in line with advances (19% YoY) with continued focus on retail deposits. CD ratio remained comfortable at ~82%, providing adequate room for growth. We estimate deposit CAGR of 18% over FY26-28E.

NIM to show positive bias; estimate 21% CAGR in NII over FY26-28E

DCBB’s NIM is expected to remain resilient and improve further, supported by the full pass-through of repo rate cuts, ongoing benefits from lower deposit costs as older high-rate term deposits mature, and strategic actions such as a reduction in term deposits, CD issuances at more favorable rates, and sourcing fresh borrowings at significantly lower costs. While portions of the older hybrid stock portfolio shifting to floating rates may see some yield moderation, minimal compression in yields on new sourcing should help DCBB sustain lending yields. With these factors cushioning funding costs and stabilizing asset yields, DCBB’s NIM appears poised to remain stable to slightly expansionary, as reflected in the 3bp QoQ increase to 3.23% in 2Q, though we remain watchful of further rate cuts. DCBB expects NII-to-average assets at 3.15-3.20% for the next two years.

Operating leverage and cost discipline to aid profitability

Operational improvements remain central to the bank’s strategy, with healthy core fee income from third-party distribution and trade fees further supporting revenue growth. The bank has reduced its employee base by 9% YoY to 10.7k. Though selective hiring will resume, it will be supported by rising business volumes. Overall costs are set to increase, but income is expected to grow at a faster pace, keeping cost-asset ratio comfortable below 2.5% and fee income-to-avg asset stable at 1- 1.05% over the next two years. We expect C/I ratio to moderate to ~58% by FY27E.

Asset quality outlook stable; guides credit costs to remain below 40-45bp

DCBB’s asset quality outlook remains stable, supported by moderating fresh slippages and marginal improvements in GNPA/NNPA ratios to 2.91%/1.21% in 2Q. While PCR eased slightly to 59.2%, credit costs remained contained at 31bp in 2Q, with full-year credit costs expected to remain below 45bp. The bank continues to prioritize strengthening recoveries and managing slippages, targeting a slippage ratio of 2.5%, though it is focusing more on enhancing productivity than aggressively reducing slippages. GNPA pressure remains elevated in AIB (due to the MFI book), but improvements in the unsecured DA book provide comfort. DCBB’s steady collections and ongoing portfolio improvements position it well to maintain healthy asset quality, enabling controlled credit costs. We estimate GNPA/NNPA ratios at 2.60%/1.03% for FY27E.

Valuation and view

DCBB has seen a healthy momentum in loan growth, supported by growing focus on gold loans and co-lending partnerships, and the bank expects annual growth of 18- 20%. Despite repo rate cuts, NIMs expanded 3bp QoQ in 2Q and management expects further improvement on a calibrated basis. With healthy business growth, operating leverage and margin improvement, we expect DCBB to report steady traction in the balance sheet and earnings growth. Management has guided for RoE of ~13.5% by FY26-27 and ~14.5% by FY27-28 (without factoring in any capital raise). Notwithstanding a sharp rally in recent months, the valuations remain attractive at 0.8x FY27E ABV for a potential RoA of ~1% and ~24% earnings CAGR estimated over FY26-28E. We reiterate our BUY rating with a revised TP of INR210 (premised on 1.0x FY27E ABV).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412