Neutral PVR-Inox Ltd for the Target Rs. 1,050 by Motilal Oswal Financial Services Ltd

Soft end to subdued FY25; content line-up improvement key

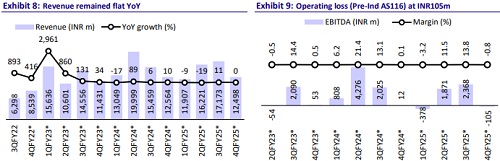

* PVR remained impacted by a weaker content slate in 4QFY25, with revenue flat YoY (-27% QoQ, in line) as ~210bp YoY dip in occupancy to 20.5% (vs. 25.7% QoQ) was offset by 11% YoY increase in ATP to INR258 (-8% QoQ).

* PVR reported an operating loss (pre-INDAS 116) of INR105m in 4QFY25.

* FY25 has been a muted year for PVR, due to the lack of tent-pole movie releases in Hindi and the continued impact of a Hollywood strike.

* We expect the content pipeline to improve in FY26 with several tent-pole movie releases in Hindi and improvement in Hollywood movies slate.

* However, PVR’s business remains highly sensitive to occupancy trends, which are dependent on the quality of content (which is not in PVR’s control). Although management sounded upbeat about the FY26 content pipeline, we note that even a 200-300bp blip in occupancy could derail the company’s screen economics and thereby our EBITDA estimates.

* We cut our FY26-27E EBITDA by ~4-5%, driven by lower admissions and lower contribution from capex-light screen additions. Reiterate Neutral with a TP of INR1,050 (based on 12.5x pre-Ind-AS 116 FY27E EBITDA).

Weak performance continues

* Consolidated revenue was flat YoY (-27% QoQ) at INR12.5b (in line), due to continued weakness in content pipeline.

* Ticketing revenue at INR6.5b (-27% QoQ) was up 2% YoY, largely on account of 11% YoY improvement in ATP to INR258 (-8% QoQ) as occupancy declined ~210bp YoY to 20.5% (vs. 25.7% QoQ).

* F&B revenue at INR3.8b (-27% QoQ) declined ~8% YoY as spends per head (SPH) declined 4% YoY to INR125 (-10% QoQ) and admits declined ~6% YoY (-18% QoQ).

* Ad revenues declined 8% YoY (-35% QoQ) to INR962m.

* Operating loss (pre Ind-AS 116) stood at INR105m (though better than our est. of ~INR345m loss).

* Movie exhibition cost of INR2.5b (+2% YoY) came in at ~39% as % of ticketing revenue (vs. 40% QoQ, 39% YoY).

* F&B COGS of INR1b (-12% YoY) came in at ~26.2% of F&B sales (50bp higher QoQ, 27.4% YoY).

* PVR reported a loss of INR1.06b (vs. est. of INR1.25b loss).

Box-office weakness impacted FY25 performance

* Consolidated revenue at INR58b declined ~5% YoY, due to weaker footfall (admits -10% YoY to ~137m)

* Ticketing revenue at INR29.5b declined ~10% YoY, largely due to lower admissions (260bp YoY decline in occupancy rate to 23%). ATP remained stable YoY at INR259.

* F&B revenue at INR18.3b declined 7% YoY as 10% YoY lower admits were partly offset by ~2% YoY increase in SPH to INR134.

* Ad revenue at INR4.5b declined ~1% YoY.

* Consolidated EBITDA (pre IND-AS 116) came in at INR3.8b (-47% YoY), driven by lower occupancy rates.

* Movie exhibition cost at INR11.8b (-16% YoY) came in at ~39.8% as % of ticketing revenue (vs. ~43% YoY).

* F&B COGS at INR4.7b (-7% YoY) came in at ~25.6% of F&B sales (largely stable YoY).

* For FY25, PVR reported a loss of INR1.5b (vs. PAT of INR1.1b YoY).

* The company generated OCF of INR8.4b (-9% YoY as lower EBITDA was partly offset by higher WC release). It incurred capex of INR3.2b in FY25 (-48% YoY), which led to FCF generation of INR3.3b (vs. INR1.1b YoY).

* As a result, net debt declined by ~INR3.5b in FY25 to INR9.6b.

Highlights from the management commentary

* FY25 performance: Box office performance was impacted by an uneven content release slate, with Bollywood and Hollywood underperforming. Movies dubbed in Hindi (Pushpa 2, Kalki) performed well. Hindi box office dropped 26% due to fewer releases and a lack of superstar movies. Hollywood fell 28% owing to continued impact of Hollywood strikes and a lack of tent-pole movies.

* Content line-up: Management indicated that 1QFY26 has benefitted from movies such as Raid 2, Kesari 2 and Jaat performing well and remains optimistic about the prospects of upcoming film releases such as Sitare Zameen Par, War 2, Housefull 5, Jolly LLB 3, and Delhi Files. Further, management expects a pickup in Hollywood collections in FY26 driven by strong pipeline, with titles such as Mission Impossible: Final Reckoning, Fantastic Four, Avatar 3, Formula 1 and The Conjuring sequel, etc.

* Screen additions: During FY25, PVR INOX opened 77 new screens, mainly in prime catchment areas, while it exited 72 underperforming ones. The closures were due to factors like deteriorating mall infrastructure or lease expiries, and resulted in EBITDA savings of INR80m. Going ahead, the company plans to add 100-110 new screens (20 already opened in 1QFY26TD), while it will continue to rationalize unviable screens. Management expects a 30:70 split between FOCO (won’t be consolidated by PVR) and asset-light/lease formats for new screen additions.

* Capex: Management indicated a capex plan of INR4-4.3b for FY26 with ~INR2.5- 3b earmarked for new projects, while the remaining would be spent on renovating the screens, maintenance capex and IT-related spends.

Valuation and view

* PVRL has taken several steps, such as curated re-releases and affordable ticket pricing on certain days, to boost footfalls, but the business remains highly sensitive to occupancy trends, which are dependent on the quality of content (which is not in PVR’s control). Although management sounded upbeat about the FY26 content pipeline, we note that even a 200-300bp blip in occupancy could derail the company’s screen economics.

* Improvement in occupancy, continued recovery in advertising revenues, and ramp-up of F&B business through ventures like PVR Café and food courts remain the key growth drivers for PVR.

* We cut our FY26-27E EBITDA by ~4-5% due to lower admissions and lower contribution from capex-light screen addition. Reiterate Neutral with a TP of INR1,050 (based on 12.5x pre-Ind-AS 116 FY27E EBITDA).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)