Buy Billionbrains Garage Ventures Ltd for the Target Rs. 185 by Motilal Oswal Financial Services Ltd

Groww-ing India’s Wealth!

No. 1 player in brokerage; multiple optionalities at play

* Billionbrains Garage Ventures (GROWW) has scaled rapidly to emerge as the largest retail broking platform (on the NSE Active clients basis) within almost four years of its launch. It held a market share of 26.6% in Nov’25, about 9% higher than the second-largest player. Originally a niche mutual fund platform, it now commands a meaningful market share in stocks (~25%) and derivatives (~14%).

* From a zero-revenue MF distributor, GROWW has evolved into a full-stack investment platform spanning broking, commodities, MTF, credit, and wealth management, with 14.8m active users across products by the end of 1HFY26. The company’s strong product adoption over the years has led to a ~3x surge in its revenue from FY23 to FY25; we further expect its revenue to double over FY25-28.

* GROWW is increasingly building optional growth levers to diversify revenues and improve earnings quality. The rapid expansion of MTF, a fast-growing commodities franchise, along with the growth of the credit portfolio through LAS and the entry into wealth management, collectively reduce dependence on the volatile broking segment. This aids a structurally more resilient earnings profile. We expect GROWW’s broking revenue contribution to dip to 64% in FY28 from 85% in FY25.

* The company acquires more than 80% of its customers organically, keeping CAC low and payback periods short. The fully in-house tech stack lowers cost-to-serve while enabling rapid feature deployment and high platform uptime. As incremental revenue scales across new businesses and fixed costs remain largely stable, we expect its EBITDA margin to expand to 68% by FY28 from 59% in FY25.

* We believe GROWW is well-positioned to compound earnings in a structurally underpenetrated Indian capital markets ecosystem. Rising cash yields—driven by MTF and higher minimum brokerage—along with product depth fueling growth in non-derivative revenue and monetization levers targeting the affluent base through the wealth management platform, should reduce earnings volatility. Meanwhile, robust cost efficiency enhances return metrics.

* We expect GROWW’s FY25-28 revenue/EBITDA/PAT CAGR at 25%/30%/30%. We initiate coverage on the stock with a BUY rating and a one-year TP of INR185 (based on 28x FY28E P/E – ~30% discount to Robinhood)

Capital markets – structural shift towards discount brokers

* In our Capital Market thematic last year, we highlighted that there will be a notable opportunity for the capital market ecosystem due to the low penetration of demat accounts in India at ~14% (vs. 62% for the US) despite stellar growth.

* Platforms such as Groww, Zerodha, Angel One, etc. have disrupted the markets, offering a wide range of investment options, savings, and investment services through user-friendly mobile apps. The NSE Active clients' market share of digital-first platforms has gone up to 76-78% from 6-8% in FY15.

* Retail participation has accelerated meaningfully since FY20, with retail cash ADTO surging 2x from the FY20 levels. NSE Active clients in the F&O segment doubled from 2.5m in Apr’23 to 5.3m by Jun’24 before stabilizing back to 3.4m post F&O regulations.

* As retail investors mature, participation is expanding beyond cash and F&O into commodities, MFs, MTFs, AIF/PMS, etc. The combination of an underpenetrated, improving market infrastructure and evolving investor behavior continues to reshape the industry landscape. This reinforces a long-term shift towards digital and low-cost brokerage platforms.

Broking business gaining market share; new segments to drive momentum

* GROWW’s cash ADTO market share is robust at 23-24%, while the derivatives market share has grown to 14.4% from 9.7%, despite regulatory headwinds. Despite a price increase (minimum brokerage of INR5 from INR2), active users in the cash segment have been on an increasing trend across segments, indicating price inelasticity and a pricing lever to offset any future impacts.

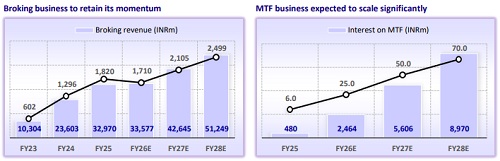

* Groww has recently launched commodities as a product, which should provide incremental broking revenue. The company is launching new trading tools aimed at “power traders” to deepen engagement. Backed by innovation, the higher-value customer segment is expanding, leading to larger order sizes and higher monetization potential. While we expect brokerage revenue contribution to decline to 67% by FY28 from 85% in FY25, the absolute revenue is likely to record a CAGR of 16% over FY25-28.

