Buy VIP Industries Ltd for the Target Rs. 490 by Motilal Oswal Financial Services Ltd

Strategy reset leads to weak performance; turnaround in FY27.

VIP Industries’ 2QFY26 print was below our estimates. Consolidated revenue declined 25.3% YoY and the company reported losses at the EBITDA/PAT level. The revenue decline was on account of 1) its focus on secondary sales by rationalizing trade discounting; 2) low uptick in BBD sales on e-com platforms as demand was skewed towards products owing to higher GST cuts, 3) lower trade discounting in MT/GT channels, and 4) lower realization. VIP cut its inventory by INR677m in 1H, and we expect to liquidate the remaining slow-moving inventory (INR250-300m) in the next quarter. In addition, VIP identified certain non-core assets (INR1.2b) for potential liquidation in the near term. With Multiples Private Equity acquiring a controlling stake, there is strong confidence in the brand’s revival potential. We expect the refreshed strategy to be anchored to 1) augmenting supply-chain efficiency with a focus on secondary sales, 2) enhancing employee productivity, 3) divesting low-profitability brands, 4) expanding its retail footprint to high-throughput locations, and 5) realigning ecommerce discounting.

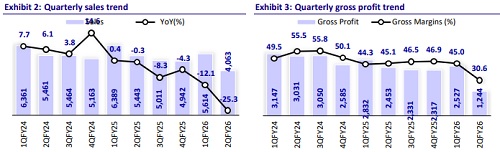

Subdued performance; limited discounts during BBD sales

VIP’s 2Q consol. revenue declined to INR4b. Though the demand conditions was strong, the demand was skewed towards the products with higher GST cuts, impacting BBD sales on e-com platforms. VIP’s decision to rationalize discounting and push secondary sales led to a severe impact on primary sales. Further, a slower offtake n in GT/MT dragged down revenue in 2Q. VIP reduced its inventory by INR677m in 1H, and we expect to liquidate the remaining slowmoving inventory (INR250-300m) in the next quarter. We believe as festive season picks up, coupled with strong marriage season ahead revenue momentum to stabilize in 4Q, supporting revenue growth of 11%+ in FY27-28.

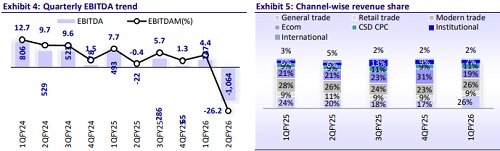

Gross margins falls to 30.6% due to higher provisions

Gross margins fell to 30.6% (-1,445bp YoY), impacted by the INR550m soft inventory provisions taken in 2Q. We believe management opted for a one-time provision rather than increasing discounts on the e-commerce channel. EBITDA loss came in at INR1b, settling the EBITDA margin at -26.2% (-2578bp YoY) despite lower other expenses (-6.2%) and lower employee costs (-8.5%). In addition, VIP identified certain non-core assets (INR1.2b) for potential liquidation in the near term. With new management prioritizing inventory cleanup and reestablishing price discipline, we anticipate EBITDA to be under pressure in FY26

Valuation and view: Reiterate BUY, expect turnaround in FY27

We expect VIP to continue gaining share and delivering industry-beating growth, leveraging the strategic drivers, which include: 1) a celebrity-led campaign to drive brand recall, 2) product upgrades with distinctive features – smart Bag-Tag, 3) store rationalization – a closure of low-RoI EBOs, and 4) Bangladesh plant turnaround. Despite near-term weakness in performance, we are optimistic about VIP’s growth story, yet given weak 1H performance, we cut FY26E/FY27E earnings by 294.0%/ 16.1% and retain BUY with a revised TP of INR490 (implying 50x Sep’27E EPS). Risks: local competition, significant rise in input costs, prolonged disruption in Bangladesh facility (refer to our IC note dated Sep’25).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412