Buy SBI Life Insurance Ltd For Target Rs. 2,000 by Motilal Oswal Financial Services Ltd

Product mix shift to non-linked drives VNB beat

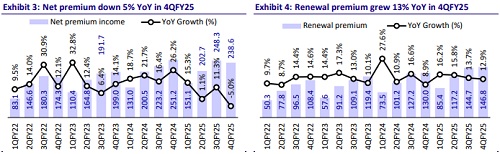

* SBI Life Insurance (SBILIFE) reported 2% YoY growth in new business APE to INR54.5b (in line). For FY25, it grew 8% YoY to INR214.2b.

* Absolute VNB grew 10% YoY to INR16.6b (14% beat). VNB margin for the quarter stood at 30.5% vs. our estimate of 27.4% (28.3% in 4QFY24). For FY25, VNB grew 7% YoY to INR59.5b, reflecting VNB margin of 27.8%. The strong growth in VNB was attributed to a significant shift in the product mix to non-ULIP products.

* Shareholder PAT remained flat YoY at INR8.1b (6% miss) in 4QFY25. For FY25, it grew 27% YoY to INR24b.

* Management expects 13-14% individual APE growth in FY26, which will be slightly above industry growth of 12% on the back of continued expansion and productivity improvement of agency channel (expecting 25% growth for FY26) and stable momentum in bancassurance channel (expecting 8-10% growth for FY26). VNB margin is expected to maintain the 27-28% range in FY26.

* We expect SBILIFE to clock a CAGR of 15%/17% in APE/VNB over FY25-27, while RoEV is likely to remain at ~19% over FY27. We have slightly cut our APE estimates considering company guidance and have increased our VNB margin estimates due to an expected shift toward traditional products and improvement in product-level margins. We reiterate our BUY rating on the stock with a TP of INR2,000 (premised on 2.0x FY27E EV).

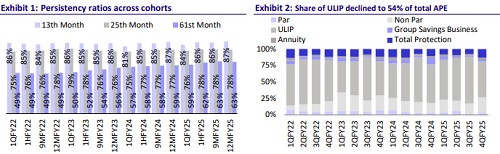

ULIP share in individual APE declines to 54.3% in 4QFY25

* SBILIFE reported 24% YoY decline in new business premium (NBP) to INR93.2b. For FY25, NBP declined 7% YoY to INR355.8b.

* 4Q gross premium fell 5% YoY to INR240b (5% miss). For FY25, premium grew 4% YoY to INR850b. Growth was driven by 7%/13% growth in firstyear/renewal premium, offset by 42% YoY decline in single premium.

* The total cost ratio was 10.1% vs. 10.7% in 4QFY24. The commission ratio was 5% vs. 4.7% in 4QFY24 owing to higher sales of traditional products through agency channel during the quarter. The operating expense ratio was 5.1% vs. 6.1% in 4QFY24, reflecting operational efficiency.

* On the product front, ULIP APE declined 5% YoY, contributing 54% to total APE (59% in 4QFY24), due to negative movement in equity markets and the company’s focus on traditional products. The group business continues to face headwinds on the savings side (declined 66% YoY), while group protection grew 41% YoY. The share of total protection APE was 13% (11% in 4QFY24).

* On the distribution front, SBILIFE continues to invest in agent addition and productivity improvement. While the individual APE through agency channel grew 5% YoY in 4QFY25, non-par APE through agency channel rose 70% YoY. Individual APE through banca channel grew 10% YoY on the back of improvement in per-branch productivity in SBI channel.

* Continued improvement has been witnessed in the 13th month and 61st month persistency (based on premium) in FY25, increasing 63bp and 414bp, respectively. 49th month persistency declined 468bp and the company has launched revival programs in the affected geographies.

* AUM grew 15% YoY to INR4.5t (in line). Solvency ratio was stable at 1.96x.

Highlights from the management commentary

* Margin improvement was on the back of (1) the launch of a high-sum-assured protection product six months back, (2) several rider attachments which increased product-level margin, and (3) in-built protection in some products.

* The company expects to achieve a 5% shift toward traditional products in FY26, taking the contribution to 35% in the product mix and 65% for ULIPs (70:30 currently).

* Agency growth is expected to be driven by an increase in the agent count and improvement in productivity. 65:35 is the product mix target for agency channel, but ULIP contribution may be slightly lower than 65% due to focus on traditional products.

Valuation and view

* SBILIFE reported a strong VNB performance in 4QFY25, aided by a shift in the product mix toward traditional products. Going forward, improvement in product-level margin and continued tilt toward non-linked products should drive VNB margin improvement. Continued investments in the agency channel will boost overall growth, while digital enhancements will keep costs in check.

* We expect SBILIFE to clock a CAGR of 15%/17% in APE/VNB over FY25-27, while RoEV is likely to remain at ~19% over FY27. We have slightly cut our APE estimates considering company guidance and have increased our VNB margin estimates due to an expected shift toward traditional products and improvement in product-level margins. We reiterate our BUY rating on the stock with a TP of INR2,000 (premised on 2.0x FY27E EV).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)