Neutral Vedanta Ltd for the Target Rs. 470 by Motilal Oswal Financial Services Ltd

Operational performance in line

* Vedanta (VEDL) reported consolidated net sales of INR405b (+14% YoY and +3% QoQ), in line with our estimates. The QoQ growth was driven by favorable market prices and higher premiums.

* VEDL’s consolidated EBITDA stood at INR115b (+31% YoY and +3% QoQ) against our estimate of INR108b. EBITDA was driven by higher volumes and premiums, partially offset by input commodity inflation.

* EBITDA margin for 4QFY25 stood at 28.3%, compared to 28.4% in 3QFY25 and 24.7% in 4QFY24.

* APAT for the quarter stood at INR35b (+122% YoY and -2% QoQ), in line with our estimate of INR34b.

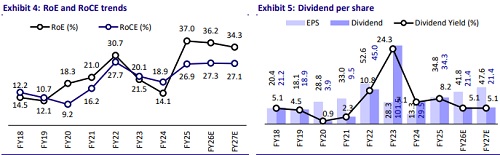

* For FY25, revenue stood at INR1530b (+10% YoY), EBITDA was INR423b (+39% YoY), and APAT came in at INR136b (+176% YoY).

* Net debt stood at INR533b, with net debt/EBITDA improving to 1.2x as of 4QFY25 vs 1.4x in 3QFY25.

Segment highlights

Aluminum :

* Net sales stood at INR160b (YoY/QoQ: +29% / +4%) against our estimate of INR154b. Reported EBITDA came in at INR47b (YoY/QoQ: +55% / +3%), against our estimate of INR43b. Aluminum cost of production increased 11% YoY and 7% QoQ to USD2,011/t during the quarter. VEDL produced 603kt of aluminum, registering +1% YoY growth but 2% QoQ decline.

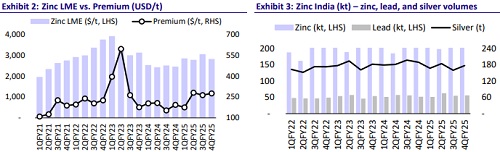

Zinc India (HZL):

* 4QFY25’s revenue stood at INR90.9b (+20% YoY/+6% QoQ) vs. our estimate of INR85.5b. Revenue growth was driven by high metal production, strong zinc and silver prices, stronger dollar, and strategic hedging gains. EBITDA stood at INR48.2b (+32% YoY/+7% QoQ) vs. our estimate of INR44.4b. The Cost of Production (CoP) for Zinc dipped 5% YoY to USD994/t in 4Q, led by better grades and recovery, lower costs, and operational efficiencies. APAT stood at INR30b (+47% YoY/+12% QoQ) against our estimate of INR25.8b. Mined metal production stood at 311kt (+4% YoY/+17% QoQ), driven by better metal grades and an increase in production at Agucha/Zawar mines.

Zinc International:

* Revenue stood at INR11.1b, up 75% YoY and 6% QoQ in 4QFY25. EBITDA came in at INR4b, up 14% QoQ in 4QFY25 (vs INR590m in 4QFY24), whereas CoP was up 7% QoQ (-25% YoY) to USD1,263/t. Zinc production was up 52% YoY and 9% QoQ in 4QFY25, driven by higher tons treated at Gamsberg and higher BMM lead and zinc grades.

Copper:

* Revenue came in at INR61b (YoY/QoQ: +22% / +6%) in 4QFY25. EBITDA reported a loss of INR490m in 4QFY25, against the operating profit of INR40m in 3QFY25. Copper cathode production stood at 44kt, up 41% YoY, but moderated 2% QoQ.

Iron Orse:

* Revenue stood at INR15.3b (YoY/QoQ: -38%/ -18%), while EBITDA stood at INR3.1b (YoY/QoQ: -44% / -17%) in 4QFY25. Saleable ore production stood at 2.1mt, up 22% YoY and 25% QoQ. Pig Iron production was up 4% YoY, but declined 5% QoQ. Sales volume declined 6% YoY and remained flat QoQ in 4QFY25.

Highlights from the management commentary

* The increase in aluminum CoP during 4QFY25 was driven by the high-cost alumina inventory. Management expects the benefit from lower alumina prices to reflect in the next quarter.

* Currently, 55% of alumina is sourced from captive sources, with the rest being imported. As production ramps up to 4mt by Q4FY26, captive sourcing is expected to increase to 65%.

* For the aluminum business, VEDL expects production volume of 2.5mt and CoP of USD1,700-1,750/t for FY26.

* For Bauxite, VEDL expects to source 60% from the domestic market (OMC) and 40% imported in 1HFY26.

* Konkola Copper Mine (KCM) is ramping up well. Management targets 150KT in FY26, with a potential upside to 170-180 KT. The mine is expected to be cash positive in FY26 with the completion of the KDMP project.

Valuation and view

* VEDL’s 4QFY25 performance came largely in line across segments. Capex plans are progressing well and will likely lead to further cost savings.

* Management targets to maintain strong growth in earnings, led by the upcoming capacity, which will produce higher VAP products. VEDL remains firm on its deleveraging plans, and going forward, higher cash flows will support both its expansion plans and deleveraging efforts. The stock currently trades at 4.9x FY27E EV/EBITDA. We have marginally cut our estimates for FY27. We reiterate our Neutral rating on the stock with an SoTP-based TP of INR470.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412