Buy LTIMindtree Ltd For Target Rs.6,600 by Motilal Oswal Financial Services Ltd

Bruised but oversold

LTIMindtree (LTIM) stock has corrected by 22% in the past three months, despite multiple positive developments: US BFS growth recovery, positive QoQ growth trajectory in 9MFY25, and the most important being the appointment of a new CEO, Mr. Venu Lambu. Key reasons for this underperformance include the slower-thanexpected discretionary pickup, revenue decline in Microsoft, and uncertainty over margins. The stock now trades at 22x FY27e EPS, vs 22/22/21x for Infosys/TCS/HCLT. We find these valuations as an attractive risk-reward opportunity and like the stock at current levels. In our note (LTIMINDTREE: Asymmetric risk-reward potential, published on 13th Jan), we have pitched LTIM as our top pick for 2025. As seen in Exhibit 1, even in our bear case scenario, LTIM could offer superior or at-par earnings growth vs key large-cap IT names. Our base case scenario now assumes revenue growth of c9% for FY26e and c11.5% for FY27e, but we pare our margin expansion assumptions further to account for more aggressive SG&A investments. We concede that near-term catalysts—weakness in hi-tech in Q4 and management’s time to settle in—preclude an immediate recovery in price, but we reiterate BUY on strong fundamentals and keep our focus on the turnaround. We also cut our target multiple by 10%, in line with our other stocks, to account for lower risk appetite in the current market. Reiterate Buy with a TP of 6,600.

Risk-reward ratio favorable; valuations attractive now

* LTIM currently trades at 22x FY27E EPS; on a blended 12M forward basis, the company is now at a 10% discount to its five-year average.

* While valuations reflect uncertainty around the Microsoft account, discretionary spend revival, and the risk to margin expansion, the riskreward has now turned favorable, in our view.

* Even in our bear case, which assumes a meager 6.5-7% YoY cc CAGR for the next two years and minimal margin expansion, LTIM has the potential to generate earnings CAGR on par with other large caps.

* A mild improvement in the demand environment, along with slight margin expansion, could push these earnings growth numbers higher and lead to a notable re-rating from current levels.

New CEO appointment a positive, but benefits may take time

* LTIM’s post-merger top-level attrition and uncertainty around succession plans have been major factors contributing to the stock’s underperformance.

* However, the appointment of Mr. Venu Lambu is a positive and should provide the company with much-needed growth momentum.

* Further, we also believe Mr. Lambu’s appointment will help stem the toplevel attrition that has been a major thorn in the side of LTIM (Exhibit 6).

* That said, the new management will take their time to settle in and drive growth, and we believe the actual benefits may accrue in FY27.

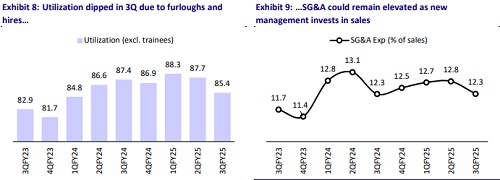

Margins a key risk; we pare back our assumptions on SG&A leverage

* Margins remain a key monitorable and the biggest risk to our thesis. It is apparent that post-merger synergies have not been realized to the extent previously anticipated, and a challenging demand environment has made it tougher to expand margins.

* While we believe the model has enough SG&A benefits to drive operating leverage, a sales focus and investment in SG&A would prolong margin recovery for the company.

* We expect margins to recover by c40bp (on a base of 14.7% for FY25e) in FY26e, a much slower expansion trajectory than earlier.

Valuation and view

* We reiterate our BUY rating on LTIM due to its superior offerings in data engineering and ERP modernization, positioning it well to capture pre-GenAI expenditures. We anticipate LTIM to outperform its large-cap peers and expect 9.1%/11.5% CC growth for FY26-FY27.

* LTIM could have managed its top-level churn rate more effectively postacquisition. Nonetheless, we believe the top-level attrition rate might remain benign going forward. Additionally, margins remain a concern and the biggest risk to our thesis.

Scenario analysis: Estimating the downside

* In our view, if discretionary spending fails to drive demand in the near future and tech-spend revival is delayed, LTIM is projected to grow by a much lower 6.2%/7.5% YoY CC growth in FY26E/FY27, leading to a ~1.5%/1.8% CQGR during these years, with EBIT margins of 14.7% and 15.0%. This could lead to an EPS of INR158.6/173.2/189.7 for FY25E/FY26E/FY27E, translating into an earnings CAGR of 9.4%. We anticipate a potential earnings downgrade of 5-11% for FY26/FY27 from our base case if the bear case materializes. In this case, the stock could be valued at 26x FY27 EPS, yielding a TP of INR 5,000, which could serve as a floor for the stock price.

* A technology upcycle and improvement in demand could enable LTIM to achieve 9.1%/11.5% YoY CC growth and expand EBIT margins by 120bp over FY25E, reaching 15.9% by FY27. In this case, LTIM will be valued at 31x, suggesting an upside of around 35% with a TP of INR6,600.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)