Buy Ambuja Cements Ltd for the Target Rs. 750 by Motilal Oswal Financial Services Ltd

Growth story unfolding

Repositioning through scale and diversification

* Recently, Adani Enterprises (AEL), the promoter group company of Ambuja Cements (ACEM), has been declared as a successful resolution applicant for the acquisition of Jaiprakash Associates (JAL) under the IBC, 2016, and received a letter of intent. JAL is engaged in a wide array of businesses, including cement.

* Earlier, ACEM had announced the merger of Adani Cementation (completed in 2QFY26), Sanghi Industries and Penna Cement (expected to be completed by end-FY26) with the company. We believe that the Adani Group will consolidate cement business into a single listed entity. Hence, after the acquisition of JAL, the cement business should be transferred to ACEM at a valuation of ~INR50b (as per our estimates), subject to regulatory approvals.

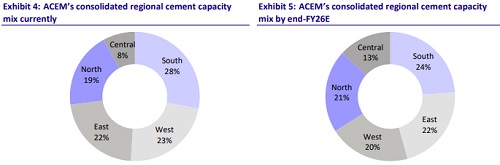

* Over the past three years, the Adani group has scaled up its cement capacity to ~107mtpa (vs. ~68mtpa at the time of acquisition) via organic and inorganic expansions. The company has recently raised its FY28 cement capacity target to 155mtpa vs. 140mtpa earlier. Based on the ongoing organic expansions, the company is expected to commission 7.0mtpa/5.6mtpa grinding capacity in 3Q/4QFY26 to reach ~120mtpa by FY26 end.

* Further, the company is committed to bringing costs down from INR4,200/t currently to INR3,650/t by FY28 (targeting to achieve INR4,000/t by Mar’26), driven by fuel mix optimization, increasing green power and alternative fuel usage, and logistics cost improvement. We estimate ACEM to deliver a CAGR of 20%/25% in consol. EBITDA/PAT over FY26-28. We estimate a 10% CAGR in consol. volume over FY26-28. Further, we estimate EBITDA/t to increase to INR1,154/INR1,230 by FY27/FY28 from INR1,043 in FY26E.

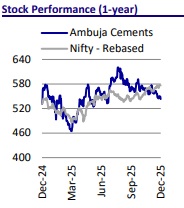

* The stock is trading attractively at 15x/13x FY27E/FY28E EV/EBITDA (vs. last 5-year average one-year forward EV/EBITDA of 18x) and USD128/USD119 EV/t (last 5-year average one-year forward EV/t of USD170). We maintain our constructive view on the company given its rising scale of operation, balanced capacity mix, and profitability improvement. We value ACEM at 20x Sep’27E EV/EBITDA to arrive at our TP of INR750.

Acquisition of JAL’s cement business expands ACEM’s footprint in central region

* JAL was one of the leading cement manufacturers with plants across India. However, due to significantly higher group-level debt, JAL sold a large part of its cement business to other leading players in the industry over FY13-17.

* Currently, JAL’s standalone cement business has four cement plants with total clinker/grinding capacity of 3.3mtpa/5.2mtpa (Exhibit: 1) in the central region. It also has a few leased limestone mines in Madhya Pradesh. Cement plants are currently non-operational; however, they can be promptly restarted with capital infusion.

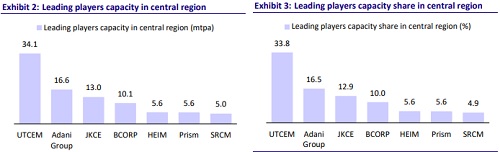

* The Adani Group’s consolidated capacity share in the central region stood at ~10%, which is likely to increase ~11% by FY28E, based on its organic expansion plans. With the acquisition of JAL’s standalone cement business, the group’s capacity share in the region will increase to ~16% by FY27-28E.

Green power, logistics optimization and group synergies to boost EBITDA/t

* ACEM targets EBITDA/t of INR1,500 by FY28 and plans to reduce costs by INR500- 550/t through several initiatives: a) saving INR200-300/t in energy costs by increasing the share of green energy (targeting 1.1GW/376MW of renewable power/WHRS capacity by FY28 vs. 673MW/228MW currently) and TSR of ~27% by FY28 vs. ~6% currently; b) saving INR100/t in logistics costs by increasing the share of sea transport and reducing lead distance, targeting to reach ~5-8% sea-based transportation by FY28, which is ~60% cheaper than road transport and ~40% cheaper than rail transport; direct dispatches now at ~75% vs. 50% two years ago, with a target of reaching ~85%; c) saving INR100/t in RM costs by leveraging group synergies; and d) saving INR50-100/t in admin and other overheads. These cost savings are expected to improve profitability, with EBITDA/t reaching INR1,500/t by FY28E.

* The integration of Penna and Orient Cement progressed as per expectations, with all sales now routed under the ACEM or ACC brand. The company has also initiated modernization and efficiency programs, including the installation of new blenders and low-heat clinker lines, which would reduce heat consumption to around 680 kcal/kg (from 730-740 Kcal/kg currently) and also reduce power usage to below 50Kwh/ton (from 60Kwh/t).

* We estimate ACEM to deliver a CAGR of ~13%/20%/25% in consolidated revenue/EBITDA/PAT over FY26-28. We estimate EBITDA/t to increase to INR1,154/INR1,230 in FY27/FY28 vs. INR1,043 in FY26E (last-five years’ average at INR966/t).

Valuation and view: Improving metrics, valuation attractive; reiterate BUY

* ACEM has reported steady improvements in profitability, achieving EBITDA/t of +INR1,000/t in the third consecutive quarters. Resilient performance was led by steady realization and QoQ reduction in opex/t. Further, the integration of acquired assets (Orient Cement/Penna/Sanghi brands) with ACC and ACEM was encouraging.

* The company’s net cash balance declined to INR25.6b as of Oct’25 vs. INR101.3b as of Mar’25, mainly due to its aggressive expansion strategy (both organic and inorganic expansions) and efficiency improvement initiatives (green power/ modernization and upgradation works/logistics capabilities). The acquisition of JAL’s standalone cement business would require a cash outflow of ~INR50b (as per our calculations, implying a valuation of USD100/t). Currently, we are not changing our estimates. The company is estimated to move from a net cash position to net debt over FY26-27E due to high capex, and turn net cash positive in FY28E, supported by healthy operating cash flow generation from expanded scale.

* Though near-term challenges (delay in cement demand pickup and weak nontrade prices) weigh on ACEM’s stock performance, we maintain our constructive view on the company given its rising scale of operation, balanced capacity mix, and profitability improvement. The stock is trading attractively at 15x/13x FY27E/FY28E EV/EBITDA (vs. last 5-year average one-year forward EV/EBITDA of 18x) and USD128/USD119 EV/t (last 5-year average one-year forward EV/t of USD170). We value ACEM at 20x Sep’27E EV/EBITDA to arrive at our TP of INR750.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412