Buy HDFC Bank Ltd for the Target Rs.2,300 by Motilal Oswal Financial Services Ltd

Steady quarter; growth poised to gain traction

Prudentially deploys HDB gains to lift floating & contingent provisions

* HDFC Bank (HDFCB) reported a 1QFY26 profit of INR181.6b (12% YoY growth, 4% beat), aided by tax reversals (tax rate of 15%).

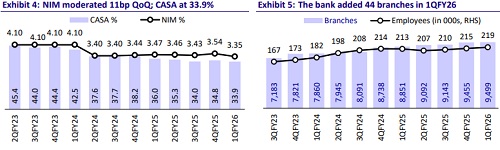

* NII grew 5% YoY to INR314.4b (3% miss). Margin on total assets contracted 11bp QoQ to 3.35% from 3.46% (adjusted for interest income on IT refund).

* Other income was INR217.3b, boosted by gains from the stake sale in HDB Financial amounting to INR91.3b. Opex rose 5% YoY to INR174.3 (in line).

* Provisions spiked to INR144b as the bank made floating provisions of INR90b and contingency provisions of INR17b, prudently utilizing the stake sale gains in its subsidiary HDB Financial and other treasury gains.

* Fresh slippages stood at INR90b (INR68b ex-agri). The GNPA/NNPA ratios rose 7bp/4bp QoQ to 1.4%/0.5%. PCR stood broadly stable at 66.9%.

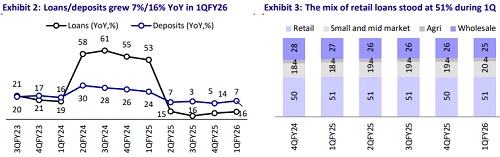

* Advances book grew 6.7% YoY but was flat QoQ at INR26.3t; deposits grew 16.2% YoY/2% QoQ to INR27.6t. The CD ratio eased to 95.1%.

* We tweak our earnings estimates and project HDFCB to deliver an FY27E RoA/RoE of 1.9%/14.9%. Reiterate BUY with a TP of INR2,300 (premised on 2.6x FY27E ABV + INR284 for subsidiaries).

Credit growth to gain traction; asset quality remains robust

* HDFCB reported a 1QFY26 profit of INR181.6b (12% YoY growth, 4% beat). NII grew 5% YoY to INR314.4b (3% miss). Margin on total assets contracted 11bp QoQ to 3.35%.

* Other income stood at INR217.3b, boosted by gains from the stake sale in HDB Financial amounting to INR91.3b. Total treasury gains stood at INR101.1b.

* Opex grew 5% YoY to INR174.3b (inline). PPoP stood at INR357.3b, while provisioning expenses stood at INR144.4b.

* The loan book grew at 6.7% YoY (flat QoQ), led by small and mid-market loans. Deposits grew 16.2% YoY/2% QoQ, with the CASA ratio moderating 90bp QoQ to 33.9%. The C/D ratio declined 140bp QoQ to 95.1%. The bank aims to grow advances in line with the system in FY26 and higher than the system in FY27E.

* The GNPA/NNPA ratios increased by7bp/4bp QoQ to 1.4%/0.5%. PCR stood broadly stable at 66.9%. Fresh slippages were INR90b (ex-agri at INR68b) vs. INR75b in 4QFY25. CAR stood at 19.9%, with Tier 1 at 17.8% (CET1 at 17.4%).

* The Board has approved a bonus issue in the ratio of 1:1 with a record date of 27th Aug’25. The bank has also announced a special dividend of INR5/sh.

* Subsidiaries’ performance: HDB Financial reported a loan growth of 14.3% YoY/2.3% QoQ to INR1093b, while PAT stood at INR5.7b. GS3 assets stood at 2.56%, while CAR was 20.2%. HDFC Securities: Revenue grew 11% YoY to INR7.3b, while PAT declined 21% YoY to INR2.3b.

Highlights from the management commentary

* Loan growth is expected to grow in line with the system in FY26 and grow faster than the system in FY27. In the medium term, HDFCB aspires to reach a CD ratio of 87-90%.

* The bank has made additional INR17b contingent provisions (57bp of loan book).

* The C/I ratio is a key priority for the bank, the current normalized rate of which is 39.6%. The bank expects this to keep improving moving forward.

* Credit costs in 1Q are elevated due to seasonality (agri). Credit costs are expected to remain in control going forward.

Valuation and view: Reiterate BUY with a TP of INR2,300

HDFCB posted a steady quarter with a slight earnings beat due to tax reversals. The NIM contracted 11bp QoQ and is expected to moderate further in 2Q due to the rate cut impact. Business growth aligns with the bank’s strategy to reduce the C/D ratio consistently, though the bank indicated it would improve its credit growth trajectory moving forward. Slippages increased mainly due to agri seasonality, while PCR was stable at ~66.9%. Further, HDFCB has prudently utilized the stake sale gains in its subsidiary HDB Financial and made floating provisions of INR90b and contingency provisions of INR17b to take the total stock of such provisions to INR366b (1.4% of loans). The gradual retirement of high-cost borrowings, along with an improvement in operating leverage and the provision buffer, will support return ratios over the coming years. We tweak our earnings estimates and project HDFCB to deliver an FY27E RoA/RoE of 1.9%/14.9%. Reiterate BUY with a TP of INR2,300 (premised on 2.6x FY27E ABV + INR284 for subsidiaries).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412