* The recently launched MTF product has reached a book of INR17b but still has a long way to go (<1% of the industry). GROWW aims to expand its market share to double digits. With a yield of ~15% and brokerage of 0.1% of order value, MTF adoption will boost cash realizations, drive ARPU uplift, and also attract new users. Revenue contribution from MTF is likely to reach 12% by FY28 from 1% in FY25.

Existing affluent customer base to support wealth management entry

* GROWW’s affluent user base has grown ~2x faster than the platform, with ~0.3m affluent customers holding ~33% of the assets. This has provided opportunities for multi-product engagement, deepening of wallet share, and long-duration wealth relationships.

* The acquisition of Fisdom, a wealth management platform, adds strategic scale to this opportunity. GROWW plans to run a tech-driven wealth platform, ensuring scalability and integrating offerings such as MF advisory, PMS, AIF, PE, unlisted securities, etc. into their product offerings, especially for affluent customers.

* The key differentiator is existing technology and product scaling capabilities. The wealth management will be focusing on product discovery (a single platform laying out all PMS/AIFs of India), onboarding (digital first and tech first), and an online payment layer. We expect the wealth management business to contribute ~7% of revenue by FY28.

Synergies in credit business through LAS/LAMF

* GROWW held USD30b worth of assets on the platform, which creates a notable monetization opportunity through Loan against Securities (LAS) and Loan against Mutual Funds (LAMF). Credit products enhance overall ARPU and profitability, with low incremental acquisition costs (since customers are already on GROWW).

* Both LAS and LAMF align directly with GROWW’s investor base, providing a natural adjacency to the broking and wealth platforms. While personal loan disbursals have recently been hit by tighter regulations for credit distribution, the introduction of these products can improve the disbursal growth trajectory. We expect the company’s credit revenue to clock a CAGR of 30% over FY25-28, backed by strong contribution from LAS and LAMF.

* Credit products naturally tie into affluent and wealthy customers who can pledge assets for liquidity. Together, LAS, LAMF, and MTF create a holistic credit ecosystem within the company. Credit business provides profit accretion and engagement stickiness, transforming GROWW into a brokerage, wealth, and credit platform.

Robust operational efficiency and strong profitability metrics

* A large part of GROWW’s costs is fixed in nature, with only 9-10% of the costs being variable. This led to a robust operating margin of 59% in FY25.

* The cost to serve (tech + transaction-related) has been 12-14% of the operating revenue with continuous investments towards enhancing capabilities. With most investments in place, we expect these costs to record an FY25-28 CAGR of 13%, with the contribution margin inching closer to 90% going forward.

* The organically built customer acquisition funnel and product expansion, which have been driving engagement, resulted in a low CAC of USD6-10 and short payback periods. These reflected significant cost efficiencies with scale. We expect the cost to grow (marketing expenses) to record an FY25-28 CAGR of 11% amid a gradually growing transacting user base.

* Cost to operate (largely employee expenses) is expected to clock an FY25-28 CAGR of 27%. We believe the company’s EBITDA margin will expand meaningfully to 66.4% by FY28, backed by the sustained momentum of core broking revenue, scale-up of non-broking revenue, and robust cost efficiency.

Valuation and view: Initiate coverage with a BUY rating

* GROWW has organically built a customer acquisition funnel by gaining trust as a zero-commission mutual fund platform (80%+ organic client acquisition). Users are staying longer, becoming wealthier, and adopting multiple products, thereby creating a compounding effect on AUM and ARPU.

* The brokerage business is experiencing an improving market share across segments with multiple additional levers, such as MTF, price hikes, commodities, et al., yet to fuel the growth. The rising affluent customers unlock wealth management opportunities for the company, with the Fisdom acquisition giving a further boost to the same. The founders' tech-first, customer-centric vision has made technology and customer experience core differentiators for GROWW.

* Despite the regulatory action at the end of FY25 on F&O, we expect GROWW to report an earnings growth of 10% in FY26 and follow it up with a stronger growth of 50%/32% in FY27/FY28. Further F&O regulations and increased competitive intensity are key risks. The tech-led model provides a lean cost structure, due to which we expect the EBITDA margin to expand to 66.4% by FY28 and the FY25-28 PAT CAGR to be 30%. We initiate coverage on the stock with a BUY rating and a one-year TP of INR185 (based on 28x FY28E P/E).

* GROWW (at ~22x FY28E P/E) is valued at a meaningful discount to global peers such as Robinhood (at ~40x CY27E P/E). As Groww’s revenue mix diversifies beyond broking ( ~85% vs ~55–60% for Robinhood in FY25) towards MTF, credit and wealth, we expect the valuation gap to narrow over time.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412