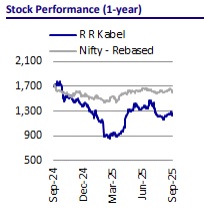

Neutral R R Kabel Ltd for the Target Rs. 1,340 by Motilal Oswal Financial Services Ltd

Capex-led growth; channel expansion fuels market reach

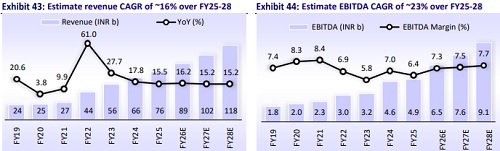

Strong growth planned over FY25-28E

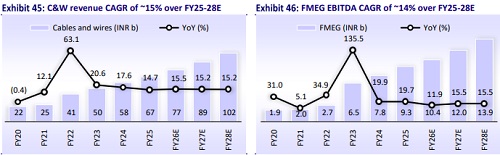

R R Kabel (RRKABEL) has embarked on a focused three-year growth journey under its strategic initiative, Project RRISE. During this period, it aims to increase capacity by 1.7x, supporting domestic business growth of 1.6x and export business growth of 1.8x. Overall, the company targets an 18% CAGR in its C&W business and a 25% CAGR in FMEG revenue. Moreover, management aims to grow EBITDA by 2.5x, and has earmarked a capex of INR12b for FY26-28E, focusing on expansions at its existing facilities in Silvassa and Waghodia. 80% of this capex will be allocated to increasing cable production capacity. INR10.5b will be invested in capacity expansion at the Waghodia plant in Gujarat, which is expected to be completed in phases by Mar’28. This will lead to an installed capacity increase of ~55% at this plant. Capex is pegged at INR1.5b for capacity expansion at the Silvassa, Dadra, and Nagar Haveli plant, which is expected to be commissioned by Dec’26. An earlier planned capex of INR2.5b at this plant is expected to become operational by Mar’26.

Product innovation and new product offerings to support growth

RRKABEL is focused on product innovation and high-margin product offerings, such as FireX LS0H-EBXL (halogen-free, low-smoke wire for public and commercial buildings) that comply with the latest safety regulations. The company is also introducing new product categories, such as medium voltage cables up to 66 kV, and enhancing its premium and mid-premium range of FMEG products (premium decorative fans, downlight panels, and switchgears). In the FMEG segment, the company is prioritizing premiumization, improving channel efficiency (optimization of logistics and promotional costs), expanding presence across multiple price points with a balanced product portfolio, and targeting profitability by FY26. It has significantly increased its distribution network over the past few years, currently backed by a pan-India distribution network including ~4,400 distributors and 4,500 dealers. Over FY20-25, its distributor and dealer counts recorded a CAGR of 32% and 12%, respectively. The company’s products are available at ~191k retail touchpoints, with a network connecting ~583k electricians. Its advertising and promotion spending increased 25% YoY to INR1.3b in FY25, and the company spent 1.6% of its revenue on ads during the year. We estimate ad spending to stand at 1.6% of revenue over FY25-28 (13% CAGR over FY25-28). Sponsorships of cricket teams such as the Kolkata Knight Riders and the UP Warriorz have contributed to enhancing the company’s brand presence. Supported by a strong R&D team, the company develops first-of-its-kind products and secures export certifications from various countries. The company exports C&W to 74 countries and has over 57 international certifications.

Capex fueled for future growth

We estimate RRKABEL’s revenue/EBITDA/PAT CAGR at ~16%/23%/20% over FY25- 28. Further, we estimate OPM to expand to ~8% over FY27-28E vs ~6% in FY25, aided by an increase in cable contribution to overall revenue. The C&W segment’s revenue posted a CAGR of ~24% over FY19-25. Going forward, we expect ~15% revenue CAGR for the C&W segment over FY25-28. In the FMEG segment, the company’s revenue posted a CAGR of ~44% over FY19-25. We estimate ~14% revenue CAGR in this segment over FY25-28. Its cumulative OCF is projected at INR12.7b over FY26-28 vs. INR12.9b over FY23-25. Cumulative net cash outflow is estimated to be INR1.2b over FY26-28 vs FCF of INR6.2b over FY23-25, driven by higher capex.

Valuation and view

RRKABEL’s volume growth in 1Q was below the industry average due to the spillover of domestic orders and cable capacity operating at optimum levels. The ongoing expansion at the Waghodia plant is estimated to boost cable volumes over the next three years. Management remains confident of achieving its fullyear volume growth guidance of ~18%, supported by a robust 25% growth in cables during 9MFY25. Additionally, the company projects to achieve break-even in the FMEG business in FY26. We value RRKABEL at 30x Sep’27E EPS to arrive at a TP of INR1,340. Reiterate Neutral.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412