Buy MTAR Technologies Ltd for the Target Rs. 1,950 by Motilal Oswal Financial Services Ltd

Healthy revenue growth but below guidance

Operating performance missed our estimates

* MTARTECH reported strong revenue/EBITDA growth of 28%/87% YoY in 4QFY25 (on low base), led by increasing wallet share from existing clients and onboarding of new customers. This growth was largely led by clean energy fuel cells (up 38%), followed by Products segment (up 77% YoY) and Aerospace (up 59%).

* However, the company fell short of its FY25 revenue/EBITDA margin guidance of INR7b+/21%+ (+/- 100bp) and ended FY25 with revenue of INR6.7b and EBITDA margins of 17.9%. This was due to the deferment of some Aerospace orders (high margin) and order hiatus amid geopolitical uncertainties (tariffs). As a result, MTARTECH has lowered its FY26 guidance for revenue growth to 25% (vs. 30% earlier) and EBITDA margins to 21% (+/- 100bp) from 24% (+/- 200bp) earlier.

* Factoring in lower-than-expected 4Q performance and lower guidance, we reduce our FY26/FY27 EPS estimates by 20%/21%. We retain our BUY rating on the stock with a TP of INR1,950 (35x FY27E EPS).

Margin improves YoY led by better gross margins (product mix)

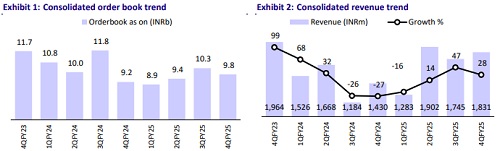

* Consolidated revenue grew 28% YoY/5% QoQ to INR1.8b (est. INR2.2b). EBITDA grew 87% YoY/3% QoQ to INR341m (est. INR558m).

* EBITDA margin expanded 590bp YoY but contracted 40bp QoQ to 18.7% (est. 25.7%). Gross margin stood at 52.3% (+700bp YoY). Employee expenses/other expenses as % of sales stood at 18.8%/14.8% (+110bp/- 10bp YoY).

* Clean Energy - Fuel Cell/AeroSpace & Defence (A&D)/Products & others revenue grew 38%/59%/77% YoY to INR1.1b/INR331m/INR377m. Revenue from Clean Energy - Nuclear declined 88% YoY to INR26m.

* The order book as of Mar’25 stood at INR9.8b, with inflows of ~INR1.3b in 4QFY25. The order book mix was ~48%/16%/28%/7% for Clean Energy – Fuel Cell/Clean energy - Nuclear/A&D/Product & others. A&D witnessed the highest YoY growth in its order book (44%).

* NWC days as of Mar’25 jumped to 229 from 222 in Dec’24, largely due to a jump in receivables days to 113 (vs. 97), which was partly offset by an increase in payable days to 77 (vs. 71). Inventory days stood flat at 186.

* In FY25, revenue/EBITDA grew 16%/7% YoY to INR6.8b/INR1.2b, while adj. PAT declined by 5.8% YoY to INR529m.

Highlights from the management commentary

* Clean energy: The company guided for revenue growth of 20% YoY, driven by momentum in fuel cells, battery storage, and hydropower. For Fluence, Proto-1 for battery storage is complete, and Proto-2 is underway with design revisions. A long-term supply agreement with Fluence is expected in 1Q/2QFY26, which will trigger volume production.

* Nuclear: The company has guided for revenue of INR600m in FY26, driven by long-term projects such as FMBC and fuel transfer systems. It expects imminent orders from NPCIL and government agencies for the refurbishment of five reactors. Additionally, it is pursuing a significant INR7-8b opportunity from the upcoming nuclear expansion initiatives, including component supplies for the Bharat 220 MW modular reactor.

* Aerospace: The company reported FY25 revenue of INR930m, driven by key contracts from ISRO, DRDO, GKN, Talis, and Elbit. It has guided for revenue of INR1.45b in FY26, supported by qualification orders, defense tender execution, and rising export demand.

Valuation and view

* With an order book of INR9.8b as of Mar’25 and a healthy pipeline across Clean Energy, A&D, and Nuclear sectors, we anticipate healthy growth and margin expansion in the coming years, driven by a scale-up in high-margin businesses and new product ramp-ups.

* We estimate a CAGR of 30%/49%/79% in revenue/EBITDA/adj. PAT over FY25- FY27. We retain our BUY rating on the stock with a TP of INR1,950 (35x FY27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412