Neutral Nestle India Target Rs.2,400by Motilal Oswal Financial Services Ltd

Moderate growth; miss on margins

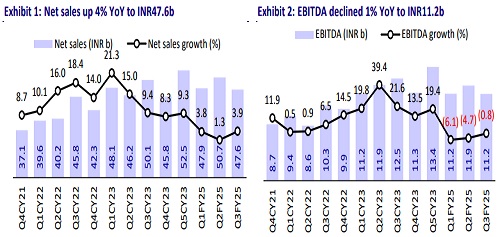

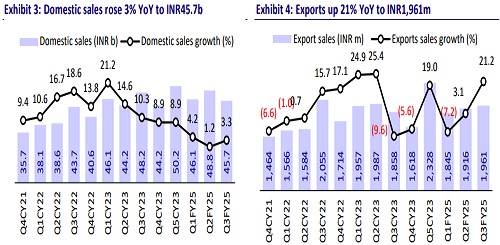

* Nestle India (Nestle) reported a 4% YoY revenue growth (est. 5%) in 3QFY25. Domestic sales grew 3% YoY, hurt by a slowdown in urban consumption and higher commodity prices. Beverage, pet care, and KitKat delivered doubledigit growth, while Milkmaid, toddler range, Maggi noodles, and Masala-eMagic posted healthy growth. Part of the prepared dishes, milk products, and chocolates experienced weakness in 3Q. Export revenue rose 21% YoY.

* GM contracted 220bp YoY/20bp QoQ to 56.4% (est. 57.8%), leading to a flat GP YoY. RM inflation was high with coffee, cocoa, cereals, and grain prices remaining elevated. EBITDA margin contracted 110bp YoY to 23.4% (est. 24.1%). We model an EBITDA margin of 23.6% for FY25 and 24.2% for FY26.

* Nestle has been a revenue growth outperformer over the past three years (largely due to price hikes), but growth has slowed in the last three quarters. Moderating urban consumption and high food inflation pose risks to near-term recovery. The stock is trading at 63x/56x FY26/FY27 EPS. Given its expensive valuation, we reiterate our Neutral rating with a TP of INR2,400 (based on 60x P/E Dec'26E).

In-line revenue; miss on margins

* Domestic sales remain muted: Nestle’s revenue rose 4% YoY to INR47.8b (est. INR48.5b) in 3QFY25. Domestic sales saw 3% YoY growth to INR45.7b hit by muted demand and higher commodity prices. However, exports saw a healthy growth of 21% YoY to INR2.0b.

* Broad-based growth across categories: Nestle sustained broad-based growth across segments, though revenue growth was low. Three of its four product groups delivered healthy growth, driven by pricing and volume. The powdered and liquid beverages segment led with high double-digit growth, while confectionery and prepared dishes & cooking aids posted high singledigit growth. E-commerce contributed 9.1% to sales, growing at double digits.

* Commodity pressure on margin: Gross margin dipped 220bp YoY to 56.4% (est. 57.8%) on rising RM prices. Prices of coffee, cocoa, cereals, and grains remained elevated, while edible oil, milk, and packaging costs were stable.

* Miss on profitability: Employee expenses rose 18% YoY, while other expenses were down 6% YoY. EBITDA margin contracted 110bp YoY to 23.4% (est. 24.1%). EBITDA declined 1% YoY to INR11.2b (est. INR 11.7b). Higher depreciation (+22% YoY) and higher interest (+51% YoY) further hurt profitability. PBT dipped 7% YoY to INR9.6b (est. INR10.5b), and Adj. PAT declined 10% YoY to INR7.0b (est. INR7.9b).

* In 9MFY25, net sales grew 3% YoY, while EBITDA/APAT declined 4%/9%.

Valuation and view

* We cut our EPS estimates by 3% for FY25 and 4% for FY26 on weak revenue growth and moderation in the margins.

* The company has been focusing on its RURBAN strategy; hence, growth was higher in RURBAN markets. Most of Nestle’s categories have been reaping the benefits of distribution penetration. Packaged food penetration has improved in the tier-2 and rural markets. The company continues to focus on portfolio enhancement through ongoing innovation and premiumization initiatives.

* Nestle’s portfolio is relatively safe from local competition, so it does not need much overhead costs to protect its market share. However, with the ongoing inflation, it is critical to maintain margins. We model ~24% EBITDA margins for FY25/FY26.

* The stock is trading at 63x/56x FY26/FY27 EPS. Given its expensive valuation, we reiterate our Neutral rating with a TP of INR2,400 (based on 60x P/E Dec'26E)

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)

.jpg)