Buy Lemon Tree Hotels Ltd for the Target Rs. 200 by Motilal Oswal Financial Services Ltd

Increase in ARR and OR propels revenue growth

Operating performance beats estimates

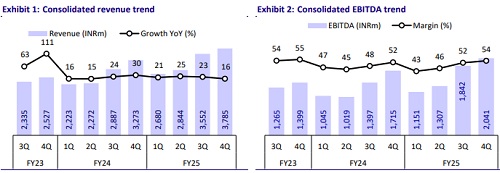

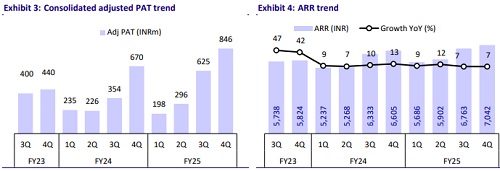

* Lemon Tree Hotels (LEMONTRE) reported healthy revenue growth of 16% YoY in 4QFY25, led by significant improvement in the occupancy rate (OR) to 77.6% (up 560bp YoY) and healthy growth in the average room rate (ARR) to INR7,402 (up 7% YoY). Operating leverage led to 150bp YoY improvement in EBITDA margins despite renovation-related expenses.

* LEMONTRE ended FY25 on a healthy note, and we expect the momentum to remain intact in FY26, led by the ramp-up of Aurika Mumbai (~83-85% OR in 4Q and ~80% expected in FY26), favorable demand-supply dynamics, renovation-driven boost in ARR and OR, loyalty program (Infinity 2.0), and initiatives taken by the company to grow retail demand (~45% mix in FY25 of room revenue).

* We largely maintain our FY26/FY27 EBITDA estimates and reiterate our BUY rating on the stock with our SoTP-based TP of INR200 for FY27.

Operating leverage underpins margin expansion

* Revenue grew 16% YoY to INR3.8b (in line), OR rose 560bp YoY to 77.6%, and ARR increased 7% YoY to INR7,042. Management fees grew 11% YoY to INR160m.

* EBITDA rose 19% YoY to INR2.0b (est INR1.9b). EBITDA margin expanded 150bp YoY to 53.9% (est. ~52.2%) on account of favorable operating leverage. Adj. PAT increased 26% YoY to INR846m (est. INR635m).

* During the quarter, LEMONTRE signed 15 new management and franchise contracts, which added 833 new rooms to its pipeline, and operationalized two hotels, which added 121 rooms to its portfolio.

* As of 31st Mar’25, total operational inventory comprised 111 hotels with 10,269 rooms and the pipeline included 101 hotels with 6,847 rooms.

* For FY25, revenue/EBITDA/adj. PAT grew 21%/23%/32% YoY to INR13b/INR6b/INR2b.

* Gross debt/CFO stood at INR17b/INR5.4b vs. INR19b/INR4.7b In FY24.

Highlights from the management commentary

* Infinity 2.0: The company relaunched its loyalty program, Infinity 2.0, to boost retail demand and achieve two-thirds (~66%) of retail demand share by FY28 (vs. 45% in FY25).

* Demand trend: LEMONTRE witnessed strong revenue growth of 21% in Apr’25, while May’25 saw lower growth of 14% due to border tensions and increasing covid fears in North India. Management guided for mid- to highteen revenue growth in 1QFY26.

* Renovations: About 70% of its portfolio has already been renovated, with the remaining 30% targeted for completion in FY26. The company plans to spend INR1.3b on renovation in FY26.

Valuation and view

* LEMONTRE is expected to maintain healthy growth momentum in FY26, led by: 1) the stabilization of Aurika Mumbai, 2) accelerated growth in management contracts (pipeline of ~6,591 rooms), and 3) the timely completion of the portfolio’s renovation (by FY26) leading to improved OR, ARR, and EBITDA margins for the company.

* We expect LEMONTRE to post a CAGR of 14%/17%/38% in revenue/EBITDA/adj. PAT over FY25-27 and RoCE to improve to ~19% by FY27 from ~11.7% in FY25. We reiterate our BUY rating on the stock with our SoTP-based TP of INR200 for FY27.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412